HSBC 2008 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2008 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.143

HSBC group companies have been named as

defendants in suits in the United States anticipated to

seek class action status and cases in the Commercial

List of the Irish courts. All of the cases where HSBC

group companies are named as a defendant are at a

very early stage. HSBC considers that it has good

defences to these claims and will continue to defend

them vigorously. HSBC is unable reliably to estimate

the liability, if any, that might arise as a result of

such claims.

Various HSBC group companies have also

received requests for information from various

regulatory authorities in connection with the alleged

fraud by Madoff. HSBC group companies are co-

operating with these requests for information.

These actions apart HSBC is party to legal

actions in a number of jurisdictions including the

UK, Hong Kong and the US arising out of its normal

business operation. HSBC considers that none of the

actions is material, and none is expected to result in

a significant adverse effect on the financial position

of HSBC, either individually or in the aggregate.

Management believes that adequate provisions have

been made in respect of the litigation arising out

of its normal business operations. HSBC has not

disclosed any contingent liability associated with

these legal actions because it is not practical to

do so.

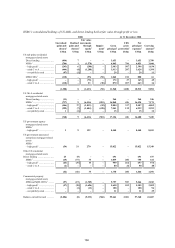

Operating and Financial Review footnotes (see pages 12 to 143)

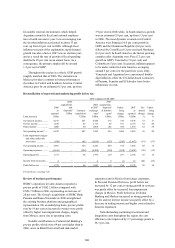

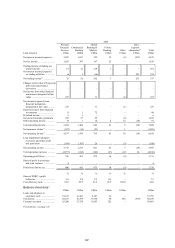

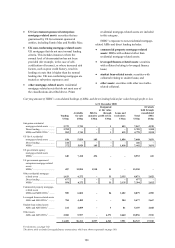

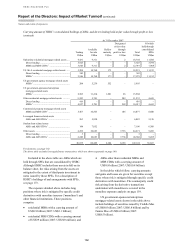

1 Columns headed ‘Acquisitions, disposals and dilution gains’ and ‘Acquisitions and disposals’ comprise the net increments or

decrements in profits in the current year (compared with the previous year) which are attributable to acquisitions or disposals of

subsidiaries made, or dilution gains, in the relevant years. Acquisitions and disposals are determined on the basis of the review and

analysis of events in each year.

2 ‘Currency translation’ is the effect of translating the results of subsidiaries and associates for the previous year at the average rates of

exchange applicable in the current year.

3 Excluding 2007 acquisitions, disposals and dilution gains.

4 ‘Other income’ in this context comprises net trading income (see 15 below), net income from financial instruments designated at fair

value, gains less losses from financial investments, gains arising from dilution of interests in associates, dividend income, net earned

insurance premiums and other operating income less net insurance claims incurred and movement in liabilities to policyholders.

5 Net operating income before loan impairment charges and other credit risk provisions.

6 Excluding 2006 acquisitions, disposals and dilution gains.

7 Interest income on trading assets is reported as ‘Net trading income’ in the consolidated income statement.

8 Interest income on financial assets designated at fair value is reported as ‘Net income from financial instruments designated at fair

value’ in the consolidated income statement.

9 Brazilian operations comprise HSBC Bank Brasil S.A.-Banco Múltiplo and subsidiaries, plus HSBC Serviços e Participações Limitada.

10 This table analyses interest-bearing bank deposits only. See page 59 for an analysis of all bank deposits.

11 Interest expense on financial liabilities designated at fair value is reported as ‘Net income on financial instruments designated at fair

value’ in the consolidated income statement other than interest on own debt.

12 This table analyses interest-bearing customer accounts only. See page 60 for an analysis of all customer accounts.

13 Net interest margin is calculated as net interest income divided by average interest earning assets.

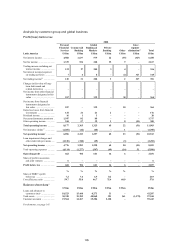

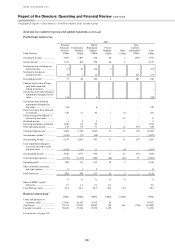

14 The main items reported under ‘Other’ are certain property activities, unallocated investment activities, centrally held investment

companies, gains arising from the dilution of interests in associates, movements in the fair value of own debt designated at fair value

(the remainder of the Group’s gain on own debt is included in Global Banking and Markets), and HSBC’s holding company and

financing operations. The results also include net interest earned on free capital held centrally, operating costs incurred by the head

office operations in providing stewardship and central management services to HSBC, and costs incurred by the Group Service Centres

and Shared Service Organisations and associated recoveries. At 31 December 2008, gains arising from the dilution of interests in

associates were nil (2007: US$1.1 billion and 2006: nil) and fair value gains on HSBC’s own debt designated at fair value were

US$6.7 billion (2007: US$2.8 billion income; 2006: US$35 million expense).

15 Assets by geographical region and customer group include intra-HSBC items. These items are eliminated, where appropriate, under the

heading ‘Intra-HSBC items’.

16 In the analyses of customer groups and global businesses, net trading income comprises all gains and losses from changes in the fair

value of financial assets and financial liabilities classified as held for trading, together with related external and internal interest

income and interest expense, and dividends received; in the statutory presentation internal interest income and expense are eliminated.

17 Net insurance claims incurred and movement in liabilities to policyholders.

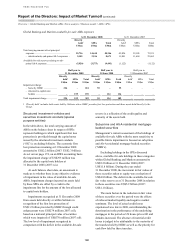

18 In 2008, Global Markets included a US$529 million gain on the widening of credit spreads on structured liabilities (2007:

US$34 million; 2006: nil).

19 ‘Other’ in Global Banking and Markets includes net interest earned on free capital held in the global business not assigned to products.

20 Trading assets and financial investments held in Europe, and by Global Banking and Markets in North America, include financial

assets which may be repledged or resold by counterparties.

21 Inter-segment elimination comprises (i) the costs of shared services and Group Service Centres included within ‘Other’ which are

recovered from customer groups, and (ii) the intra-segment funding costs of trading activities undertaken within Global Banking and

Markets. HSBC’s balance sheet management business, reported within Global Banking and Markets, provides funding to the trading

businesses. To report Global Banking and Markets’ ‘Net trading income’ on a fully funded basis, ‘Net interest income’ and ‘Net interest

income/(expense) on trading activities’ are grossed up to reflect internal funding transactions prior to their elimination in the inter-

segment column.

22 France primarily comprises the domestic operations of HSBC France, HSBC Assurances and the Paris branch of HSBC Bank.

23 United States includes the impairment of goodwill in respect of Personal Financial Services - North America as described in Note 22 on

the Financial Statements.