ICICI Bank 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F66

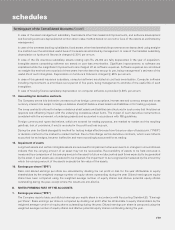

schedules

forming part of the Consolidated Accounts (Contd.)

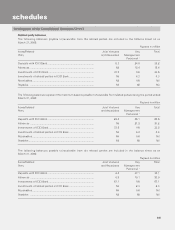

Geographical segments

The Group reports its operations under the following geographical segments.

a. Domestic Operations comprises branches and subsidiaries having operations in India.

b. Foreign Operations comprises branches and subsidiaries having operations outside India and offshore banking unit

having operations in India.

Based on above segments the assets and revenue of the Bank for the year ended March 31, 2006 have been prepared.

Rupees in million

Sr. No. Particulars Domestic Foreign

Operations Operations Total

1. Revenue ..................................................................... 243,570.9 14,040.0 257,610.9

2. Assets ........................................................................ 2,436,465.6 333,394.4 2,769,860.0

Hitherto the business operations of the Bank were largely concentrated in India. The assets and income from foreign

operations were not significant to the overall consolidated operations of the Bank and have accordingly not been disclosed

for the earlier comparative year.

12. Subvention income

The Bank has aligned its accounting policy for subvention income with its accounting policy for direct marketing agency/

associate expenses. Accordingly, subvention income has been accounted for in the period in which it is received instead of

over the period of the loan. As a result of the change in policy, the impact on profit after tax for the year ended March 31,

2006 is not expected to be significant.

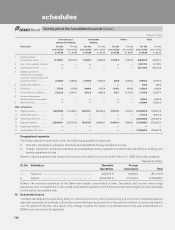

Rupees in million

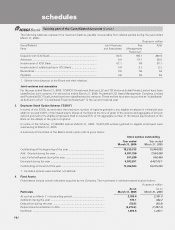

Consumer and Investment Others Total

commercial banking banking

Particulars For the For the For the For the For the For the For the For the

year ended year ended year ended year ended year ended year ended year ended year ended

31.03.06 31.03.05 31.03.06 31.03.05 31.03.06 31.03.05 31.03.06 31.03.05

1 Revenue (before

extraordinary profit) .............. 151,950.1 108,779.9 53,425.6 32,599.2 63,152.8 37,037.6 268,528.5 178,416.7

2 Less: Inter- segment revenue ——————(10,917.6) (9,102.8)

3 Total revenue (1) -(2) .............. ——————257,610.9 169,313.9

4 Operating profit (i.e.

Profit before unallocated

expenses, extraordinary profit,

provision and tax) .................. 33,404.2 19,965.0 14,156.9 10,439.3 288.0 (1,606.8) 47,849.2 28,797.5

5 Unallocated expenses .......... ——————384.0 384.0

6 Provisions .............................. 7,532.2 1,150.9 8,944.9 3,478.4 (210.7) (422.9) 16,266.4 4,206.4

7 Profit before tax (4)-(5)-(6) ..... 25,872.0 18,814.1 5,212.0 6,960.9 498.7 (1,183.9) 31,198.8 24,207.1

8 Income tax expenses

(net)/(net deferred tax credit) ——————6,998.0 5,683.8

9 Net Profit (7)-(8) ..................... ——————24,200.8 18,523.3

Other Information

10 Segment assets ................... 1,802,556.0 1,118,447.3 824,793.1 588,286.8 110,734.9 47,778.4 2,738,084.0 1,754,512.5

11 Unallocated assets ............... ——————31,776.0 28,915.3

12 Total assets (10)+(11) ........... ——————2,769,860.0 1,783,427.8

13 Segment liabilities ................. 2,080,899.1 1,353,714.3 584,579.5 389,689.1 104,381.4 40,024.4 2,769,860.0 1,783,427.8

14 Unallocated liabilities ........... ————————

15 Total liabilities (13)+(14) ....... ——————2,769,860.0 1,783,427.8