Xerox 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107Xerox 2012 Annual Report

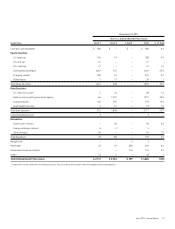

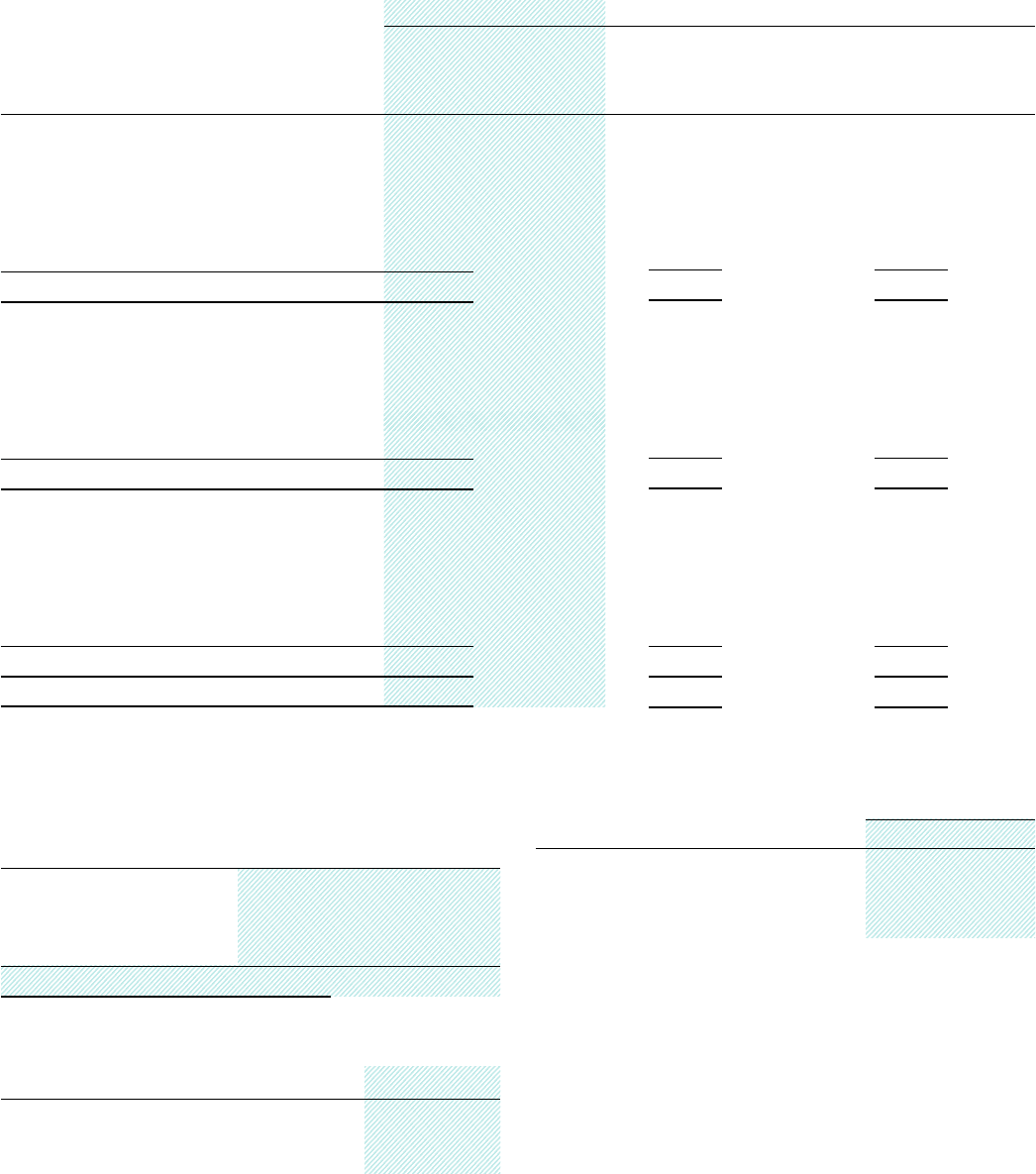

The total unrecognized compensation cost related to non-vested stock-

based awards at December 31, 2012 was as follows:

Remaining Weighted-

Unrecognized Average Vesting Period

Awards Compensation (Years)

Restricted Stock Units $ 125 1.5

Performance Shares 58 1.5

Stock Options 12 1.6

Total $ 195

The aggregate intrinsic value of outstanding RSUs and PSs awards was

as follows:

Awards December 31, 2012

Restricted Stock Units $ 207

Performance Shares 99

Information related to stock options outstanding and exercisable at

December 31, 2012 was as follows:

Options

Outstanding Exercisable

Aggregate intrinsic value $ 7 $ 5

Weighted-average remaining

contractual life (years) 4.3 3.9

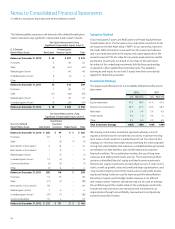

Summary of Stock-based Compensation Activity

2012 2011 2010

Weighted Weighted Weighted

Average Grant Average Grant Average Grant

Date Fair Date Fair Date Fair

(Shares in thousands; amounts per share) Shares Value Shares Value Shares Value

Restricted Stock Units

Outstanding at January 1 33,784 $ 8.70 32,431 $ 8.68 25,127 $ 10.18

Granted 13,033 7.82 8,035 10.66 11,845 8.56

Vested (14,848) 6.89 (5,225) 11.64 (3,671) 18.22

Cancelled (1,555) 8.97 (1,457) 8.57 (870) 10.36

Outstanding at December 31 30,414 9.19 33,784 8.70 32,431 8.68

Performance Shares

Outstanding at January 1 9,763 $ 9.21 7,771 $ 9.78 4,874 $ 15.49

Granted 5,193 7.87 4,852 10.42 5,364 8.10

Vested – – (1,587) 12.84 (1,566) 18.48

Cancelled (420) 8.96 (1,273) 12.79 (901) 15.51

Outstanding at December 31 14,536 8.74 9,763 9.21 7,771 9.78

Stock Options

Outstanding at January 1 50,070 $ 6.98 71,038 $ 8.00 28,363 $ 10.13

Granted – – – – 96,662 6.79

Cancelled/expired (8,617) 8.58 (14,889) 8.38 (2,735) 7.33

Exercised (7,721) 5.69 (6,079) 8.21 (51,252) 6.92

Outstanding at December 31 33,732 6.86 50,070 6.98 71,038 8.00

Exercisable at December 31 28,676 6.95 39,987 7.14 57,985 8.38