ICICI Bank 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Annual Report 2005-2006

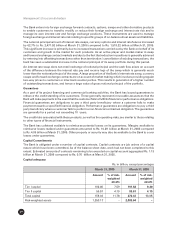

Rs. in billion, except percentages

Fiscal 2005 Fiscal 2006 % change

Advertisement 1.16 1.86 60.3

Others 6.48 10.04 54.9

Total non-interest expense (excluding lease depreciation

and direct marketing agency expenses) 25.17 35.47 40.9

Depreciation (net of lease equalisation) on leased assets 2.97 2.77 (6.7)

Direct marketing agency expense(1) 4.85 6.55 35.1

Total non-interest expense 32.99 44.79 35.8

(1) Other than on automobile loans, which is reduced from interest income.

(2) All amounts have been rounded off to the nearest Rs. 10.0 million.

Non-interest expense (excluding direct marketing agency expense and lease depreciation) increased by

40.9% for fiscal 2006 to Rs. 35.47 billion from Rs. 25.17 billion for fiscal 2005 primarily due to 46.8%

increase in employee expenses.

Employee expenses increased 46.8% to Rs. 10.82 billion in fiscal 2006 from Rs. 7.37 billion in fiscal 2005

primarily due to a 40.8% increase in the number of employees to 25,384 at March 31, 2006 from 18,029

at March 31, 2005. The increase in employees was commensurate with the growth in business.

Depreciation on fixed assets other than leased assets, increased by 18.4% to Rs. 3.47 billion from

Rs. 2.93 billion primarily due to additions to premises of Rs. 1.45 billion and other fixed assets of Rs. 4.36

billion during fiscal 2006.

Other operating expenses increased primarily due to the increased volume of business, particularly in

retail banking and includes maintenance of ATMs, credit card related expenses, call centre expenses and

technology expenses. The number of savings accounts increased to about 8.9 million at March 31, 2006

from about 7.5 million at March 31, 2005. The number of credit cards issued increased to about

5.2 million at March 31, 2006 from about 3.3 million at March 31, 2005. The number of branches (excluding

foreign branches and OBUs) and extension counters increased to 614 at March 31, 2006 from 562 at

March 31, 2005. ATMs increased to 2,200 at March 31, 2006 from 1,910 at March 31, 2005.

Depreciation (net of lease equalisation) on leased assets decreased 6.7% to Rs. 2.77 billion in fiscal 2006

from Rs. 2.97 billion in fiscal 2005.

ICICI Bank uses marketing agents, called direct marketing agents or associates, for sourcing retail assets.

These commissions are expensed upfront and not amortised over the life of the loan. Commissions paid

to these direct marketing agents for retail assets are included in non-interest expense (other than

commissions in respect of car loans). ICICI Bank incurred direct marketing agency expenses of Rs. 6.55

billion on the retail asset portfolio (other than automobile loans) in fiscal 2006 compared to Rs. 4.85

billion in fiscal 2005, with the increase being commensurate with growth in business volumes.

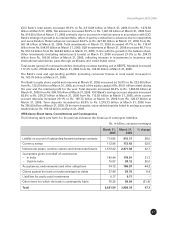

Provisions & tax

Provisions and contingencies (excluding provisions for tax) increased to Rs. 15.94 billion in fiscal 2006

from Rs. 4.29 billion in fiscal 2005 primarily due to the significantly higher level of amortisation of premium

on government securities in fiscal 2006 (Rs. 8.02 billion, compared to Rs. 2.76 billion in fiscal 2005)

primarily due to increase in the investments in government securities (one time transfer from available

for sale to held to maturity category in fiscal 2005) and lower level of write-backs in fiscal 2006. With

effect from the quarter ended December 31, 2005, RBI increased the requirement of general provisioning

on standard loans (excluding loans to agriculture sector and small and medium enterprises) to 0.40%

compared to 0.25% applicable till September 30, 2005. In accordance with these guidelines the Bank has

made general provision of Rs. 3.39 billion in fiscal 2006. During fiscal 2006, the Bank reassessed its

provision requirement on performing loans and non-performing loans on a portfolio basis and wrote