Xerox 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47Xerox 2012 Annual Report

these Senior Notes, debt issuance costs of $6 million were deferred.

This debt issuance partially funded the May 2012 maturity of our

$1,100 million of 5.59% Senior Notes.

Refer to Note 12 – Debt in the Consolidated Financial Statements for

additional information regarding our debt.

Financial Instruments

Refer to Note 13 – Financial Instruments in the Consolidated Financial

Statements for additional information regarding our derivative

financial instruments.

Share Repurchase Programs – Treasury Stock

During 2012, we repurchased 146.3 million shares for an aggregate

cost of $1.1 billion, including fees. Through February 20, 2013, we

repurchased an additional 1.4 million shares at an aggregate cost of

$10.1 million, including fees, for a cumulative program total of

429.7 million shares at a cost of $4.7 billion, including fees. We expect

total share repurchases of at least $400 million in 2013.

In October 2012, the Board of Directors authorized an additional

$1.0 billion in share repurchase, bringing the total remaining

authorization for share repurchases to $1.3 billion as of

February 20, 2013.

Refer to Note 19 – Shareholders’ Equity – Treasury Stock in the

Consolidated Financial Statements for additional information

regarding our share repurchase programs.

Dividends

The Board of Directors declared aggregate dividends of $226 million,

$241 million and $243 million on common stock in 2012, 2011 and

2010, respectively. The decrease in 2012 as compared to prior years is

primarily due to a lower level of outstanding shares in 2012 as a result

of the repurchase of shares under our share repurchase programs.

The Board of Directors declared aggregate dividends of $24 million,

$24 million and $21 million on the Series A Convertible Preferred Stock

in 2012, 2011 and 2010, respectively. The preferred shares were issued

in connection with the acquisition of ACS.

In addition, the company increased its dividend from 4.25 cents per

share to 5.75 cents per share per quarter, beginning with the dividend

payable on April 30, 2013. Accordingly, we expect approximately

$300 million in dividend payments for the full year 2013.

Liquidity and Financial Flexibility

We manage our worldwide liquidity using internal cash management

practices, which are subject to (1) the statutes, regulations and

practices of each of the local jurisdictions in which we operate,

(2) the legal requirements of the agreements to which we are a

party and (3) the policies and cooperation of the financial institutions

we utilize to maintain and provide cash management services.

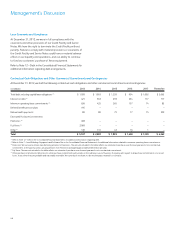

Our principal debt maturities are in line with historical and projected

cash flows and are spread over the next ten years as follows (in millions):

Year Amount

2013 $ 1,039

2014 1,093

2015 1,259

2016 954

2017 1,002

2018 1,001

2019 650

2020 –

2021 1,062

2022 and thereafter 350

Total $ 8,410

Foreign Cash

At December 31, 2012, we had $1,246 million of cash and cash

equivalents on a consolidated basis. Of that amount, approximately

$400 million was held outside the U.S. by our foreign subsidiaries to

fund future working capital, investment and financing needs of our

foreign subsidiaries. Accordingly, we have asserted that such funds are

indefinitely reinvested outside the U.S.

We believe we have sufficient levels of cash and cash flows to support

our domestic requirements. However, if the cash held by our foreign

subsidiaries was needed to fund our U.S. requirements, there would not

be a significant tax liability associated with the repatriation, as any U.S.

liability would be reduced by the foreign tax credits associated with the

repatriated earnings.

However, our determination above is based on the assumption that

only the cash held outside the U.S. would be repatriated as a result

of an unanticipated or unique domestic need. It does not assume

repatriation of the entire amount of indefinitely reinvested earnings of

our foreign subsidiaries. As disclosed in Note 16 – Income and Other

Taxes in our Consolidated Financial Statements, we have not estimated

the potential tax consequences associated with the repatriation of the

entire amount of our foreign earnings indefinitely reinvested outside

the U.S. We do not believe it is practical to calculate the potential tax

impact, as there is a significant amount of uncertainty with respect to

determining the amount of foreign tax credits as well as any additional

local withholding tax and other indirect tax consequences that may

arise from the distribution of these earnings. In addition, because such

earnings have been indefinitely reinvested in our foreign operations,

repatriation would require liquidation of those investments or a

recapitalization of our foreign subsidiaries, the impacts and effects of

which are not readily determinable.