ICICI Bank 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F30

forming part of the Accounts (Contd.)

schedules

During the year ended March 31, 2006, there has been no debt restructuring for small and medium enterprises.

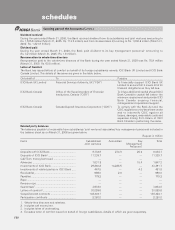

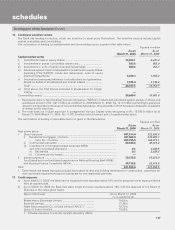

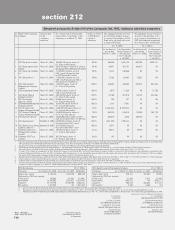

c) The Bank has restructured borrower accounts in standard, sub-standard and doubtful categories. The gross amounts

(net of write-off) of asset restructured during the year are given below.

Rupees in million

Loan category Year ended March 31, 2006 Year ended March 31, 2005

No. Amount Interest No. Amount Interest

Sacrifice Sacrifice

Standard................... ——— 16 15,745.2 685.8

Sub-standard ........... 1 62.4 — 3 558.7 —

Doubtful ................... 1 21.5 — 5 182.5 —

Total 2 83.9 — 24 16,484.4 685.8

Note: The above details include accounts restructured under the Corporate Debt Restructuring “CDR” scheme during the year, other

than cases that were restructured and disclosed in earlier years by the Bank and subsequently referred to and admitted under

the CDR scheme during the current year.

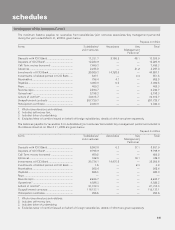

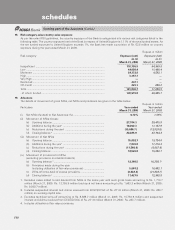

23. Details of non-performing assets sold, excluding those sold to SC/RC

The Bank has sold certain cases of non-performing assets in terms of the guidelines issued by RBI circular no.

DBOD.NO.BP.BC.16/21.04.048/2005-06 dated July 13, 2005 on such sale. The details of assets sold are given below.

