ICICI Bank 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Management’s Discussion & Analysis

Total interest income increased 46.5% to Rs. 137.84billion in fiscal 2006 from Rs. 94.10 billion in fiscal

2005 primarily due to an increase of 48.0% in the average interest-earning assets to Rs.1,706.81billion,

offset, in part, by a decline in yield on interest-earning assets to 8.0% in fiscal 2006 from 8.1% in fiscal

2005. The decline in yield was primarily due to lower level of sell-down gains in fiscal 2006 compared to

fiscal 2005, offset by an increase in the yield on investments. While the yield on average advances declined

by 0.8% to 8.6% in fiscal 2006, the yield on average investments increased by 1.2% to 7.6% in fiscal

2006.

Total interest expense increased 46.1% to Rs. 95.97 billion in fiscal 2006 from Rs.65.71 billion in fiscal

2005, due to a 45.7% increase in average interest-bearing liabilities to Rs. 1,658.73billion. Cost of funds

for fiscal year 2006 remained at 5.8%. Cost of deposits increased to 5.0% in fiscal 2006 from 4.5% in

fiscal 2005 consequent to the general increase in interest rates in India, in particular the increase in

short-term interest rates in the second half of fiscal 2006. Deposits increased 65.4% to 1,650.83 billion at

March 31, 2006, constituting 77.2% of the Bank’s total funding (comprising deposits, borrowings and

subordinated debt) compared to 70.5% at March 31, 2005.

Fee income

Fee income increased by 55.3% to Rs. 32.59 billion in fiscal 2006 from Rs. 20.98 billion in fiscal 2005

primarily due to growth in credit card fees and third-party product distribution fees, increase in income

from remittances and other fees from international banking business and growth in corporate banking

fees. During fiscal 2006, retail products and services contributed about 58% of total fee income, corporate

products and services contributed about 30% and international products and services contributed the

balance 12%. Fee income includes merchant foreign exchange income amounting to Rs. 2.55 billion in

fiscal 2006 and Rs. 1.77 billion in fiscal 2005.

Treasury income

Total income from treasury-related activities increased 30.5% to Rs. 9.28 billion in fiscal 2006 from

Rs. 7.11 billion in fiscal 2005 primarily due to increase in the profit on sale of equity investments. Capital

gains on shares were Rs. 6.77 billion for fiscal 2006 compared to Rs. 4.61 billion for fiscal 2005, as ICICI

Bank continued to capitalise on the opportunities created by the buoyant equity markets through divestment

of certain of its non-core investments and through proprietary trading positions. Treasury income also

includes income from derivatives reflecting primarily the transactions undertaken with customers by the

Bank.

Lease & other income

Lease income decreased by 10.0% to Rs. 3.61 billion in fiscal 2006 from Rs. 4.01 billion in fiscal 2005

mainly due to a reduction in lease assets since ICICI Bank is not entering into new lease transactions. ICICI

Bank’s total lease assets were Rs. 11.74 billion at March 31, 2006 compared to Rs. 14.53 billion at

March 31, 2005. Other income increased 111.2% to Rs. 4.35 billion for fiscal 2006 compared to Rs. 2.06

billion for fiscal 2005 primarily due to increase in dividend from subsidiaries and gains from buyback of

shares by subsidiaries.

Non-interest expense

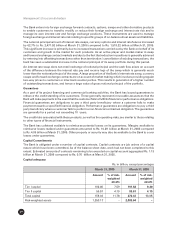

The following table sets forth, for the periods indicated, the principal components of non-interest expense.

Rs. in billion, except percentages

Fiscal 2005 Fiscal 2006 % change

Employee expenses 7.37 10.82 46.8

Depreciation on fixed assets other than leased assets 2.93 3.47 18.4

Rent, taxes & lighting 1.85 2.35 27.0

Printing & stationery 0.88 1.11 26.1

Postage & courier 1.74 2.16 24.1

Repairs, telephone & maintenance 2.16 2.58 19.4

Insurance 0.60 1.08 80.0