ICICI Bank 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F14

forming part of the Accounts (Contd.)

schedules

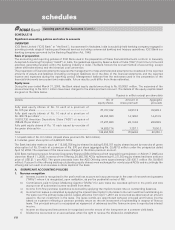

namely insignificant, low, moderate, high, very high, restricted and off-credit and provisioning made on exposures

exceeding 90 days on a graded scale ranging from 0.25% to 100%. For exposures with contractual maturity of less

than 90 days, 25% of the normal provision requirement is held. If the country exposure (net) of the Bank in respect of

each country does not exceed 1% of the total funded assets, no provision is maintained on such country exposure.

4. Transfer and servicing of financial assets

The Bank transfers commercial and consumer loans through securitisation transactions. The transferred loans are

de-recognised and gains/losses are recorded only if the Bank surrenders the rights to benefits specified in the loan contract.

Recourse and servicing obligations are reduced from proceeds of the sale. Retained beneficial interests in the loans is

measured by allocating the carrying value of the loans between the assets sold and the retained interest, based on the

relative fair value at the date of the securitisation.

During the year RBI has issued guidelines on accounting for securitisation of standard assets. In accordance with these

guidelines, with effect from February 1, 2006, the Bank accounts for any loss arising on sale immediately at the time of sale

and the profit/premium arising on account of sale is amortised over the life of the securities issued or to be issued by the

special purpose vehicle/special purpose entity to which the assets are sold.

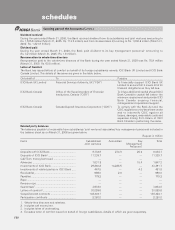

5. Fixed assets and depreciation

a) Premises and other fixed assets are carried at cost less accumulated depreciation. Depreciation is charged over the

estimated useful life of a fixed asset on a straight-line basis. The rates of depreciation for fixed assets, which are not

lower than the rates prescribed in schedule XIV of the Companies Act, 1956, are given below.

Asset Depreciation Rate

Premises owned by the Bank ................................................................................... 1.63%

Improvements to leasehold premises ...................................................................... 1.63% or over the lease period,

whichever is higher

ATMs ......................................................................................................................... 12.50%

Plant and machinery like air conditioners, xerox machines, etc. ............................. 10.00%

Computers ................................................................................................................ 33.33%

EDC Terminals ........................................................................................................... 16.67%

Furniture and fixtures ................................................................................................ 15.00%

Motor vehicles .......................................................................................................... 20.00%

Others (including Software and system development expenses) ........................... 25.00%

b) Depreciation on leased assets is made on a straight-line basis at the higher of the rates determined with reference to

the primary period of lease and the rates specified in Schedule XIV to the Companies Act, 1956.

c) Assets purchased/sold during the year are depreciated on the basis of actual number of days the asset has been put

to use.

d) Items costing less than Rs.5,000/- are depreciated fully over a period of 12 months from the date of purchase.

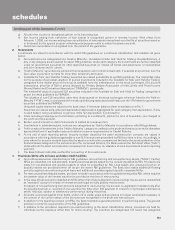

6. Foreign currency transactions

a) Foreign currency income and expenditure items of domestic operations are translated at the exchange rates prevailing

on the date of the transaction, income and expenditure items of integral foreign operations (representative offices) are

translated at weekly average closing rate, and income and expenditure of non-integral foreign operations (foreign

branches and offshore banking units) are translated at quarterly average closing rate.

b) Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing

exchange rates notified by Foreign Exchange Dealers’ Association of India (“FEDAI”) at the balance sheet date and the

resulting profits/losses are included in the profit and loss account.

c) Both monetary and non-monetary foreign currency assets and liabilities of non-integral foreign operations are translated

at closing exchange rates notified by FEDAI at the balance sheet date and the resulting profits/losses from exchange

differences are accumulated in the foreign currency translation reserve until the disposal of the net investment in the

non-integral foreign operations.

d) Outstanding forward exchange contracts are revalued at the exchange rates notified by FEDAI for specified maturities

and at interpolated rates for contracts of in-between maturities. The resultant gains or losses are recognised in the

profit and loss account.

e) Contingent liabilities on account of guarantees, endorsements and other obligations are stated at the exchange rates

notified by FEDAI at the balance sheet date.

7. Accounting for derivative contracts

The Bank enters into derivative contracts such as foreign currency options, interest rate and currency swaps and cross

currency interest rate swaps to hedge on-balance sheet/off-balance sheet assets and liabilities or for trading purposes.

The swap contracts entered to hedge on-balance sheet assets and liabilities are structured in such a way that they bear an

opposite and offsetting impact with the underlying on-balance sheet items. The impact of such derivative instruments is

correlated with the movement of underlying assets and accounted pursuant to the principles of hedge accounting.

Foreign currency and rupee derivatives, which are entered for trading purposes, are marked to market and the resulting

gain/loss, (net of provisions, if any) is recorded in the profit and loss account.