ICICI Bank 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F42

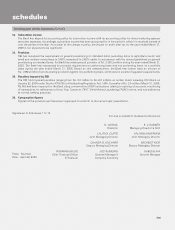

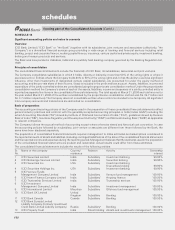

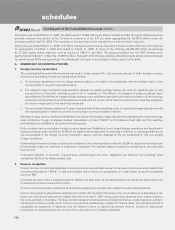

Significant Accounting Policies and Notes to Accounts (refer Schedule 18)

The Schedules referred to above form an integral part of the consolidated balance sheet

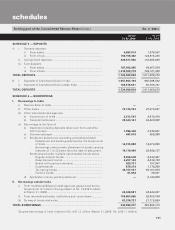

consolidated cash flow statement

for the year ended March 31, 2006

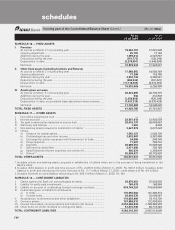

Particulars Year ended Year ended

31.03.2006 31.03.2005

Cash flow from operating activities

Net profit before taxes ........................................................................... 31,198,896 24,207,093

Adjustments for :

Depreciation and amortisation ............................................................... 9,462,631 9,778,945

Net (appreciation) / depreciation on investments .................................. 8,660,775 5,287,521

Provision in respect of non-performing assets (including

prudential provision on standard assets) ............................................... 8,117,173 (889,859)

Provision for contingencies & others ...................................................... 203,564 85,984

(Profit) / loss on sale of fixed assets ....................................................... (51,832) 9,232

57,591,207 38,478,916

Adjustments for :

(Increase) / decrease in investments ...................................................... (202,720,286) (50,917,262)

(Increase) / decrease in advances .......................................................... (606,401,452) (313,691,838)

Increase / (decrease) in borrowings ....................................................... 82,006,471 60,236,038

Increase / (decrease) in deposits ............................................................ 713,348,700 330,298,939

(Increase) / decrease in other assets...................................................... (45,598,461) (28,297,407)

Increase / (decrease) in other liabilities and provisions ......................... 81,889,315 74,907,141

22,524,287 72,535,611

(Payment) / refund of taxes (net) ............................................................ (10,198,463) (9,475,531)

Net cash generated from operating activities .................................... (A) 69,917,031 101,538,996

Cash flow from investing activities

Purchase of fixed assets ........................................................................ (6,557,240) (5,914,656)

Proceeds from sale of fixed assets ........................................................ 1,010,888 323,177

(Purchase) / sale of long-term investments ............................................ (96,168,425) (37,444,165)

Acquisition of subsidiaries (net of cash acquired) ................................. (688,736) —

Net cash generated from investing activities ..................................... (B) (102,403,513) (43,035,644)

Cash flow from financing activities

Proceeds from issue of share capital ..................................................... 79,039,409 31,922,933

Amount received on exercise of stock options & calls in arrears .......... 811,100 649,861

Net proceeds / (repayment) of bonds (including subordinated debts) .. 6,534,092 (38,366,923)

Dividend and dividend tax paid .............................................................. (7,598,693) (6,381,725)

Net cash generated from financing activities ..................................... (C) 78,785,908 (12,175,854)

Effect of exchange fluctuation on translation reserve ....................... (D) (25,495) 65,418

Net increase / (decrease) in cash and cash equivalents .................... (A) + (B) + (C) + (D) 46,273,931 46,392,916

Cash and cash equivalents as at 1st April........................................... 136,277,018 89,884,102

Cash and cash equivalents as at 31st March ...................................... 182,550,949 136,277,018

(Rs. in ‘000s)

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Deputy Managing Director

JYOTIN MEHTA

General Manager &

Company Secretary

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Joint Managing Director

NACHIKET MOR

Deputy Managing Director

RAKESH JHA

General Manager

For S. R. Batliboi & Co.

Chartered Accountants

per VIREN H. MEHTA

a Partner

Membership No. : 048749

Place : Mumbai

Date : April 29, 2006

As per our Report of even date. For and on behalf of the Board of Directors

VISHAKHA MULYE

Chief Financial Officer &

Treasurer