ICICI Bank 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

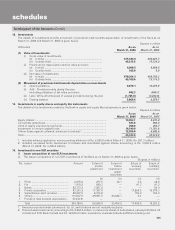

F15

forming part of the Accounts (Contd.)

schedules

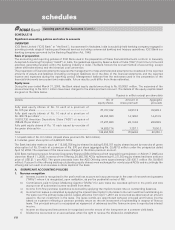

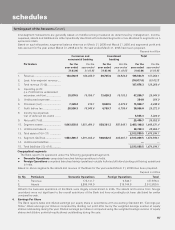

8. Employee Stock Option Scheme (“ESOS”)

The Bank has formulated an Employees Stock Option Scheme. The Scheme provides that employees are granted an option

to acquire equity shares of the Bank that vests in a graded manner. The options may be exercised within a specified period.

The Bank follows the intrinsic value method as prescribed by the guidance note on “Accounting for Stock Options” issued

by the Institute of Chartered Accountants of India (“ICAI”) to account for its stock-based employees compensation plans.

Compensation cost measured by the excess, if any, of the fair market price of the underlying stock over the exercise price.

The grant price of the Bank’s stock option is the last closing price on the stock exchange on the day preceding the date of

grant of stock options and accordingly there is no compensation cost under the intrinsic value method.

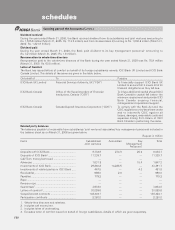

9. Staff retirement benefits

ICICI Bank is required to pay gratuity to employees who retire or resign after at least five years of continuous service. ICICI

Bank makes contributions to three separate gratuity funds, for employees inducted from erstwhile ICICI, employees inducted

from erstwhile Bank of Madura and employees of ICICI Bank other than employees inducted from erstwhile ICICI and

erstwhile Bank of Madura.

The gratuity funds for employees inducted from erstwhile ICICI and erstwhile Bank of Madura are separate gratuity funds

managed by ICICI Prudential Life Insurance Company. Actuarial valuation of the gratuity liability is determined by an actuary

appointed by ICICI Prudential Life Insurance Company. The investments of the funds are made according to rules prescribed

by the Government of India. The accounts of the funds are audited by independent auditors.

The gratuity fund for employees of ICICI Bank other than employees inducted from erstwhile ICICI and erstwhile Bank of

Madura is administered by the Life Insurance Corporation of India. In accordance with the gratuity fund’s rules, actuarial

valuation of gratuity liability is calculated based on certain assumptions regarding rate of interest, salary growth, mortality

and staff turnover.

ICICI Bank contributes 15% of the total annual salary of each employee to a superannuation fund for ICICI Bank employees.

ICICI Bank’s employees get an option on retirement or resignation to receive one-third of the total balance and a monthly

pension based on the remaining two-third balance. In the event of death of an employee, his or her beneficiary receives the

remaining accumulated balance of 66.7%. ICICI Bank also gives a cash option to its employees, allowing them to receive

the amount contributed by ICICI Bank in their monthly salary during their employment.

Till March 31, 2005, the superannuation fund was administered solely by the Life Insurance Corporation of India. Subsequent

to March 31, 2005, the fund is being administered by both Life Insurance Corporation of India and ICICI Prudential Life

Insurance Company Limited. Employees have the option to retain the existing balance with Life Insurance Corporation of

India or seek a transfer to ICICI Prudential Insurance Company.

ICICI Bank is statutorily required to maintain a provident fund as a part of its retirement benefits to its employees. There are

separate provident funds for employees inducted from erstwhile Bank of Madura (other than those employees who have

opted for pensions), and for other employees of ICICI Bank. These funds are managed by in-house trustees. Each employee

contributes 12.0% of his or her basic salary (10.0% for clerks and sub-staff of erstwhile Bank of Madura) and ICICI Bank

contributes an equal amount to the funds. The investments of the funds are made according to rules prescribed by the

Government of India. The accounts of the funds are audited by independent auditors.

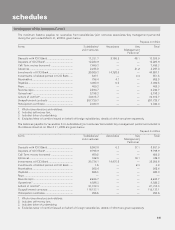

10. Income taxes

Income tax expense is the aggregate amount of current tax, deferred tax and fringe benefit tax charge. Current year taxes

are determined in accordance with the Income-tax Act, 1961. Deferred tax adjustments comprise of changes in the deferred

tax assets or liabilities during the period.

Deferred tax assets and liabilities are recognised on a prudent basis for the future tax consequences of timing differences

arising between the carrying values of assets and liabilities and their respective tax basis, and carry forward losses. Deferred

tax assets and liabilities are measured using tax rates and tax laws that have been enacted or substantially enacted prior to

the balance sheet date. The impact of changes in the deferred tax assets and liabilities is recognised in the profit and loss

account.

Deferred tax assets are recognised and reassessed at each reporting date, based upon management’s judgement as to

whether realisation is considered certain. Deferred tax assets are recognised on carry forward of unabsorbed depreciation

and tax losses only if there is virtual certainty that such deferred tax asset can be realised against future profits.

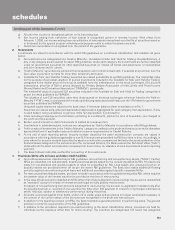

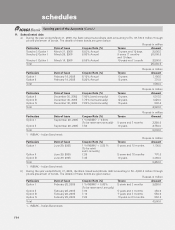

11. Impairment of assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of

the carrying amount of an asset to future net discounted cash flows expected to be generated by the asset. If such assets

are considered to be impaired, the impairment to be recognised is measured by the amount by which the carrying amount

of the assets exceeds the fair value of the assets.

12. Accounting for contingencies

The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of information

available up to the date on which the financial statements are prepared. A provision is recognised when an enterprise has

a present obligation as a result of past event and it is probable that an outflow of resources will be required to settle the

obligation, in respect of which a reliable estimate can be made. Provisions are determined based on management estimate

required to settle the obligation at the balance sheet date, supplemented by experience of similar transactions. These are