ICICI Bank 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Management’s Discussion & Analysis

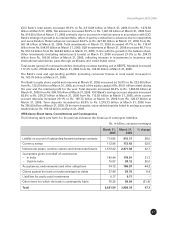

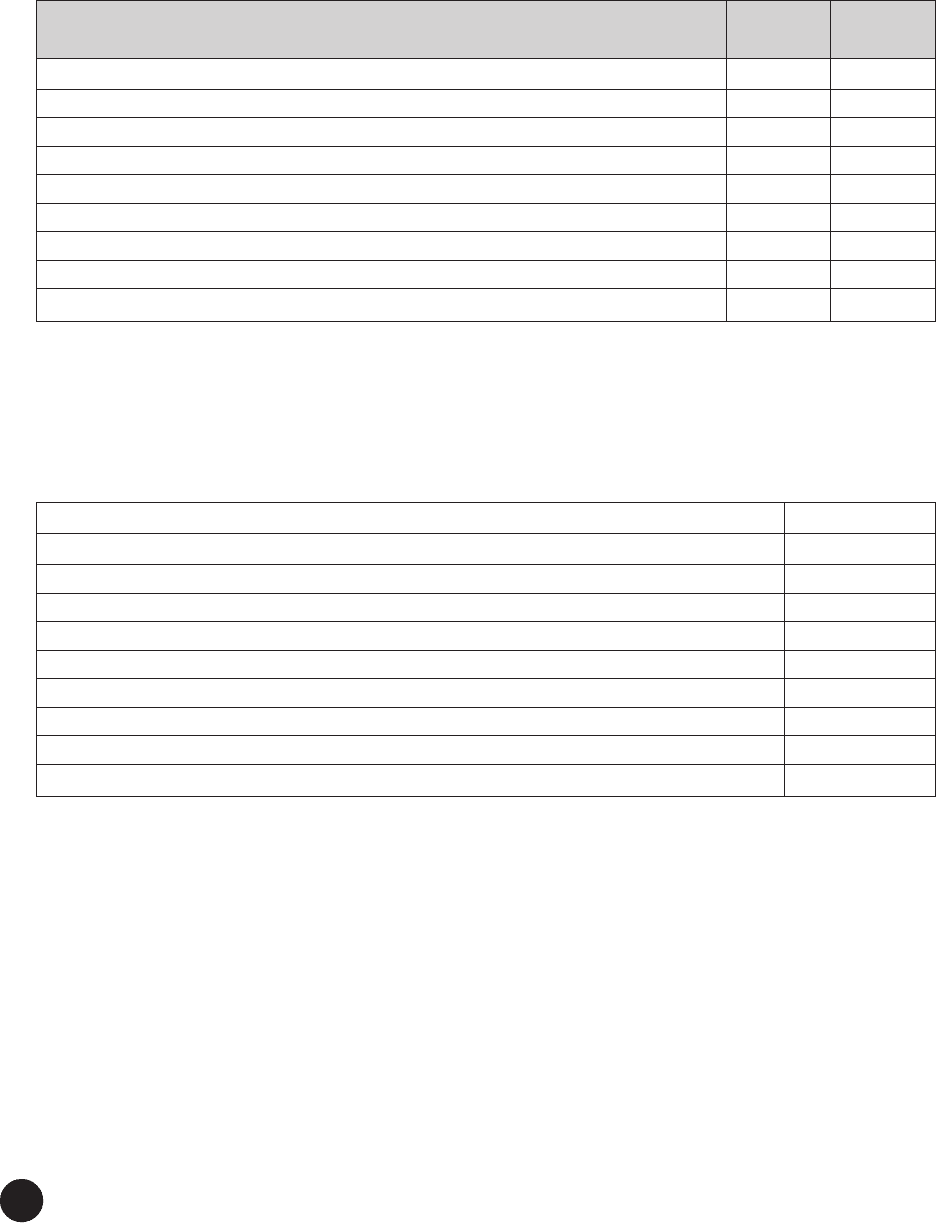

The following table sets forth, for the periods indicated, the profit/(loss) of the principal subsidiaries of

ICICI Bank.

Rs. in billion

Fiscal Fiscal

2005 2006

ICICI Securities Limited 0.64 1.57

ICICI Prudential Life Insurance Company Limited (2.12) (1.88)

ICICI Lombard General Insurance Company Limited 0.48 0.50

ICICI Venture Funds Management Company Limited 0.32 0.50

ICICI Home Finance Company Limited 0.10 0.12

Prudential ICICI Asset Management Company Limited 0.17 0.31

ICICI Bank UK Limited 0.10 0.64

ICICI Bank Canada (0.25) (0.25)

ICICI Bank Eurasia Limited Liability Company – 0.01

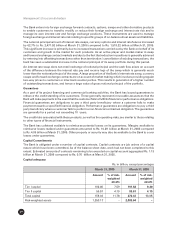

RECONCILIATION OF PROFITS AS PER INDIAN GAAP AND US GAAP

As a result of the differences in the basis of accounting under US GAAP and Indian GAAP, the Bank’s US

GAAP accounts showed a profit of Rs. 20.04 billion as compared to consolidated profit of Rs. 24.20 billion

under Indian GAAP in fiscal 2006. A condensed reconciliation of consolidated profit after tax as per

Indian GAAP with net income as per US GAAP for fiscal 2006 is set out in the following table:

Rs. in billion

Consolidated profit after tax as per Indian GAAP 24.20

Adjustments :

Allowances for loan losses (5.21)

Business combinations (1.05)

Consolidation 0.27

Valuation of securities 0.54

Amortisation of fees & cost 3.16

Accounting for derivatives (0.15)

Deferred taxes (1.72)

Net income as per US GAAP 20.04

(1) All amounts have been rounded off to the nearest Rs. 10.0 million.