Xerox 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43Xerox 2012 Annual Report

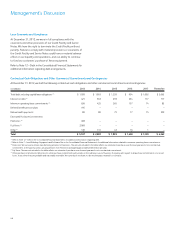

Segment Loss 2012

Other segment loss of $241 million, improved $14 million from the prior

year, primarily driven by a decrease in Other Expenses, Net partially

offset by lower gross profit as a result of the decline in revenues.

Revenue 2011

Other segment revenue of $1,530 million decreased 7%, including

2-percentage points positive impact from currency, due to a decline

in paper sales, wide format systems and other supplies partially offset

by an increase in revenue from patent sales and licensing as noted

below. Paper comprised approximately 59% of the 2011 Other

segment revenue.

In 2011, we entered into an agreement with another company that

included, among other items, the sale of certain patents and the

cross-licensing of certain patents of each party, pursuant to which we

received an up-front payment with the remaining amount payable

in two equal annual installment payments. Consistent with our

accounting policy for these transactions, revenue associated with this

agreement will be recorded as earned and only to the extent of cash

received. During 2011, the Other segment included revenue and pre-

tax income/segment profit of approximately $32 million and

$26 million ($16 million after-tax), respectively, which is net of certain

expenses paid in connection with this agreement.

Segment Loss 2011

Other segment loss of $255 million, improved $87 million from the

prior year, primarily driven by lower non-financing interest expense and

SAG expense.

(1) See the “Non-GAAP Financial Measures” section for an explanation of this non-GAAP

financial measure.

(2) Color revenues and pages represent revenues and pages from color enabled devices and

are a subset of total revenues and excludes Global Imaging Systems, Inc. (“GIS”).

Capital Resources and Liquidity

Our ability to maintain positive liquidity going forward depends on

our ability to continue to generate cash from operations and access

the financial capital markets, both of which are subject to general

economic, financial, competitive, legislative, regulatory and other

market factors that are beyond our control.

• As of December 31, 2012 and 2011, total cash and cash equivalents

were $1,246 million and $902 million, respectively, we had no

borrowings under our Commercial Paper Programs as of December

31, 2012 and $100 million as of December 31, 2011. There were

no outstanding borrowings or letters of credit under our $2 billion

Credit Facility for either year end. The increase in our cash balance

in 2012 was largely from the sales and run-off of finance receivables

partially offset by an increase in share repurchases. We expect to use

approximately $400 million of our total cash to pay down maturing

Senior Notes in May 2013.

• Our Commercial Paper program was established in 2010 as a means

to reduce our cost of capital and to provide us with an additional

liquidity vehicle in the market. Aggregate Commercial Paper and

Credit Facility borrowings may not exceed the borrowing capacity

under our Credit Facility at any time.

• Over the past three years we have consistently delivered strong

cash flow from operations driven by the strength of our

annuity-based revenue model. Cash flows from operations were

$2,580 million, $1,961 million and $2,726 million for the three years

ended December 31, 2012, respectively.

• We expect cash flows from operations between $2.1 and $2.4 billion

for 2013. We expect lower contributions from finance receivables of

approximately $500 million, due to fewer collections as a result of

the 2012 finance receivables sales and a lower natural run-off of the

portfolio, given our expectations of better equipment activity. This

impact is expected to be partially offset by lower pension funding

requirements. We expect the rest of working capital to be essentially

flat year-over-year.

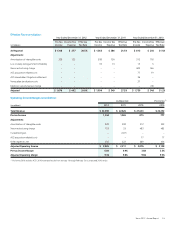

Cash Flow Analysis

The following summarizes our cash flows for the three years ended December 31, 2012, as reported in our Consolidated Statements of Cash Flows

in the accompanying Consolidated Financial Statements:

Year Ended December 31, Change

(in millions) 2012 2011 2010 2012 2011

Net cash provided by operating activities $ 2,580 $ 1,961 $ 2,726 $ 619 $ (765)

Net cash used in investing activities (761) (675) (2,178) (86) 1,503

Net cash used in financing activities (1,472) (1,586) (3,116) 114 1,530

Effect of exchange rate changes on cash and cash equivalents (3) (9) (20) 6 11

Increase (decrease) in cash and cash equivalents 344 (309) (2,588) 653 2,279

Cash and cash equivalents at beginning of year 902 1,211 3,799 (309) (2,588)

Cash and Cash Equivalents at End of Year $ 1,246 $ 902 $ 1,211 $ 344 $ (309)