Xerox 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51Xerox 2012 Annual Report

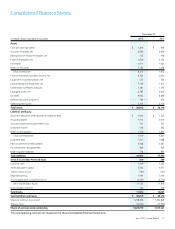

The fair market values of our fixed-rate financial instruments are

sensitive to changes in interest rates. At December 31, 2012, a 10%

change in market interest rates would change the fair values of such

financial instruments by approximately $113 million.

Non-GAAP Financial Measures

We have reported our financial results in accordance with generally

accepted accounting principles (“GAAP”). In addition, we have

discussed our results using non-GAAP measures.

Management believes that these non-GAAP financial measures

provide an additional means of analyzing the current periods’ results

against the corresponding prior periods’ results. However, these

non-GAAP financial measures should be viewed in addition to, and

not as a substitute for, the Company’s reported results prepared in

accordance with GAAP. Our non-GAAP financial measures are not

meant to be considered in isolation or as a substitute for comparable

GAAP measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Our management regularly uses our supplemental non-GAAP financial

measures internally to understand, manage and evaluate our business

and make operating decisions. These non-GAAP measures are among

the primary factors management uses in planning for and forecasting

future periods. Compensation of our executives is based in part on the

performance of our business based on these non-GAAP measures.

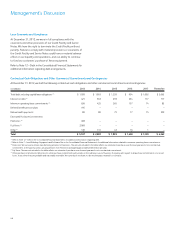

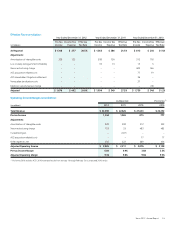

A reconciliation of these non-GAAP financial measures, and the most

directly comparable measures calculated and presented in accordance

with GAAP, are set forth on the following tables.

Adjusted Earnings Measures

To better understand the trends in our business and the impact of

the ACS acquisition, we believe it is necessary to adjust the following

amounts determined in accordance with GAAP to exclude the effects

of the certain items as well as their related income tax effects. For our

2012 reporting year, adjustments were limited to the amortization of

intangible assets:

• Net income and Earnings per share (“EPS”), and

• Effective tax rate.

The above have been adjusted for the following items:

• Amortization of intangible assets (all periods): The amortization

of intangible assets is driven by our acquisition activity which can

vary in size, nature and timing as compared to other companies

within our industry and from period to period. Accordingly, due to the

incomparability of acquisition activity among companies and from

period to period, we believe exclusion of the amortization associated

with intangible assets acquired through our acquisitions allows

investors to better compare and understand our results. The use

of intangible assets contributed to our revenues earned during the

periods presented and will contribute to our future period revenues

as well. Amortization of intangible assets will recur in future periods.

• Restructuring and asset impairment charges (including those

incurred by Fuji Xerox) (2010 only): Restructuring and asset

impairment charges consist of costs primarily related to severance

and benefits for employees terminated pursuant to formal

restructuring and workforce reduction plans. We exclude these

charges because we believe that these historical costs do not reflect

expected future operating expenses and do not contribute to a

meaningful evaluation of our current or past operating performance.

In addition, such charges are inconsistent in amount and frequency.

Such charges are expected to yield future benefits and savings with

respect to our operational performance.

• Acquisition-related costs (2010 only): We incurred significant

expenses in connection with our acquisition of ACS which we

generally would not have otherwise incurred in the periods presented

as a part of our continuing operations. Acquisition-related costs

include transaction and integration costs, which represent external

incremental costs directly related to completing the acquisition and

the integration of ACS and Xerox. We believe it is useful for investors

to understand the effects of these costs on our total operating

expenses.

• Other discrete, unusual or infrequent costs and expenses:

In addition, we have also excluded the following additional items

given the discrete, unusual or infrequent nature of the item on our

results of operations for the period: (1) Loss on early extinguishment

of liability (2011 and 2010), (2) Medicare subsidy tax law change

(income tax effect only) (2010), (3) ACS shareholder’s litigation

settlement (2010) and (4) Venezuela devaluation (2010). We believe

the exclusion of these items allows investors to better understand

and analyze the results for the period as compared to prior periods

as well as expected trends in our business.

We also calculate and utilize an Operating income and margin earnings

measure by adjusting our pre-tax income and margin amounts to

exclude certain items. In addition to the amortization of intangible

assets and restructuring expenses (see above), operating income and

margin also exclude Other expenses, net. 2011 operating income

and margin also exclude a Curtailment gain recorded in the fourth

quarter 2011 while 2010 operating income and margin exclude ACS

acquisition related costs (see above). Other expenses, net is primarily

comprised of non-financing interest expense and also includes certain

other non-operating costs and expenses. The Curtailment gain resulted

from the amendment of our primary non-union U.S. defined benefit

pension plans for salaried employees to fully freeze future benefit and

service accruals after December 31, 2012. We exclude these amounts

in order to evaluate our current and past operating performance and to

better understand the expected future trends in our business.