Xerox 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion

50

our results of operations, cash flows and financial position in the

period or periods in which such change in determination, judgment or

settlement occurs.

Unrecognized Tax Benefits

As of December 31, 2012, we had $201 million of unrecognized tax

benefits. This represents the tax benefits associated with various tax

positions taken, or expected to be taken, on domestic and foreign tax

returns that have not been recognized in our financial statements due

to uncertainty regarding their resolution. The resolution or settlement

of these tax positions with the taxing authorities is at various stages

and therefore we are unable to make a reliable estimate of the

eventual cash flows by period that may be required to settle these

matters. In addition, certain of these matters may not require cash

settlement due to the existence of credit and net operating loss

carryforwards, as well as other offsets, including the indirect benefit

from other taxing jurisdictions that may be available.

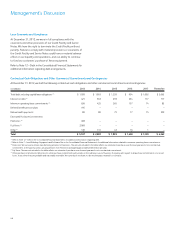

Off-Balance Sheet Arrangements

Occasionally we may utilize off-balance sheet arrangements in our

operations (as defined by the SEC Financial Reporting Release 67

(FRR-67), “Disclosure in Management’s Discussion and Analysis

about Off-Balance Sheet Arrangements and Aggregate Contractual

Obligations.”). We enter into the following arrangements that have

off-balance sheet elements:

• Operating leases in the normal course of business. The nature of

these lease arrangements is discussed in Note 7 – Land, Buildings,

Equipment and Software, Net in the Consolidated Financial

Statements.

• We have facilities, primarily in the U.S., Canada and several countries

in Europe, that enable us to sell to third-parties certain accounts

receivable without recourse. In most instances a portion of the sales

proceeds are held back by the purchaser and payment is deferred

until collection of the related sold receivables. Refer to Note 4 –

Accounts Receivables, Net in the Consolidated Financial Statements

for further information regarding these facilities.

• During 2012 we entered into arrangements to sell our entire interest

in certain groups of finance receivables where we received cash and

beneficial interests from the third-party purchaser. Refer to Note 5 –

Finance Receivables, Net in the Consolidated Financial Statements

for further information regarding these sales.

At December 31, 2012, we do not believe we have any off-balance

sheet arrangements that have, or are reasonably likely to have, a

material current or future effect on financial condition, changes

in financial condition, revenues or expenses, results of operations,

liquidity, capital expenditures or capital resources.

In addition, see the table above for the Company’s contractual cash

obligations and other commercial commitments and Note 17 –

Contingencies and Litigation in the Consolidated Financial Statements

for additional information regarding contingencies, guarantees,

indemnifications and warranty liabilities.

Financial Risk Management

We are exposed to market risk from foreign currency exchange rates

and interest rates, which could affect operating results, financial

position and cash flows. We manage our exposure to these market

risks through our regular operating and financing activities and, when

appropriate, through the use of derivative financial instruments. We

utilized derivative financial instruments to hedge economic exposures,

as well as reduce earnings and cash flow volatility resulting from shifts

in market rates.

Recent market events have not caused us to materially modify or

change our financial risk management strategies with respect to our

exposures to interest rate and foreign currency risk. Refer to Note 13 –

Financial Instruments in the Consolidated Financial Statements for

additional discussion on our financial risk management.

Foreign Exchange Risk Management

Assuming a 10% appreciation or depreciation in foreign currency

exchange rates from the quoted foreign currency exchange rates at

December 31, 2012, the potential change in the fair value of foreign

currency-denominated assets and liabilities in each entity would not be

significant because all material currency asset and liability exposures

were economically hedged as of December 31, 2012. A 10%

appreciation or depreciation of the U.S. Dollar against all currencies

from the quoted foreign currency exchange rates at December 31,

2012 would have an impact on our cumulative translation adjustment

portion of equity of approximately $711 million. The net amount

invested in foreign subsidiaries and affiliates, primarily Xerox Limited,

Fuji Xerox, Xerox Canada Inc. and Xerox Brasil, and translated into U.S.

Dollars using the year-end exchange rates, was approximately

$7.1 billion at December 31, 2012.

Interest Rate Risk Management

The consolidated weighted-average interest rates related to our total

debt for 2012, 2011 and 2010 approximated 4.7%, 5.2%, and 5.8%,

respectively. Interest expense includes the impact of our interest rate

derivatives.

Virtually all customer-financing assets earn fixed rates of interest.

The interest rates on a significant portion of the Company’s term debt

are fixed.

As of December 31, 2012, $903 million of our total debt of

$8,489 million carried variable interest rates, including the effect of pay

variable interest rate swaps, if any, we may use to reduce the effective

interest rate on our fixed coupon debt.