Xerox 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79Xerox 2012 Annual Report

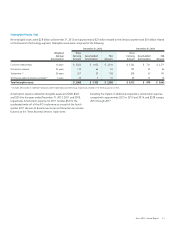

Useful lives of our internal use and product software generally vary from

three to ten years. Included within product software is approximately

$200 of capitalized costs associated with a software system developed

for use in certain of our government services businesses.

Our 2012 impairment review indicated these costs will be recoverable

from estimated future operating profits. However, since the review

indicated that the excess of estimated future operating profits over

capitalized costs was less than 5%; in 2013 we will continue to closely

monitor any significant changes in the estimated future revenues or

margins from current or potential customers. Beginning in 2013, the

costs associated with this software system will be amortized over seven

years.

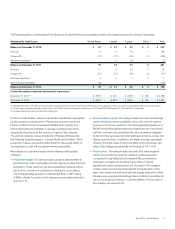

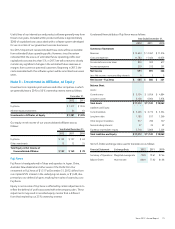

Note 8 – Investment in Affiliates, at Equity

Investments in corporate joint ventures and other companies in which

we generally have a 20% to 50% ownership interest were as follows:

December 31,

2012 2011

Fuji Xerox $ 1,317 $ 1,334

All other equity investments 64 61

Investments in Affiliates, at Equity $ 1,381 $ 1,395

Our equity in net income of our unconsolidated affiliates was as

follows:

Year Ended December 31,

2012 2011 2010

Fuji Xerox $ 139 $ 137 $ 63

Other investments 13 12 15

Total Equity in Net Income of

Unconsolidated Affiliates $ 152 $ 149 $ 78

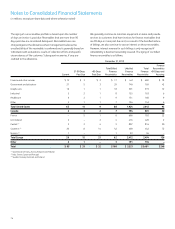

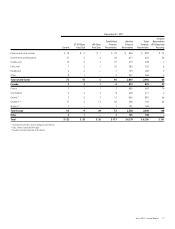

Fuji Xerox

Fuji Xerox is headquartered in Tokyo and operates in Japan, China,

Australia, New Zealand and other areas of the Pacific Rim. Our

investment in Fuji Xerox of $1,317 at December 31, 2012, differs from

our implied 25% interest in the underlying net assets, or $1,430, due

primarily to our deferral of gains resulting from sales of assets by us to

Fuji Xerox.

Equity in net income of Fuji Xerox is affected by certain adjustments to

reflect the deferral of profit associated with intercompany sales. These

adjustments may result in recorded equity income that is different

from that implied by our 25% ownership interest.

Condensed financial data of Fuji Xerox was as follows:

Year Ended December 31,

2012 2011 2010

Summary of Operations

Revenues $ 12,633 $ 12,367 $ 11,276

Costs and expenses 11,783 11,464 10,659

Income before income taxes 850 903 617

Income tax expense 279 312 291

Net Income 571 591 326

Less: Net income – noncontrolling interests 6 5 5

Net Income – Fuji Xerox $ 565 $ 586 $ 321

Balance Sheet

Assets:

Current assets $ 5,154 $ 5,056 $ 4,884

Long-term assets 6,158 6,064 5,978

Total Assets $11,312 $11,120 $10,862

Liabilities and Equity:

Current liabilities $ 3,465 $ 3,772 $ 3,534

Long-term debt 1,185 817 1,260

Other long-term liabilities 917 700 707

Noncontrolling interests 27 25 22

Fuji Xerox shareholders’ equity 5,718 5,806 5,339

Total Liabilities and Equity $11,312 $11,120 $10,862

Yen/U.S. Dollar exchange rates used to translate are as follows:

Financial Statement Exchange Basis 2012 2011 2010

Summary of Operations Weighted average rate 79.89 79.61 87.64

Balance Sheet Year-end rate 86.01 77.62 81.66