ICICI Bank 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F47

schedules

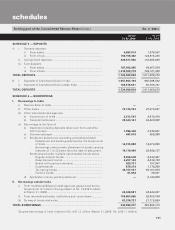

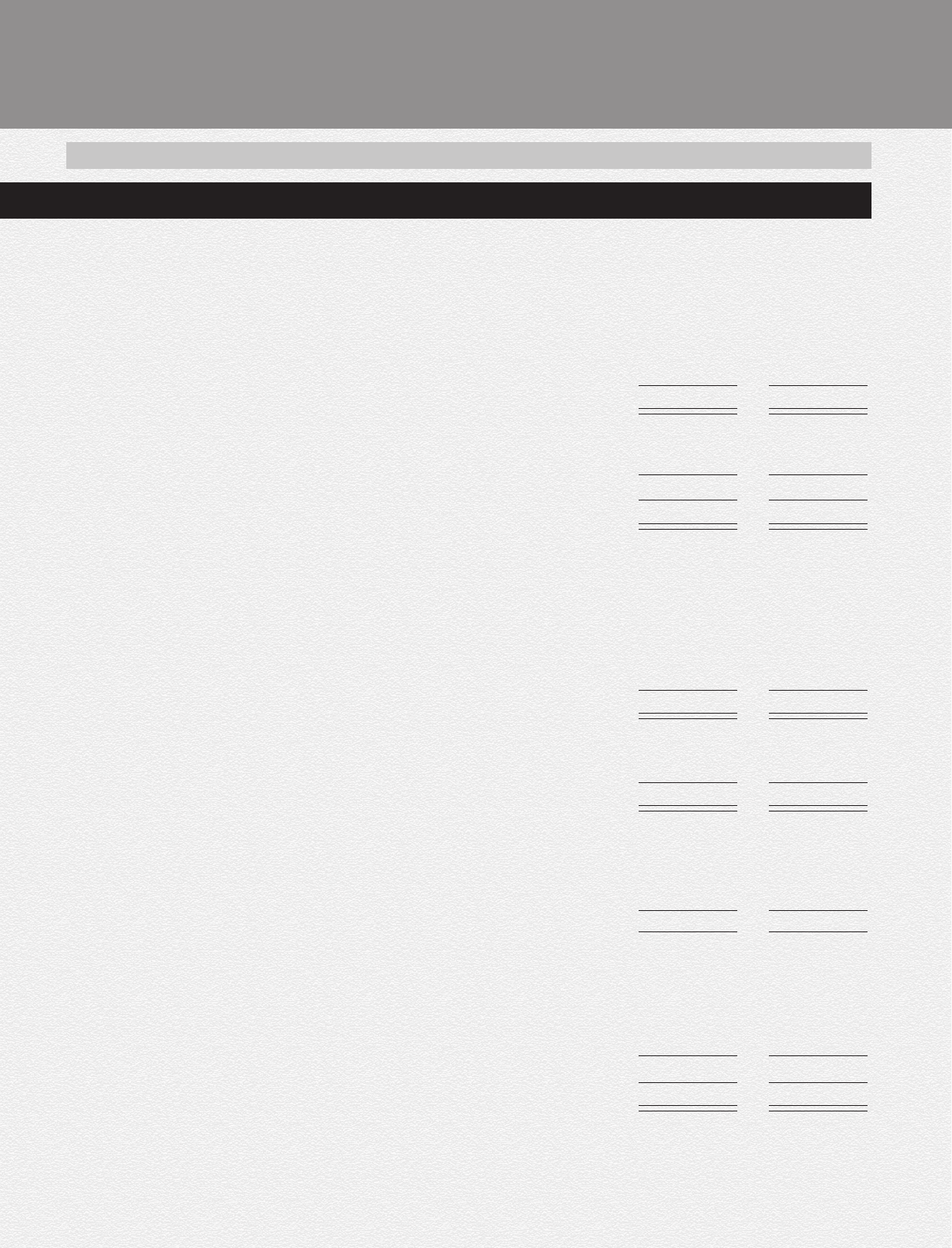

SCHEDULE 8 — INVESTMENTS [net of provisions]

I. Investments in India

i) Government securities ...................................................................... 527,979,787 359,865,891

ii) Other approved securities ................................................................. 356,349 318,890

iii) Shares (includes equity and preference shares) ............................... 38,738,178 32,027,936

iv) Debentures and bonds ...................................................................... 27,896,238 35,035,525

v) Others (commercial paper, mutual fund units, pass through

certificates, security receipts etc.) 1.................................................. 166,027,372 101,247,552

TOTAL ........................................................................................................ 760,997,924 528,495,794

II. Investments outside India

i) Government securities ...................................................................... 10,701,989 377,947

ii) Others ................................................................................................ 68,438,909 17,642,421

TOTAL ........................................................................................................ 79,140,898 18,020,368

TOTAL INVESTMENTS ..................................................................................... 840,138,822 546,516,162

1. Includes assets held to cover linked liabilities of life insurance business of Rs. 70,788.5 million

(March 31, 2005: Rs. 26,540.6 million).

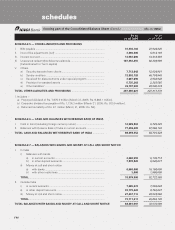

SCHEDULE 9 — ADVANCES (net of provisions)

A. i) Bills purchased and discounted ........................................................ 63,426,766 43,984,209

ii) Cash credits, overdrafts and loans repayable on demand ................ 258,593,077 123,344,410

iii) Term loans.......................................................................................... 1,209,251,205 772,559,072

iv) Securitisation, finance lease and hire purchase receivables 1.......... 31,332,154 24,211,871

TOTAL ........................................................................................................ 1,562,603,202 964,099,562

B. i) Secured by tangible assets [includes advances against Book debt]21,290,962,380 827,679,644

ii) Covered by Bank/Government guarantees ....................................... 15,235,139 10,795,838

iii) Unsecured.......................................................................................... 256,405,683 125,624,080

TOTAL ........................................................................................................ 1,562,603,202 964,099,562

C. I. Advances in India

i) Priority sector ............................................................................. 447,310,487 215,591,362

ii) Public sector .............................................................................. 11,572,043 11,154,310

iii) Banks ......................................................................................... 48,863 4,517,162

iv) Others ........................................................................................ 913,884,547 650,547,563

TOTAL ........................................................................................................ 1,372,815,940 881,810,397

II. Advances outside India

i) Due from banks ......................................................................... 25,492,873 10,375,851

ii) Due from others

a) Bills purchased and discounted ........................................ 44,128,091 24,884,221

b) Syndicated loans................................................................ 39,708,130 11,925,394

c) Others ................................................................................ 80,458,168 35,103,699

TOTAL ........................................................................................................ 189,787,262 82,289,165

TOTAL ADVANCES ........................................................................................... 1,562,603,202 964,099,562

1.Includes receivables under lease amounting to Rs. 695.1 million (March 31, 2005 : Rs. 913.6 million).

2.Includes a loan of Rs. 16,028.7 million (March 31, 2005: Rs. Nil) for which security is being created.

As on As on

31.03.2006 31.03.2005

(Rs. in ‘000s)forming part of the Consolidated Balance Sheet (Contd.)