Xerox 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(in millions, except per-share data and where otherwise noted)

80

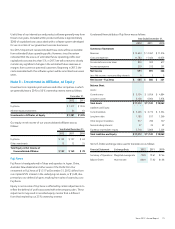

Note 9 – Goodwill and Intangible Assets, Net

Goodwill

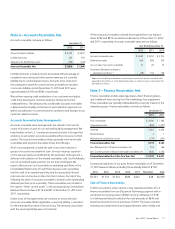

The following table presents the changes in the carrying amount of

goodwill, by reportable segment:

Document

Services Technology Total

Balance at December 31, 2009 (1) $ 1,295 $ 2,127 $ 3,422

Foreign currency translation (22) (25) (47)

Acquisitions:

ACS 5,127 – 5,127

EHRO 77 – 77

TMS 35 – 35

IBS – 14 14

Other 10 11 21

Balance at December 31, 2010 $ 6,522 $ 2,127 $ 8,649

Foreign currency translation (28) (6) (34)

Acquisitions:

Unamic/HCN 43 – 43

Breakaway 33 – 33

ESM 28 – 28

Concept Group – 26 26

MBM – 20 20

Other 21 17 38

Balance at December 31, 2011 $ 6,619 $ 2,184 $ 8,803

Foreign currency translation 41 34 75

Acquisitions:

WDS 69 – 69

R.K. Dixon – 30 30

Other 51 34 85

Balance at December 31, 2012 $ 6,780 $ 2,282 $ 9,062

(1) Includes the reallocation of approximately $300 of goodwill related to our Managed

Print Services business from Document Technology to Services to reflect the current

composition of our Segments.

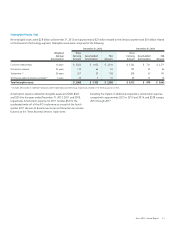

Transactions with Fuji Xerox

We receive dividends from Fuji Xerox, which are reflected as a reduction

in our investment. Additionally, we have a Technology Agreement

with Fuji Xerox whereby we receive royalty payments for their use

of our Xerox brand trademark, as well as rights to access our patent

portfolio in exchange for access to their patent portfolio. These

payments are included in Outsourcing, service and rental revenues in

the Consolidated Statements of Income. We also have arrangements

with Fuji Xerox whereby we purchase inventory from and sell inventory

to Fuji Xerox. Pricing of the transactions under these arrangements is

based upon terms the Company believes to be negotiated at arm’s

length. Our purchase commitments with Fuji Xerox are in the normal

course of business and typically have a lead time of three months. In

addition, we pay Fuji Xerox and they pay us for unique research and

development costs.

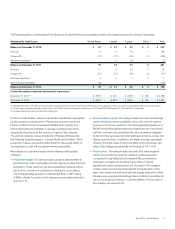

Transactions with Fuji Xerox were as follows:

Year Ended December 31,

2012 2011 2010

Dividends received from Fuji Xerox $ 52 $ 58 $ 36

Royalty revenue earned 132 128 116

Inventory purchases from Fuji Xerox 2,069 2,180 2,098

Inventory sales to Fuji Xerox 147 151 147

R&D payments received from Fuji Xerox 2 2 1

R&D payments paid to Fuji Xerox 15 21 30

As of December 31, 2012 and 2011, net amounts due to Fuji Xerox

were $110 and $105, respectively.