Xerox 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Our strategy and business model fundamentals translate into the

following 2013 priorities:

• managing our Services business for growth;

• maintaining our leadership in Document Technology;

• managing our business with a focus on operational excellence; and

• delivering strong cash flow and returning value to shareholders.

Acquisitions

Consistent with our strategy to expand our Services offerings through

acquisitions, we acquired the following companies in 2012:

In July 2012 we acquired:

• Wireless Data Services (“WDS”), a telecommunications technical

support and consultancy firm headquartered in the U.K. WDS uses

a proprietary cloud-based platform called GlobalMineTM to capture,

analyze and manage millions of technical support interactions

across thousands of different types of mobile devices.

• Lateral Data, a leading e-discovery technology provider based in

the United States. Lateral Data’s flagship software, ViewpointTM,

brings simplicity and affordability to e-discovery by enabling

corporate legal departments and law firms to manage the entire

e-discovery lifecycle using a single, in-house solution.

In January 2012 we acquired:

• LaserNetworks Inc., a provider of MPS solutions that include print

device tracking, centralized service and supply management and

document routing. LaserNetworks is headquartered in Canada.

An example of an advantaged vertical is healthcare, where we have

built a $2 billion business that touches every aspect of the industry –

government, provider, payer, employer and pharma. In addition,

we apply our innovation to differentiate our offerings. As a result, we

are positioned to capitalize on current industry trends, including the

changes presented by health reform. We also view transportation,

wireless communications and graphic communications, among

others, as advantaged verticals in which we have a leading position,

strong capabilities and attractive market opportunities.

• Disciplined Management of Portfolio – Xerox has the most broad

and diverse set of offerings in the Services segment and the most

complete product portfolio in the Document Technology business.

Our acquisitions are targeted at businesses that will increase our

Services capabilities, position us in attractive Services segments

and provide us with a greater global presence. We will continue

to focus on managing our portfolio to maximize profitable growth.

• Leverage Document Technology Leadership – Xerox is the market

share leader in the Document Technology market. We led the

establishment of the managed print services (“MPS”) market and

we continue to lead this area of market growth. Our MPS offerings

continue to expand, and now consist of a continuum of offerings

that serve large enterprise down through small and mid-size

businesses. In addition, we leverage our leadership in Document

Technology to help grow our business process outsourcing and

IT outsourcing businesses.

• Expand Customer Relationships – We expand customer

relationships through a strategy of “penetrate and radiate.” As

we establish relationships, we prove our capabilities and then

work with the customer to determine other areas where we

can improve their operations and drive down costs by managing

non-core parts of their business. Our wide array of Services offerings

enables us to do this effectively and results in a win-win for Xerox

and our customers.

• Invest in New Services – Our Services acquisitions are a key

element of our strategy. We target companies that provide new

capabilities, offer access to adjacent services areas or expand our

geographic presence. We will continue to invest in new services to

grow our business profitably.

Annuity-Based Business Model

Through our annuity-based business model, we deliver significant

cash generation and have a strong foundation upon which we can

expand earnings.

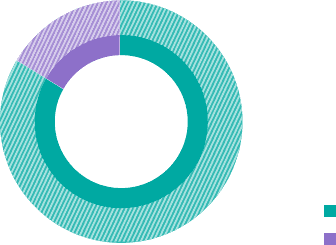

The fundamentals of our business are based on an annuity model that

drives significant recurring revenue and cash generation. Approximately

84 percent of our 2012 total revenue was annuity-based revenue that

includes contracted services equipment maintenance, consumable

Annuity: 84%

Equipment Sales: 16%

Revenue Stream

Our Business

84%

16%

supplies and financing, among other elements. The remaining

16 percent of our revenue comes from equipment sales, either from

lease agreements that qualify as sales for accounting purposes

or outright cash sales.