ICICI Bank 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

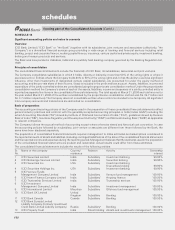

F53

Dividend income is accounted on an accrual basis when the right to receive the dividend is established.

In case of investment banking subsidiary, fees from issue management, loan syndication, financial advisory services and

trusteeship fees are recognised based on the stage of completion of assignments and terms of agreement with the client.

Fees received by the Company’s Canadian subsidiary, from its commercial clients for term loans, demand loans, mortgages

and operating lines of credit are deferred and recognised over the term of a loan. Upon approval of the credit facility, fee

income is amortised over the term of the loan, except for demand loans, which are amortised over a 12-month period. Non-

refundable loan fees received from commercial clients are accounted immediately if the credit facility is not approved.

All other fee income is recognised upfront on its becoming due except for fees for guarantees which are amortised over the

contracted period of the commitment.

Net income arising from sell down of loan assets is recognised upfront in interest income. With effect from February 1,

2006, in accordance with new guidelines issued by RBI, net income arising from securitisation of loan assets is amortised

over the life of securities issued or to be issued by the special purpose vehicle/special purpose entity to which the assets

are sold.

Income from brokerage activities is recognised as income on the trade date of the transaction. Brokerage income in relation

to public issues/ other securities is recognised based on mobilisation and terms of agreement with the client. The Bank

follows trade date method for accounting of its investments.

Life insurance premium is recognised as income when due. Premium on lapsed policies is recognised as income when

such policies are reinstated. For linked business, premium is recognised when the associated units are allotted. Income

from linked funds, which includes fund management charges, administrative charges and mortality charges is recovered

from the linked fund in accordance with the terms and conditions of the policy and is accounted on accrual basis. Accretion

of discount and amortisation of premium relating to debt securities is recognised over the holding/maturity period on a

straight-line basis.

General insurance premium is recognised as income over the period of risk or the contract period based on 1/365 method,

whichever is appropriate on a gross basis, net of service tax. Any subsequent revision to premium is recognised over the

remaining period of risk or contract period. Adjustments to premium income arising on cancellation of policies are recognised

in the period in which it is cancelled. Commission on reinsurance business is recognised as income in the period of ceding

the risk. Profit commission under re-insurance treaties is recognised as income in the period of determination of profits.

Insurance premium on ceding of the risk is recognised in the period in which the risk is ceded. Any subsequent revision to

premium ceded is recognised in the period of such revision. Adjustment to reinsurance premium arising on cancellation of

policies is recognised in the period in which it is cancelled. In case of life insurance business, reinsurance premium ceded

is accounted in accordance with the treaty or in-principle arrangement with the reinsurer.

Premium deficiency is recognised when the sum of expected claim costs and related expenses exceed the reserve for

unexpired risks and is computed at a business segment level.

3. Stock based compensation

The Company uses the intrinsic value based method as prescribed by the guidance note on ‘Accounting for Stock Options”

issued by ICAI to account for its stock-based employees compensation plans. Compensation cost for fixed and variable

stock-based awards is measured by the excess, if any, of the fair market price of the underlying stock over the exercise

price. Compensation for fixed awards is measured at the grant date while compensation costs for variable awards is

estimated until the number of shares an individual is entitled to receive and the exercise price are known (measurement

date).

4. Income taxes

Income tax expense is the aggregate amount of current tax, deferred tax and fringe benefit tax charge. Current year taxes

are determined in accordance with the Income Tax Act, 1961. Deferred tax adjustments comprise changes in the deferred

tax assets or liabilities during the year.

Deferred tax assets and liabilities are recognised for the future tax consequences of timing differences arising between the

carrying values of assets and liabilities and their respective tax bases and operating carry forward losses. Deferred tax

assets are recognised only after giving due consideration to prudence. Deferred tax assets and liabilities are measured

using tax rates and tax laws that have been enacted or substantially enacted by the balance sheet date. The impact on

account of changes in the deferred tax assets and liabilities is also recognised in the profit and loss account.

schedules

forming part of the Consolidated Accounts (Contd.)