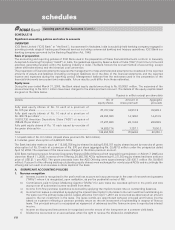

ICICI Bank 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

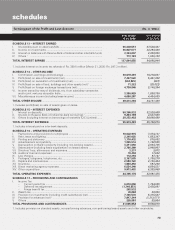

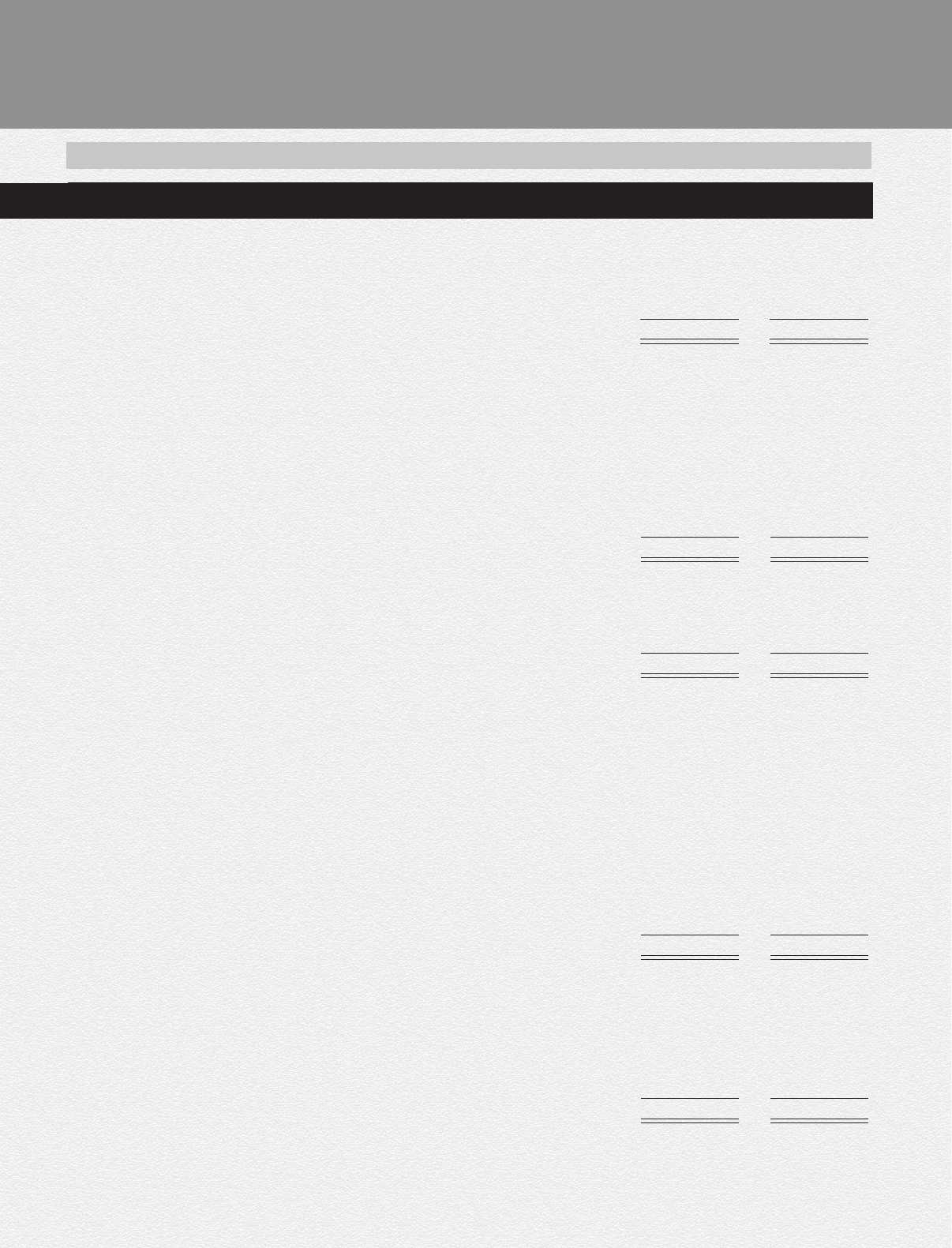

F11

forming part of the Profit and Loss Account

schedules

Year ended Year ended

31.03.2006 31.03.2005

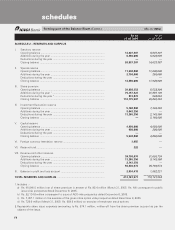

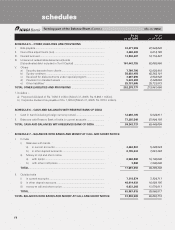

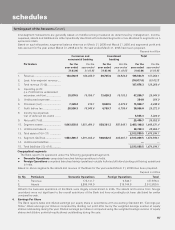

SCHEDULE 13 – INTEREST EARNED

I. Interest/discount on advances/bills ........................................................... 96,849,551 67,528,301

II. Income on investments ............................................................................. 36,927,577 22,294,366