Rupees in million

Year ended

Particulars March 31, 2006

1. No. of borrower accounts sold .......................................................... 366

2. Aggregate outstanding (Gross) ......................................................... 14,384.1

3. Aggregate consideration received .................................................... 2,223.2

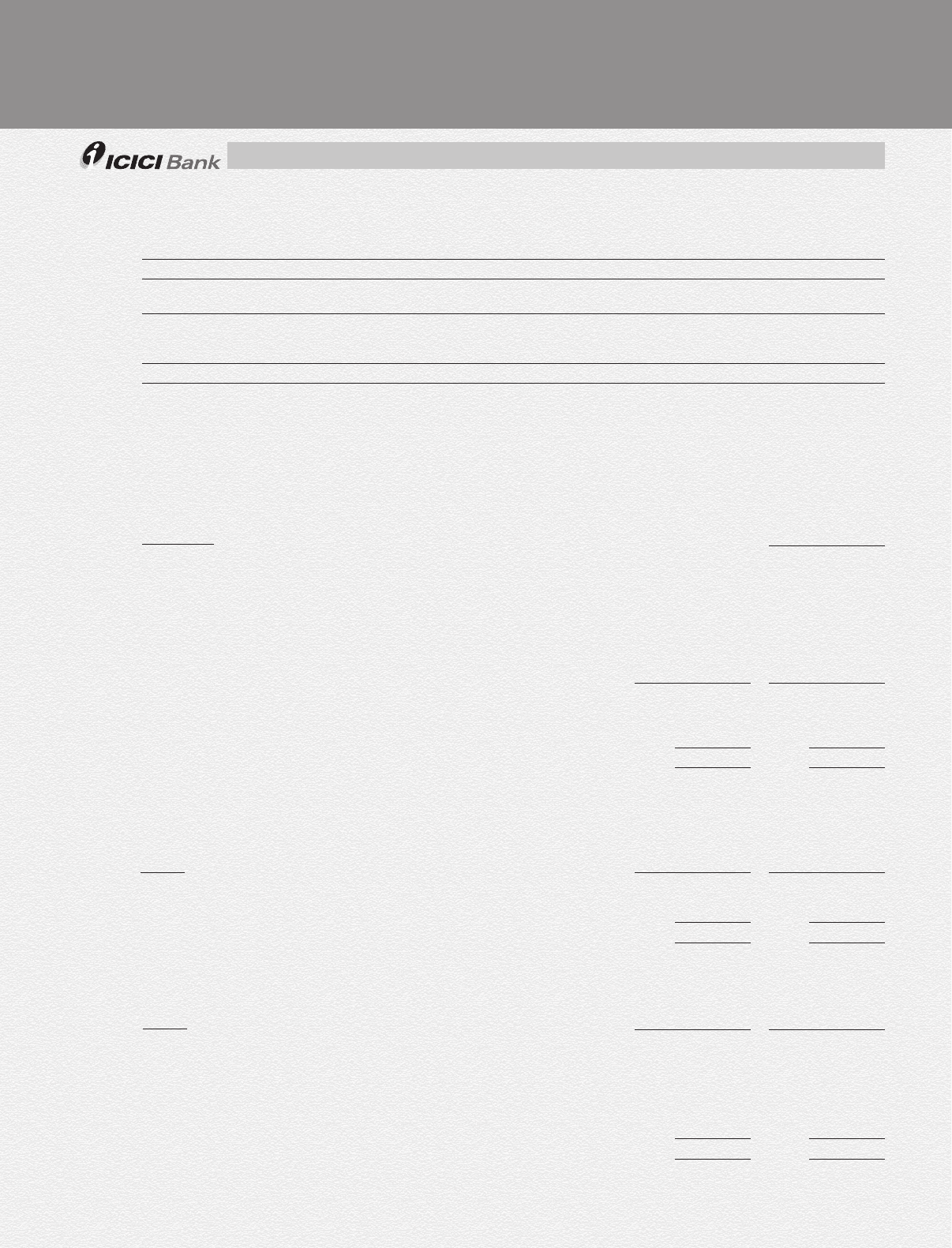

24. Fixed Assets

Fixed assets include softwares acquired by the Bank. The movement in software assets is given below. Rupees in million

Year ended Year ended

March 31, 2006 March 31, 2005

At cost as on March 31st of preceding year ............................................. 2,422.6 2,057.7

Additions during the year .......................................................................... 430.1 364.9

Deductions during the year ....................................................................... ——

Depreciation to date .................................................................................. (2,026.3) (1,396.5)

Net block.................................................................................................... 826.4 1,026.1

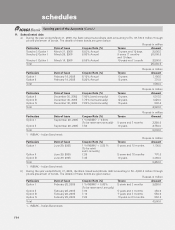

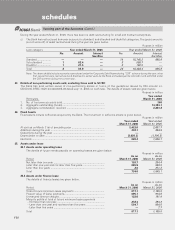

25. Assets under lease

25.1 Assets under operating lease

The details of future rentals payable on operating leases are given below. Rupees in million

As on As on

Period March 31, 2006 March 31, 2005

Not later than one year ...................................................................... 126.7 234.4

Later than one year and not later than five years .............................. 605.9 999.5

Later than five years .......................................................................... 2.0 311.2

Total 734.6 1,545.1

25.2 Assets under finance lease

The details of finance leases are given below. Rupees in million

As on As on

Period March 31, 2006 March 31, 2005

Total of future minimum lease payments .......................................... 817.1 1,105.5

Present value of lease payments ....................................................... 695.1 913.6

Unmatured finance charges .............................................................. 122.0 191.9

Maturity profile of total of future minimum lease payments

- Not later than one year.................................................................. 232.4 293.3

- Later than one year and not later than five years ......................... 584.7 804.5

- Later than five years ...................................................................... —7.7

Total 817.1 1,105.5