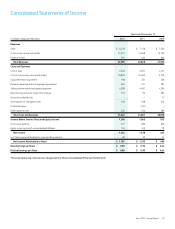

Xerox 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

46

In 2013, we expect to continue the leveraging of our finance assets at

an assumed 7:1 ratio of debt to equity. We also may sell or securitize

certain finance receivables as another means to support our customer

financing activities – see discussion further below of finance receivable

sale activity in 2012. The following summarizes our total debt at

December 31, 2012 and 2011:

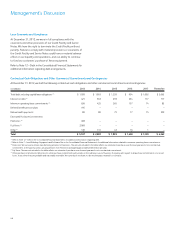

December 31,

(in millions) 2012 2011

Principal debt balance (1) $ 8,410 $ 8,450

Net unamortized discount (63) (7)

Fair value adjustments 142 190

Total Debt $ 8,489 $ 8,633

(1) Includes Commercial Paper of $0 and $100 million as of December 31, 2012 and 2011,

respectively.

Sales of Accounts Receivable

Accounts receivable sales arrangements are utilized in the normal

course of business as part of our cash and liquidity management. We

have facilities in the U.S., Canada and several countries in Europe that

enable us to sell certain accounts receivables without recourse to third-

parties. The accounts receivables sold are generally short-term trade

receivables with payment due dates of less than 60 days.

Accounts receivables sales were as follows:

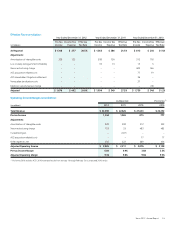

Year ended December 31,

(in millions) 2012 2011 2010

Accounts receivable sales $ 3,699 $ 3,218 $ 2,374

Deferred proceeds 639 386 307

Loss on sale of accounts receivable 21 20 15

Estimated (decrease) increase to

operating cash flows (1) (78) 133 106

(1) Represents the difference between current and prior year fourth quarter receivable sales

adjusted for the effects of: (i) the deferred proceeds, (ii) collections prior to the end of the

year, and (iii) currency.

Refer to Note 4 – Accounts Receivables, Net in the Consolidated

Financial Statements for additional information.

Sales of Finance Receivables

In 2012, we sold our entire interest in two separate portfolios of U.S.

finance receivables from our Document Technology segment with a

combined net carrying value of $682 million to a third-party financial

institution for cash proceeds of $630 million and beneficial interests

from the purchaser of $101 million. These transactions enable us to

lower the cost associated with our financing portfolio.

A pre-tax gain of $44 million was recognized on these sales and is net

of additional fees and expenses of $5 million. The gain was reported in

Finance income in Document Technology segment revenues. We will

continue to service the sold receivables and expect to a record servicing

fee income of approximately $12 million over the expected life of the

associated receivables.

Refer to Note 5 – Finance Receivables, Net in the Consolidated

Financial Statements for additional information.

The net impact on operating cash flows from the sales of accounts

receivable and finance receivables is summarized below:

Year ended December 31,

(in millions) 2012 2011 2010

Cash received from finance receivables sales $ 625 $ – $ –

Collections on sold finance receivables (1) (45) – –

Net cash impact of finance receivable sales 580 – –

Net cash impact of accounts receivable sales (78) 133 106

Net Cash Impact On Cash Flows

From Operating Activities $ 502 $ 133 $ 106

(1) Represents cash that would have been collected if we had not sold finance receivables.

Capital Market Activity

Debt Exchange

In February 2012, we completed an exchange of our 5.71% Zero

Coupon Notes due 2023 with an accreted book value at the date of the

exchange of $303 million, for $362 million of our 4.50% Senior Notes

due 2021. Accordingly, this increased the principal amount for our

4.50% Senior Notes due 2021 from $700 million to $1,062 million. The

exchange was conducted to retire high-interest, long-dated debt in a

favorable interest rate environment. The debt exchange was accounted

for as a non-revolving debt modification and, therefore, it did not result

in any gain or loss. The difference between the book value of our Zero

Coupon Notes and the principal value of the Senior Notes issued in

exchange will be accreted over the remaining term of the Senior Notes.

Upfront fees paid to third parties in connection with the exchange were

not material and were expensed as incurred.

Senior Notes

In March 2012, we issued $600 million of Floating Rate Senior Notes

due 2013 (the “2013 Floating Rate Notes”) and $500 million of 2.95%

Senior Notes due 2017 (the “2017 Senior Notes”). The 2013 Floating

Rate Notes were issued at par and the 2017 Senior Notes were issued

at 99.875% of par, resulting in aggregate net proceeds for both notes

of approximately $1,093 million. The 2013 Floating Rate Notes accrue

interest at a rate per annum, reset quarterly, equal to the three-month

LIBOR plus 1.400% and are payable quarterly. The 2017 Senior Notes

accrue interest at a rate of 2.95% per annum and are payable semi-

annually. As a result of the discount, they have a weighted average

effective interest rate of 2.977%. In connection with the issuance of