ICICI Bank 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F55

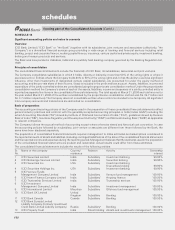

The unit liability in respect of linked business has been taken as the value of the units standing to the credit of policyholders,

using the net asset value (NAV) prevailing at the valuation date. Theadequacy of charges under unit-linked policies to meet

future expenses has been tested and provision made as appropriate. Provision has also been made for the cost of guarantee

under unit-linked products that carry a guarantee.

9. Acquisition costs for insurance business

Acquisition costs are those costs that vary with, and are primarily related to the acquisition of new and renewal of insurance

contracts including commissions and policy issue expenses. These costs are expensed in the period in which they are

incurred.

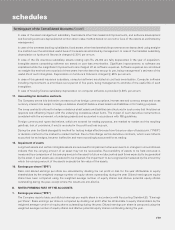

10. Staff retirement benefits

ICICI Bank is required to pay gratuity to employees who retire or resign after at least five years of continuous service. ICICI

Bank makes contributions to three separate gratuity funds, for employees inducted from erstwhile ICICI, employees inducted

from erstwhile Bank of Madura and employees of ICICI Bank other than employees inducted from erstwhile ICICI and

erstwhile Bank of Madura.

The gratuity funds for employees inducted from erstwhile ICICI and erstwhile Bank of Madura are separate gratuity funds

managed by ICICI Prudential Life Insurance Company. Actuarial valuation of the gratuity liability is determined by an actuary

appointed by ICICI Prudential Life Insurance Company. The investments of the funds are made according to rules prescribed

by the Government of India. The accounts of the funds are audited by independent auditors.

The gratuity fund for employees of ICICI Bank other than employees inducted from erstwhile ICICI and erstwhile Bank of

Madura is administered by the Life Insurance Corporation of India. In accordance with the gratuity fund’s rules, actuarial

valuation of gratuity liability is calculated based on certain assumptions regarding rate of interest, salary growth, mortality

and staff turnover.

ICICI Bank contributes 15.0% of the total annual salary of each employee to a superannuation fund for ICICI Bank employees.

ICICI Bank’s employees get an option on retirement or resignation to receive one-third of the total balance and a monthly

pension based on the remaining two-third balance. In the event of death of an employee, his or her beneficiary receives the

remaining accumulated balance of 66.7%. ICICI Bank also gives a cash option to its employees, allowing them to receive

the amount contributed by ICICI Bank in their monthly salary during their employment.

Untill March 31, 2005, the superannuation fund was solely administered by the Life Insurance Corporation of India. Subsequent

to March 31, 2005, the fund is being administered by both Life Insurance Corporation of India and ICICI Prudential Life

Insurance Company Limited. Employees have the option to retain the existing balance with Life Insurance Corporation of

India or seek a transfer to ICICI Prudential Life Insurance Company.

ICICI Bank is statutorily required to maintain a provident fund as a part of its retirement benefits to its employees. There are

separate provident funds for employees inducted from erstwhile Bank of Madura (other than those employees who have

opted for pensions), and for other employees of ICICI Bank. These funds are managed by in-house trustees. Each employee

contributes 12.0% of his or her basic salary (10.0% for clerks and sub-staff of erstwhile Bank of Madura) and ICICI Bank

contributes an equal amount to the funds. The investments of the funds are made according to rules prescribed by the

Government of India. The accounts of the funds are audited by independent auditors.

In respect of other entities within the group, retirement benefits in the form of provident fund and other defined contribution

schemes, the contribution payable by the Company for the year is charged to the profit and loss account for that year. In

respect of gratuity benefit and other benefit schemes, where the Company makes payments for retirement benefits out of

its own funds, provisions are made in the profit and loss account based on actuarial valuation. In cases where the liability for

retirement benefits is funded through a scheme administered by an insurer, the contributions payable during the year to the

insurer is charged to the profit and loss account for that year.

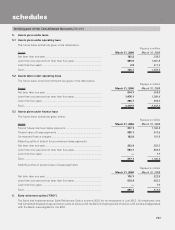

11. Accounting for contingencies

The Company estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of

information available up to the date on which the consolidated financial statements are prepared. A provision is recognised

when an enterprise has a present obligation as a result of past event and it is probable that an outflow of resources will be

required to settle the obligation, in respect of which a reliable estimate can be made. Provisions are determined based on

management estimate required to settle the obligation at the balance sheet date, supplemented by experience of similar

transactions. These are reviewed at each balance sheet date and adjusted to reflect the current estimates. In cases where

the available information indicates that the loss on the contingency is reasonably possible but the amount of loss cannot be

reasonably estimated, a disclosure is made in the consolidated financial statements. In case of remote possibility neither

provision nor disclosure is made in the consolidated financial statements.

schedules

forming part of the Consolidated Accounts (Contd.)