ICICI Bank 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F48

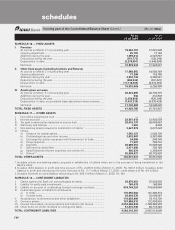

SCHEDULE 10 — FIXED ASSETS

I. Premises

At cost as on March 31 of preceding year ................................................ 19,584,791 17,091,998

Opening adjustment .................................................................................. 25,155 71,166

Additions during the year .......................................................................... 1,699,414 2,547,867

Deductions during the year ....................................................................... (151,771) (126,240)

Depreciation to date .................................................................................. (2,278,057) (1,649,800)

Net block ................................................................................................... 18,879,532 17,934,991

II. Other fixed assets (including furniture and fixtures)

At cost as on March 31 of preceding year ................................................ 17,808,855 14,589,789

Opening adjustment .................................................................................. 77,299 179,786

Additions during the year .......................................................................... 4,838,149 3,300,561

Deductions during the year ....................................................................... (202,946) (261,281)

Depreciation to date .................................................................................. (11,710,388) (8,510,555)

Net block ................................................................................................... 10,810,969 9,298,300

III. Assets given on Lease

At cost as on March 31 of preceding year ................................................ 20,424,065 20,736,475

Additions during the year .......................................................................... 544 212,838

Deductions during the year ....................................................................... (1,259,086) (525,248)

Depreciation to date, accumulated lease adjustment and provisions ...... (7,427,319) (5,875,429)

Net block ................................................................................................... 11,738,204 14,548,636

TOTAL FIXED ASSETS ..................................................................................... 41,428,705 41,781,927

SCHEDULE 11 — OTHER ASSETS

I. Inter-office adjustments (net) .................................................................... ——

II. Interest accrued ......................................................................................... 22,887,616 13,835,593

III. Tax paid in advance/tax deducted at source (net) ..................................... 28,418,197 26,943,097

IV. Stationery and stamps ............................................................................... 1,663 3,609

V. Non-banking assets acquired in satisfaction of claims 1........................... 3,627,879 3,677,234

VI. Others

a) Advance for capital assets................................................................. 1,545,327 1,002,726

b) Outstanding fees and other income.................................................. 3,578,907 3,387,499

c) Exchange fluctuation suspense with Government of India .............. 24,966 244,749

d) Swap suspense ................................................................................. 71,587 794,710

e) Deposits ............................................................................................. 26,069,853 15,020,640

f) Deferred tax asset (Net)..................................................................... 2,471,990 702,188

g) Early Retirement Option expenses not written off............................ 885,979 1,269,979

h) Others 2 3 ............................................................................................. 55,989,973 28,779,920

TOTAL OTHER ASSETS.................................................................................... 145,573,937 95,661,944

1.Includes certain non-banking assets acquired in satisfaction of claims which are in the process of being transferred in the

Bank’s name.

2.Includes debit balance in profit and loss account of Rs. 2,435.6 million (March 31, 2005: Rs. 908.8 million) including debit

balance in profit and loss account for joint ventures of Rs. 13.7 million (March 31, 2005: credit balance of Rs. 4.6 million).

3.Includes Goodwill on consolidation amounting to Rs. 624.0 million (March 31, 2005: Rs. Nil).

SCHEDULE 12 — CONTINGENT LIABILITIES

I. Claims against the Bank not acknowledged as debts .............................. 29,879,081 27,532,692

II. Liability for partly paid investments........................................................... 168,472 168,396

III. Liability on account of outstanding forward exchange contracts ............. 919,149,224 714,653,064

IV. Guarantees given on behalf of constituents

a) In India ............................................................................................... 170,959,502 141,495,318

b) Outside India...................................................................................... 20,488,570 16,095,087

V. Acceptances, endorsements and other obligations ................................. 110,082,608 74,115,736

VI. Currency swaps ......................................................................................... 197,909,516 112,834,926

VII. Interest rate swaps, currency options and interest rate futures ............... 2,852,269,039 1,793,399,905

VIII. Other items for which the Bank is contingently liable .............................. 61,410,349 80,718,484

TOTAL CONTINGENT LIABILITIES .................................................................. 4,362,316,361 2,961,013,608

schedules

As on As on

31.03.2006 31.03.2005

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)