ICICI Bank 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F29

forming part of the Accounts (Contd.)

schedules

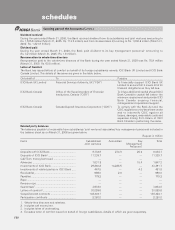

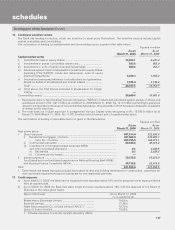

20. Financial assets transferred during the year to Securitisation Company (SC) / Reconstruction Company (RC)

The Bank has transferred certain assets to an asset reconstruction company (ARC) in terms of the guidelines issued by RBI

governing such transfer. For the purpose of the valuation of the underlying security receipts issued by the ARCIL, the

security receipts were valued at their respective NAVs as advised by the ARCIL. The details of the assets transferred for the

years ended March 31, 2006 and March 31, 2005 are given in the table below.

Rupees in million

Year ended Year ended

March 31, 2006 March 31, 2005

A No. of accounts ........................................................................................................ 15 82

B Aggregate value (net of provisions) of accounts sold to SC/RC .............................. 4,794.0 13,279.3

C Aggregate consideration .......................................................................................... 4,066.3 10,862.3

D Additional consideration realised in respect of accounts transferred in earlier years1..... ——

E Aggregate gain/(loss) over net book value ............................................................... (727.7) (2,417.0)

1. During the year ended March 31, 2006, ARCIL fully redeemed security receipts of four trusts and partly redeemed

security receipts of two trusts. The Bank realised Rs. 95.7 million over the gross book value in respect of these trusts.

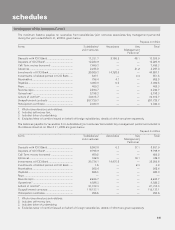

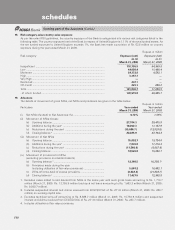

21. Provisions on standard asset

The provision on standard assets held by the Bank in accordance with RBI guidelines was Rs. 5,638.3 million at March 31,

2006 (March 31, 2005: Rs. 2,248.1 million).

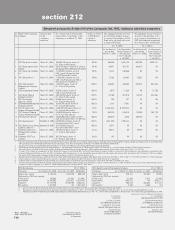

22. Information in respect of restructured assets

a) Details of loan assets subjected to restructuring is given below.

Rupees in million

Year ended Year ended

March 31, 2006 March 31, 2005

(i) Total amount of loan assets subjected to restructuring,

rescheduling, renegotiation;.................................................................... 4,139.4 20,196.5

of which under CDR

[(i) = (ii)+(iii)+(iv)]..................................................................................... 4,077.0 18,060.1

(ii) The amount of standard assets subjected to restructuring,

rescheduling, renegotiation;.................................................................... 4,055.5 19,455.3

of which under CDR ................................................................................ 4,055.5 17,501.4

(iii) The amount of sub-standard assets subjected to restructuring,

rescheduling, renegotiation;.................................................................... 62.4 558.7

of which under CDR ................................................................................ — 558.7

(iv) The amount of doubtful assets subjected to restructuring,

rescheduling, renegotiation;.................................................................... 21.5 182.5

of which under CDR ................................................................................ 21.5 —

Note: Above details exclude cases that were approved by CDR Forum and disclosed in the earlier years by the Bank and in which certain

terms and conditions have been modified by CDR Forum during the current year. The above table includes cases that were restructured

and disclosed in earlier years by the Bank and subsequently referred to and admitted under the CDR scheme during the current year.

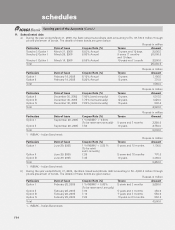

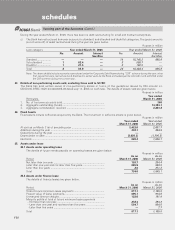

b) The gross amounts (net of write-offs) of restructuring under the CDR schemes during the year are given below.

Rupees in million

Loan category Year ended March 31, 2006 Year ended March 31, 2005

No. Amount Interest No. Amount Interest

Sacrifice Sacrifice

Standard................... 2 4,055.5 50.7 17 17,501.4 788.0

Sub-standard ........... ——— 3 558.7 —

Doubtful ................... 1 21.5 — ———

Total 3 4,077.0 50.7 20 18,060.1 788.0

Note: Above details exclude cases that were approved by CDR Forum and disclosed in the earlier years by the Bank and in which certain

terms and conditions have been modified by CDR Forum during the current year. The above table includes cases that were restructured

and disclosed in earlier years by the Bank and subsequently referred to and admitted under the CDR scheme during the current year.