ICICI Bank 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F59

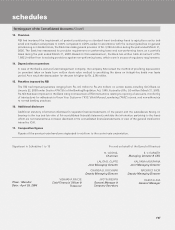

In case of the asset management subsidiary, fixed assets other than leasehold improvements, and software development

and licensing costs are depreciated at written down value method based on economic lives of the assets as estimated by

management.

In case of the overseas banking subsidiaries, fixed assets other than leasehold improvements are depreciated using straight-

line method over the estimated useful lives of the assets as estimated by management. In case of the Canadian subsidiary,

depreciation on furniture & fixtures is charged @ 20% per annum.

In case of the life insurance subsidiary, assets costing upto Rs. 20,000 are fully depreciated in the year of acquisition.

Intangible assets comprising software are stated at cost less amortisation. Significant improvements to software are

capitalised while the insignificant improvements are charged off as software expenses. Software expenses are amortised

on straight-line method over a period of three years from the date they are put to use, being management’s estimate of the

useful life of such intangibles. Depreciation on furniture & fixtures is charged @ 25% per annum.

In case of the general insurance subsidiary, computer software are stated at cost less amortisation. Computer software

including improvements is amortised over a period of five years, being management’s estimate of the useful life of such

intangibles.

In case of housing finance subsidiary, depreciation on computer software is provided @ 20% per annum.

17. Accounting for derivative contracts

The Company enters into derivative contracts such as foreign currency options, interest rate and currency swaps and cross

currency interest rate swaps to hedge on-balance sheet/off-balance sheet assets and liabilities or for trading purposes.

The swap contracts entered to hedge on-balance sheet assets and liabilities are structured in such a way that they bear an

opposite and offsetting impact with the underlying on-balance sheet items. The impact of such derivative instruments is

correlated with the movement of underlying assets and accounted in accordance with RBI guidelines.

Foreign currency and rupee derivatives, which are entered for trading purposes, are marked to market and the resulting

gain/loss, (net of provisions, if any) is recorded in the profit and loss account.

During the year the Bank changed its method for testing hedge effectiveness from the price value of basis point (“PVBP”)

or duration method to the marked to market method. Due to this change certain derivative contracts, which were hitherto

accounted for as hedges, became ineffective and were accordingly accounted for as trading.

18. Impairment of assets

Long-lived assets and certain intangible assets are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is

measured by a comparison of the carrying amount of an asset to future net discounted cash flows expected to be generated

by the asset. If such assets are considered to be impaired, the impairment to be recognised is measured by the amount by

which the carrying amount of the assets exceeds the fair value of the assets.

19. Earnings per share (“EPS”)

Basic and diluted earnings per share are calculated by dividing the net profit or loss for the year attributable to equity

shareholders by the weighted average number of equity shares outstanding during the year. Diluted earnings per equity

share have been computed using the weighted average number of equity shares and dilutive potential equity shares

outstanding during the year, except where the results are anti-dilutive.

B. NOTES FORMING PART OF THE ACCOUNTS

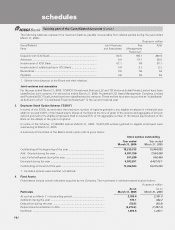

1. Earnings per share (”EPS”)

The Company reports basic and diluted earnings per equity share in accordance with Accounting Standard 20, “Earnings

per Share”. Basic earnings per share is computed by dividing net profit after tax attributable to equity shareholders by the

weighted average number of equity shares outstanding during the year. Diluted earnings per share is computed using the

weighted average number of equity shares and dilutive potential equity shares outstanding during the year.

schedules

forming part of the Consolidated Accounts (Contd.)