III. Interest on balances with Reserve Bank of India and other inter-bank funds 3,354,647 2,320,089

IV. Others 1................................................................................................... 713,183 1,956,188

TOTAL INTEREST EARNED .............................................................................. 137,844,958 94,098,944

1. Includes interest on income tax refunds of Rs. 399.8 million (March 31, 2005: Rs. 247.3 million).

SCHEDULE 14 – OTHER INCOME

I. Commission, exchange and brokerage ..................................................... 30,019,493 19,210,001

II. Profit/(loss) on sale of investments (net) ................................................... 7,497,522 5,461,352

III. Profit/(loss) on revaluation of investments (net) ........................................ (534,825) (907)

IV. Profit/(loss) on sale of land, buildings and other assets (net) 1................. 71,222 (20,822)

V. Profit/(loss) on foreign exchange transactions (net).................................. 4,730,846 3,146,394

VI. Income earned by way of dividends, etc. from subsidiary companies

and/or joint ventures abroad/in India ......................................................... 3,386,929 1,880,786

VII. Miscellaneous income (including lease income) ...................................... 4,660,207 4,484,635

TOTAL OTHER INCOME ................................................................................... 49,831,394 34,161,439

1. Includes profit/(loss) on sale of assets given on lease.

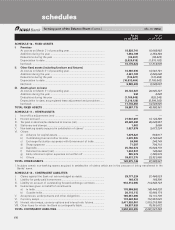

SCHEDULE 15 – INTEREST EXPENDED

I. Interest on deposits ................................................................................... 58,366,832 32,520,688

II. Interest on Reserve Bank of India/inter-bank borrowings 1....................... 9,254,169 2,527,689

III. Others (including interest on borrowings of erstwhile ICICI Limited) ....... 28,353,482 30,660,499

TOTAL INTEREST EXPENDED ......................................................................... 95,974,483 65,708,876

1. Includes interest paid on inter-bank deposits.

SCHEDULE 16 – OPERATING EXPENSES

I. Payments to and provisions for employees .............................................. 10,822,935 7,374,121

II. Rent, taxes and lighting ............................................................................. 2,348,028 1,853,347

III. Printing and stationery ............................................................................... 1,110,432 876,632

IV. Advertisement and publicity ...................................................................... 1,855,514 1,162,555

V. Depreciation on Bank’s property (including non-banking assets) ............. 3,471,658 2,933,725

VI. Depreciation (including lease equalisation) on leased assets .................. 2,766,260 2,969,907

VII. Directors’ fees, allowances and expenses ................................................ 3,237 3,872

VIII. Auditors’ fees and expenses ..................................................................... 18,456 17,632

IX. Law charges............................................................................................... 112,356 97,141

X. Postages, telegrams, telephones, etc. ...................................................... 2,157,585 1,736,270

XI. Repairs and maintenance .......................................................................... 2,580,722 2,159,454

XII. Insurance ................................................................................................... 1,080,254 597,230

XIII. Direct marketing agency expenses ........................................................... 6,554,240 4,854,521

XIV. Other expenditure ...................................................................................... 9,913,493 6,355,068

TOTAL OPERATING EXPENSES ...................................................................... 44,795,170 32,991,475

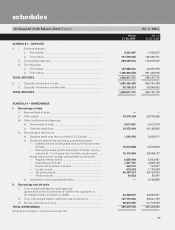

SCHEDULE 17 – PROVISIONS AND CONTINGENCIES

I. Income Tax

– Current period tax .............................................................................. 6,618,650 1,764,935

– Deferred tax adjustment .................................................................... (1,346,853) 3,425,081

– Fringe benefit tax ............................................................................... 263,532 —

II. Wealth tax .................................................................................................. 30,000 30,000

III. Provision for investments (including credit substitutes) (net) ................... 7,766,578 5,415,587

IV. Provision for advances (net) 1....................................................................................................................... 7,947,244 (1,213,571)

V. Others ........................................................................................................ 226,801 85,984

TOTAL PROVISIONS AND CONTINGENCIES ................................................ 21,505,952 9,508,016

1. Includes provision on standard assets, non-performing advances, non-performing leased assets and other receivables.

(Rs. in ‘000s)