Xerox 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105Xerox 2012 Annual Report

Other Contingencies

We have issued or provided the following guarantees as of December

31, 2012:

• $454 for letters of credit issued to (i) guarantee our performance

under certain services contracts; (ii) support certain insurance

programs and (iii) support our obligations related to the Brazil tax

and labor contingencies.

• $736 for outstanding surety bonds. Certain contracts, primarily those

involving public sector customers, require us to provide a surety bond

as a guarantee of our performance of contractual obligations.

In general, we would only be liable for the amount of these guarantees

in the event of default in our performance of our obligations under

each contract; the probability of which we believe is remote. We believe

that our capacity in the surety markets as well as under various credit

arrangements (including our Credit Facility) is sufficient to allow us to

respond to future requests for proposals that require such credit support.

We have service arrangements where we service third-party student

loans in the Federal Family Education Loan program (“FFEL”) on behalf

of various financial institutions. We service these loans for investors

under outsourcing arrangements and do not acquire any servicing

rights that are transferable by us to a third party. At December 31,

2012, we serviced a FFEL portfolio of approximately 3.7 million loans

with an outstanding principal balance of approximately $53.0 billion.

Some servicing agreements contain provisions that, under certain

circumstances, require us to purchase the loans from the investor if the

loan guaranty has been permanently terminated as a result of a loan

default caused by our servicing error. If defaults caused by us are cured

during an initial period, any obligation we may have to purchase these

loans expires. Loans that we purchase may be subsequently cured,

the guaranty reinstated and the loans repackaged for sale to third

parties. We evaluate our exposure under our purchase obligations on

defaulted loans and establish a reserve for potential losses, or default

liability reserve, through a charge to the provision for loss on defaulted

loans purchased. The reserve is evaluated periodically and adjusted

based upon management’s analysis of the historical performance of

the defaulted loans. As of December 31, 2012, other current liabilities

include reserves which we believe to be adequate. At December 31,

2012, other current liabilities include reserves of approximately $3.6 for

losses on defaulted loans purchased.

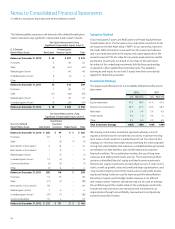

Note 18 – Preferred Stock

Series A Convertible Preferred Stock

In 2010, in connection with our acquisition of ACS, we issued 300,000

shares of Series A convertible perpetual preferred stock with an

aggregate liquidation preference of $300 and an initial fair value of

$349. The convertible preferred stock pays quarterly cash dividends

at a rate of 8% per year ($24 per year). Each share of convertible

preferred stock is convertible at any time, at the option of the holder,

into 89.8876 shares of common stock for a total of 26,966 thousand

shares (reflecting an initial conversion price of approximately $11.125

per share of common stock), subject to customary anti-dilution

adjustments.

On or after February 5, 2015, if the closing price of our common stock

exceeds 130% of the then applicable conversion price (currently

$11.125 per share of common stock) for 20 out of 30 trading days,

we have the right to cause any or all of the convertible preferred stock

to be converted into shares of common stock at the then applicable

conversion rate. The convertible preferred stock is also convertible, at

the option of the holder, upon a change in control, at the applicable

conversion rate plus an additional number of shares determined by

reference to the price paid for our common stock upon such change

in control. In addition, upon the occurrence of certain fundamental

change events, including a change in control or the delisting of Xerox’s

common stock, the holder of convertible preferred stock has the right to

require us to redeem any or all of the convertible preferred stock in cash

at a redemption price per share equal to the liquidation preference and

any accrued and unpaid dividends to, but not including the redemption

date. The convertible preferred stock is classified as temporary equity

(i.e., apart from permanent equity) as a result of the contingent

redemption feature.

Note 19 – Shareholders’ Equity

Preferred Stock

As of December 31, 2012, we had one class of preferred stock

outstanding. See Note 18 – Preferred Stock for further information. We

are authorized to issue approximately 22 million shares of cumulative

preferred stock, $1.00 par value per share.

Common Stock

We have 1.75 billion authorized shares of common stock, $1.00

par value per share. At December 31, 2012, 155 million shares were

reserved for issuance under our incentive compensation plans,

48 million shares were reserved for debt to equity exchanges,

27 million shares were reserved for conversion of the Series A

convertible preferred stock and 2 million shares were reserved for

the conversion of convertible debt.

Treasury Stock

We account for the repurchased common stock under the cost method

and include such treasury stock as a component of our common

shareholder’s equity. Retirement of treasury stock is recorded as a

reduction of Common stock and Additional paid-in capital at the time

such retirement is approved by our Board of Directors.