Xerox 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101Xerox 2012 Annual Report

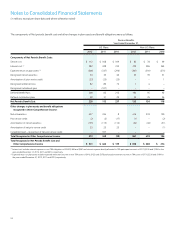

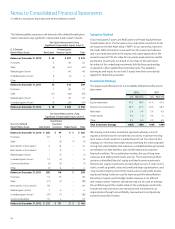

Total income tax expense (benefit) was allocated as follows:

Year Ended December 31,

2012 2011 2010

Pre-tax income $ 277 $ 386 $ 256

Common shareholders’ equity:

Changes in defined benefit plans (233) (277) 12

Stock option and incentive plans, net (5) 1 (6)

Cash flow hedges (24) 3 5

Translation adjustments (9) 2 6

Total Income Tax Expense (Benefit) $ 6 $ 115 $ 273

Unrecognized Tax Benefits and Audit Resolutions

Due to the extensive geographical scope of our operations, we are

subject to ongoing tax examinations in numerous jurisdictions.

Accordingly, we may record incremental tax expense based upon

the more-likely-than-not outcomes of any uncertain tax positions.

In addition, when applicable, we adjust the previously recorded tax

expense to reflect examination results when the position is effectively

settled. Our ongoing assessments of the more-likely-than-not outcomes

of the examinations and related tax positions require judgment and

can increase or decrease our effective tax rate, as well as impact our

operating results. The specific timing of when the resolution of each

tax position will be reached is uncertain. As of December 31, 2012, we

do not believe that there are any positions for which it is reasonably

possible that the total amount of unrecognized tax benefits will

significantly increase or decrease within the next 12 months.

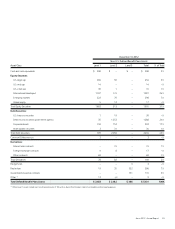

A reconciliation of the beginning and ending amount of unrecognized

tax benefits is as follows:

2012 2011 2010

Balance at January 1 $ 225 $ 186 $ 148

Additions from acquisitions – – 46

Additions related to current year 28 43 38

Additions related to prior years positions 5 38 24

Reductions related to prior years positions (36) (17) (16)

Settlements with taxing authorities (1) (13) (14) (19)

Reductions related to lapse of

statute of limitations (8) (8) (35)

Currency – (3) –

Balance at December 31 $ 201 $ 225 $ 186

(1) Majority of settlements did not result in the utilization of cash.

Included in the balances at December 31, 2012, 2011 and 2010 are

$16, $36 and $39, respectively, of tax positions that are highly certain

of realizability but for which there is uncertainty about the timing

or that they may be reduced through an indirect benefit from other

taxing jurisdictions. Because of the impact of deferred tax accounting,

other than for the possible incurrence of interest and penalties, the

disallowance of these positions would not affect the annual effective

tax rate.

We recognized interest and penalties accrued on unrecognized tax

benefits, as well as interest received from favorable settlements within

income tax expense. We had $20, $28 and $31 accrued for the

payment of interest and penalties associated with unrecognized tax

benefits at December 31, 2012, 2011 and 2010, respectively.

In the U.S., with the exception of ACS, we are no longer subject to

U.S. federal income tax examinations for years before 2007. ACS is

no longer subject to such examinations for years before 2005. With

respect to our major foreign jurisdictions, we are no longer subject to

tax examinations by tax authorities for years before 2000.

Deferred Income Taxes

We had undistributed earnings of foreign subsidiaries and other

foreign investments carried at equity at December 31, 2012 of

approximately $8.8 billion. We have provided deferred taxes on

approximately $500 of those earnings due to their anticipated

repatriation to the U.S. The remaining $8.3 billion of undistributed

earnings have been indefinitely reinvested and we currently do not

plan to initiate any action that would precipitate a deferred tax impact.

We do not believe it is practical to calculate the potential deferred tax

impact, as there is a significant amount of uncertainty with respect to

determining the amount of foreign tax credits as well as any additional

local withholding tax and other indirect tax consequences that may

arise from the distribution of these earnings. In addition, because such

earnings have been indefinitely reinvested in our foreign operations,

repatriation would require liquidation of those investments or a

recapitalization of our foreign subsidiaries, the impacts and effects of

which are not readily determinable.