ICICI Bank 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F31

forming part of the Accounts (Contd.)

schedules

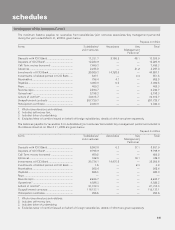

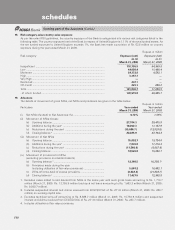

25.3 The maturity profile of present value of lease payments is given below.

The details of maturity profile of present value of finance lease payments are given below.

Rupees in million

As on As on

Period March 31, 2006 March 31, 2005

Not later than one year ...................................................................... 176.7 222.8

Later than one year and not later than five years .............................. 518.4 683.3

Later than five years .......................................................................... —7.5

Total 695.1 913.6

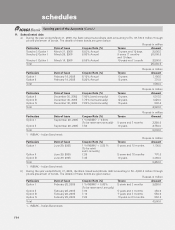

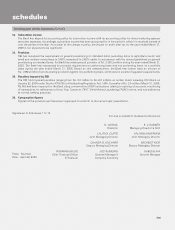

26. Early Retirement Option (“ERO”)

The Bank had implemented an Early Retirement Option Scheme 2003 for its employees in July 2003. All employees who

had completed 40 years of age and seven years of service with the Bank (including period of service with entities amalgamated

with the Bank) were eligible for the ERO.

The ex-gratia payments under ERO and termination benefits and leave encashment in excess of the provision made (net of

tax benefits), aggregating to Rs. 1,910.0 million is being amortised over a period of five years commencing August 1, 2003

(the date of retirement of employees exercising the Option being July 31, 2003).

On account of the above ERO scheme, an amount of Rs. 384.0 million (March 31, 2005: Rs. 384.0 million) has been charged

to revenue being the proportionate amount amortised for the year ended March 31, 2006.

27. Provisions for income tax

The provision for income tax (including deferred tax and fringe benefit tax) for the year ended March 31, 2006 and March 31,

2005 amounted to Rs. 5,535.3 million and Rs. 5,190.0 million respectively.

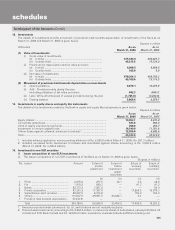

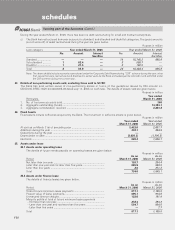

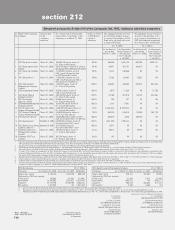

28. Deferred Tax

As on March 31, 2006, the Bank has recorded net deferred tax asset of Rs. 1,642.8 million (March 31, 2005: Rs. 148.7

million), which has been included in Other Assets. The break-up of deferred tax assets and liabilities into major items is

given below.

Rupees in million

As on As on

Particulars March 31, 2006 March 31, 2005

Deferred tax asset

Provision for bad and doubtful debts ........................................................ 6,501.5 6,990.8

Capital loss ................................................................................................ 950.0 —

Others ........................................................................................................ 880.7 917.2

8,332.2 7,908.0

Less: Deferred tax liability

Depreciation on fixed assets.......................................................... 6,697.2 7,537.7

Others ............................................................................................. —221.6

6,697.2 7,759.3

Add: Deferred tax asset pertaining to foreign branches ........................ 7.8 —

Total net deferred tax asset/ (liability) ............................................ 1,642.8 148.7

During the year ended March 31, 2006, the Bank has created a deferred tax asset on carry forward capital losses as based

on its firm plans it is virtually certain that sufficient future taxable capital gains will be available against which the loss can be

set off.

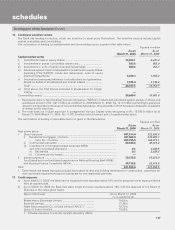

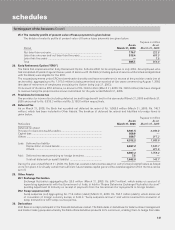

29. Other Assets

29.1 Exchange fluctuation

Exchange fluctuation aggregating Rs. 25.0 million (March 31, 2005: Rs. 244.7 million), which arises on account of

rupee-tying agreements with the Government of India, is held in “Rupee Determine Exchange Fluctuation Account”

pending adjustment at maturity on receipt of payments from the Government for repayments to foreign lenders.

29.2 Swap suspense (net)

Swap suspense (net) aggregating Rs. 71.6 million (debit) (March 31, 2005: Rs. 794.7 million (debit)), which arises out

of conversion of foreign currency swaps, is held in “Swap suspense account” and will be reversed at conclusion of

swap transactions with swap counter-parties.

30. Derivatives

ICICI Bank is a major participant in the financial derivatives market. The Bank deals in derivatives for balance sheet management

and market making purposes whereby the Bank offers derivative products to its customers, enabling them to hedge their risks.