Xerox 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53Xerox 2012 Annual Report

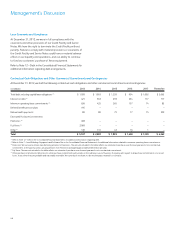

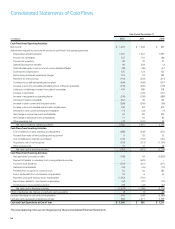

Effective Tax reconciliation:

Year Ended December 31, 2012 Year Ended December 31, 2011 Year Ended December 31, 2010

Pre-Tax Income Tax Effective Pre-Tax Income Tax Effective Pre-Tax Income Tax Effective

(in millions) Income Expense Tax Rate Income Expense Tax Rate Income Expense Tax Rate

As Reported $ 1,348 $ 277 20.5% $ 1,565 $ 386 24.7% $ 815 $ 256 31.4%

Adjustments:

Amortization of intangible assets 328 125 398 150 312 118

Loss on early extinguishment of liability – – 33 13 15 5

Xerox restructuring charge – – – – 483 166

ACS acquisition-related costs – – – – 77 19

ACS shareholders’ litigation settlement – – – – 36 –

Venezuelan devaluation costs – – – – 21 –

Medicare subsidy tax law change – – – – – (16)

Adjusted $ 1,676 $ 402 24.0% $ 1,996 $ 549 27.5% $ 1,759 $ 548 31.2%

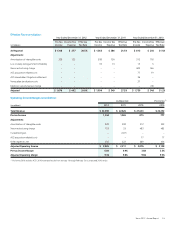

Operating Income/Margin reconciliation:

As Reported Pro-forma (1)

(in millions) 2012 2011 2010 2010

Total Revenue $ 22,390 $ 22,626 $ 21,633 $ 22,252

Pre-tax Income 1,348 1,565 815 777

Adjustments:

Amortization of intangible assets 328 398 312 339

Xerox restructuring charge 153 33 483 483

Curtailment gain – (107) – –

ACS acquisition-related costs – – 77 77

Other expenses, net 256 322 389 444

Adjusted Operating Income $ 2,085 $ 2,211 $ 2,076 $ 2,120

Pre-tax Income Margin 6.0% 6.9% 3.8% 3.5%

Adjusted Operating Margin 9.3% 9.8% 9.6% 9.5%

(1) Pro-forma 2010 includes ACS’s 2010 estimated results from January 1 through February 5 in our reported 2010 results.