ICICI Bank 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F22

schedules

forming part of the Accounts (Contd.)

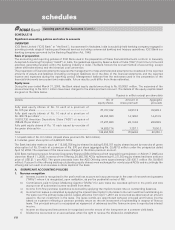

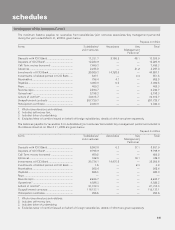

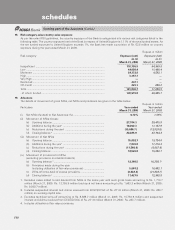

The maximum balance payable to/ receivable from subsidiaries/ joint ventures/ associates/ key management personnel

during the year ended March 31, 2005 is given below.

Rupees in million

Items Subsidiaries/ Associates Key Total

Joint ventures Management

Personnel1

Deposits with ICICI Bank .............................. 19,352.2 2,405.5 196.1 21,953.8

Deposits of ICICI Bank2................................. 9,798.9 — — 9,798.9

Call/ Term money borrowed ......................... 3,500.0 — — 3,500.0

Advances ...................................................... 2,435.6 — 19.1 2,454.7

Investments of ICICI Bank ............................ 40,204.6 33,399.0 — 73,603.6

Investments of related parties in ICICI Bank 16.6 — 2.3 18.9

Receivables ................................................... 202.4 — — 202.4

Payables ........................................................ 1,762.1 — — 1,762.1

Repo .............................................................. 128.8 — — 128.8

Reverse repo................................................. 2,244.7 — — 2,244.7

Guarantees3.................................................. 4,928.3 — — 4,928.3

Letters of comfort4........................................ 21,318.3 — — 21,318.3

Swaps/forward contracts ............................. 230,905.2 — — 230,905.2

Participation certificate ................................. 896.6 — — 896.6

1. Whole-time directors and relatives.

2. Includes call money lent.

3. Includes letter of undertaking.

4. Excludes letter of comfort issued on behalf of foreign subsidiaries, details of which are given separately.

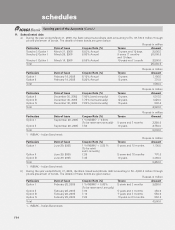

Subsidiaries and joint ventures

ICICI Venture Funds Management Company Limited, ICICI Securities Limited, ICICI Brokerage Services Limited, ICICI

International Limited, ICICI Trusteeship Services Limited, ICICI Home Finance Company Limited, ICICI Investment Management

Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK Limited, ICICI Bank Canada, ICICI

Prudential Life Insurance Company Limited, ICICI Distribution Finance Private Limited (ICICI Distribution Finance Private

Limited has merged with ICICI Home Finance Company Limited effective August 11, 2005), ICICI Lombard General Insurance

Company Limited, Prudential ICICI Asset Management Company Limited, Prudential ICICI Trust Limited, ICICI Bank Eurasia

Limited Liability Company and TSI Ventures (India) Private Limited.

Associates

ICICI Equity Fund, ICICI Eco-net Internet and Technology Fund, ICICI Emerging Sectors Fund, ICICI Strategic Investments

Fund, ICICI Property Trust and TCW/ICICI Investment Partners L.L.C.

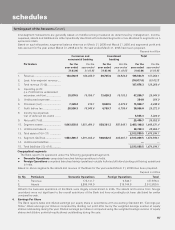

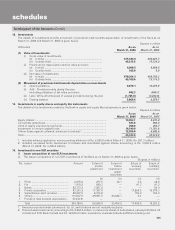

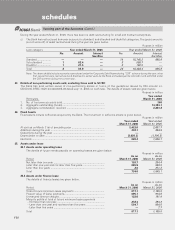

7. Securitisation

The Bank sells loans through securitisation and direct assignment. The information on securitisation activity of the Bank as

an originator for the year ended March 31, 2006 and March 31, 2005 is given in the table below.

Rupees in million

Year ended Year ended

March 31, 2006 March 31, 2005

Total number of loan assets securitised .................................................... 909,130 942,567

Total book value of loan assets securitised ............................................... 94,856.2 160,071.2

Sale consideration received for the securitised assets............................. 102,856.6 163,412.2

Net gain on account of securitisation ....................................................... 4,032.4 3,976.1