Xerox 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91Xerox 2012 Annual Report

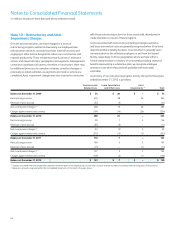

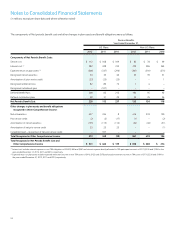

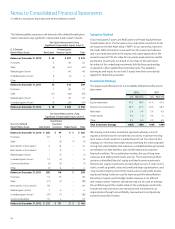

Benefit plans pre-tax amounts recognized in AOCL at December 31:

Pension Benefits

U.S. Plans Non-U.S. Plans Retiree Health

2012 2011 2012 2011 2012 2011

Net actuarial loss $ 1,255 $ 963 $ 2,013 $ 1,589 $ 97 $ 70

Prior service (credit) cost (17) (38) – 1 (128) (163)

Total Pre-tax Loss (Gain) $ 1,238 $ 925 $ 2,013 $ 1,590 $ (31) $ (93)

Accumulated Benefit Obligation $ 5,027 $ 4,617 $ 6,359 $ 5,517

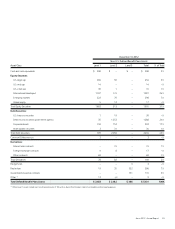

Aggregate information for pension plans with an Accumulated benefit obligation in excess of plan assets is presented below:

December 31, 2012

Underfunded Plans Unfunded Plans Total

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S. Total

Projected benefit obligation $ 4,679 $ 5,997 $ 355 $ 527 $ 5,034 $ 6,524 $ 11,558

Accumulated benefit obligation 4,672 5,686 355 520 5,027 6,206 11,233

Fair value of plan assets 3,574 5,213 – – 3,574 5,213 8,787

December 31, 2011

Underfunded Plans Unfunded Plans Total

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S. Total

Projected benefit obligation $ 4,342 $ 4,391 $ 327 $ 445 $ 4,669 $ 4,836 $ 9,505

Accumulated benefit obligation 4,291 4,127 326 434 4,617 4,561 9,178

Fair value of plan assets 3,393 3,811 – – 3,393 3,811 7,204

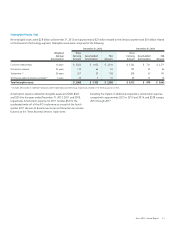

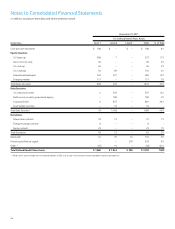

Our pension plan assets and benefit obligations at December 31, 2012

were as follows:

Fair Value

of Pension Pension Benefit Net Funded

(in billions) Plan Assets Obligations Status

U.S. funded $ 3.6 $ 4.6 $ (1.0)

U.S. unfunded – 0.4 (0.4)

Total U.S. $ 3.6 $ 5.0 $ (1.4)

U.K. 3.4 3.7 (0.3)

Canada 0.7 1.0 (0.3)

Other funded 1.3 1.5 (0.2)

Other unfunded – 0.5 (0.5)

Total $ 9.0 $ 11.7 $ (2.7)

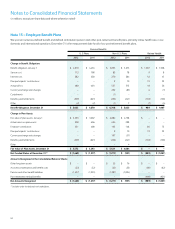

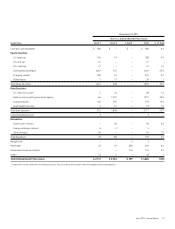

Most of our defined benefit pension plans generally provide employees

a benefit, depending on eligibility, calculated under a highest average

pay and years of service formula. Our primary domestic defined

benefit pension plans provide a benefit at the greater of (i) the highest

average pay and years of service formula, (ii) the benefit calculated

under a formula that provides for the accumulation of salary and

interest credits during an employee’s work life or (iii) the individual

account balance from the Company’s prior defined contribution plan

(Transitional Retirement Account or TRA).