ICICI Bank 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F71

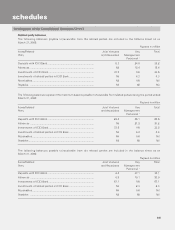

a) Allowance for loan losses

The differences in the allowance for loan losses between Indian GAAP and US GAAP are primarily on account of:

i) Prescriptive provisioning on performing and non-performing loans as per Reserve Bank of India (“RBI”)

guidelines under Indian GAAP as compared to allowances made in accordance with SFAS No. 5 on

“Accounting for Contingencies” and SFAS No. 114 on “Accounting by Creditors for Impairment of a Loan”

issued by the FASB under US GAAP. Under Indian GAAP, in line with the RBI guidelines, the Bank classifies

loans as non-performing when interest or instalments are overdue for more than 90 days. RBI norms also

allow banks to create additional floating provisions over and above the specific provisions. The additional

floating provisions are generally based on losses anticipated by the Bank on historical loss experiences or

expected anticipated losses in certain loans.

ii) Differences in the discount rates and cash flows used for computing allowances created on restructured

loans under Indian GAAP and US GAAP.

iii) Provisions on sale of certain loans to an asset reconstruction company not accounted for as sale under

USGAAP. The loss on assets transferred to an asset reconstruction company are included under allowance

for loan losses under US GAAP whereas under Indian GAAP, these are netted off from the security receipts

received as consideration for sale as the transfer of these loans is treated as a sale under Indian GAAP. The

allowance for loan losses under US GAAP as at March 31, 2006 included Rs. 28,336.7 million (March 31,

2005: Rs 25,358.8 million) on loans sold to an asset reconstruction company.

The guidelines on provisioning for loan losses are as follows:

Classification Provisioning

Standard loans A general provision of 0.40% (excluding direct advances to the agricultural and small

and medium enterprise sectors) is required for all standard (non-impaired) loans.

Sub-standard assets A loan is classified as sub-standard if interest payments or instalments have remained

overdue for more than 90 days. A provision of 10% is required for all sub-standard

loans. An additional provision of 10% is required for accounts that are abinitio

unsecured.

Doubtful assets A loan is classified as a doubtful loan, if it has remained as sub-standard for more

than a year.

A 100% provision/write-off is required in respect of the unsecured portion of

the doubtful loans. Until year-end fiscal 2004, a 20% to 50% provision was

required for the secured portion as follows:

Up to one year: 20% provision;

One to three years: 30% provision; and

More than three years: 50% provision.

Effective quarter ended June 30, 2004 a 100% provision is required for loans classified

as doubtful for more than three years on or after April 1, 2004. In respect of assets

classified as doubtful for more than three years up to March 31, 2004, 60% to 100%

provision on the secured portion is required as follows:

By March 31, 2005: 60% provision;

By March 31, 2006: 75% provision; and

By March 31, 2007: 100% provision.

reconciliation to US GAAP and related notes

for the year ended March 31, 2006