ICICI Bank 2006 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F70

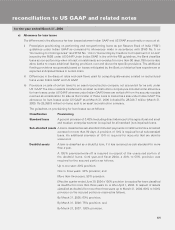

I. Differences between Indian GAAP and US GAAP

The consolidated financial statements of the Company are prepared in accordance with Indian GAAP which differs in

certain significant aspects from US GAAP.

The following tables summaries the significant adjustments to consolidated net income and stockholders’ equity

which would result from the application of US GAAP:

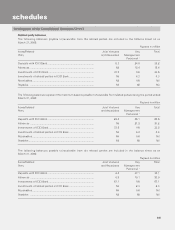

1. Net income reconciliation

Rupees in million

Note Year ended March 31,

2004 2005 2006

Consolidated profit after tax as per Indian GAAP 15,803.8 18,523.3 24,200.9

Adjustments on account of :

Allowance for loan losses (a) (11,585.3) (14,666.9) (5,214.7)

Business combinations (b) (1,331.8) (500.5) (1,051.2)

Consolidation (c) (312.0) 613.0 277.5

Valuation of debt and equity securities (d) (1,609.7) 150.5 537.8

Amortisation of fees and costs (e) 1,247.1 1,935.7 3,158.9

Accounting for derivatives (f) 834.9 (1,478.8) (154.4)

Deferred taxes (g) 2,172.1 3,953.7 (1,714.5)

Total impact of all adjustments (10,584.7) (9,993.3) (4,160.6)

Net income as per US GAAP 5,219.1 8,530.0 20,040.3

Basic earnings per share

Indian GAAP (consolidated) 25.73 25.45 30.96

US GAAP 8.50 11.72 25.64

Diluted earnings per share

Indian GAAP (consolidated) 25.52 25.25 30.64

US GAAP 8.43 11.60 25.34

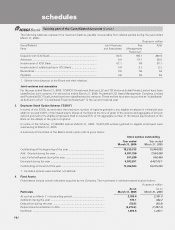

2. Stockholders’ equity reconciliation

Rupees in million

Note As on March 31,

2005 2006

Consolidated networth as per Indian GAAP 121,833.3 219,982.2

Adjustments on account of:

Allowance for loan losses (a) (14,819.8) (20,034.0)

Business combinations (b) 396.8 (661.0)

Consolidation (c) (492.8) (2,067.4)

Valuation of debt and equity securities (d) 2,018.8 (1,971.0)

Amortisation of fees and costs (e) 4,005.6 7,389.1

Accounting for derivatives (f) 179.3 26.1

Deferred taxes (g) 7,734.4 7,358.5

Proposed dividend (h) 7,140.3 8,624.3

Total impact of all adjustments 6,162.6 (1,335.4)

Stockholders’ equity as per US GAAP 127,995.9 218,646.8

reconciliation to US GAAP and related notes

for the year ended March 31, 2006