Xerox 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

38

The 2010 net currency losses included a currency loss of $21 million for

the re-measurement of our Venezuelan Bolivar denominated monetary

net assets following a devaluation of the Bolivar in the first quarter of

2010. This loss was partially offset by a cumulative translation gain

of $6 million that was recognized upon the repatriation of cash and

liquidation of a foreign subsidiary.

ACS Shareholders’ Litigation Settlement: The 2010 expense of

$36 million relates to the settlement of claims by ACS shareholders

arising from our acquisition of ACS in 2010. The total settlement for

all defendants was approximately $69 million, with Xerox paying

approximately $36 million net of insurance proceeds.

Litigation Matters: Litigation matters for 2012, 2011 and 2010

represent charges related to probable losses for various legal

matters, none of which were individually material. Refer to Note 17 –

Contingencies and Litigation, in the Consolidated Financial Statements

for additional information regarding litigation against the Company.

Loss on Sales of Accounts Receivables: Represents the loss incurred

on our sales of accounts receivables. Refer to “Sales of Accounts

Receivables” below and Note 4 – Accounts Receivables, Net in

the Consolidated Financial Statements for additional information

regarding our sales of receivables.

Loss on Early Extinguishment of Liability: The 2011 loss of

$33 million was related to the redemption by Xerox Capital Trust I,

our wholly-owned subsidiary trust, of its $650 million 8% Preferred

Securities due in 2027. The redemption resulted in a pre-tax loss of

$33 million ($20 million after-tax), representing the call premium of

approximately $10 million, as well as the write-off of unamortized debt

costs and other liability carrying value adjustments of $23 million.

The 2010 loss of $15 million represents the loss associated with the

redemption of senior and medium-term notes in the fourth quarter

2010 and reflects a call premium and the write-off of unamortized

debt costs.

Deferred Compensation Investment Gains: Represents gains

on investments supporting certain of our deferred compensation

arrangements. These gains or losses are offset by an increase or

decrease, respectively, in compensation expense recorded in SAG in our

Services segment as a result of the increase or decrease in the liability

associated with these arrangements.

Income Taxes

The 2012 effective tax rate was 20.5% or 24.0% on an adjusted basis.1

The adjusted tax rate for the year was lower than the U.S. statutory

rate primarily due to foreign tax credits resulting from anticipated

dividends and other foreign transactions as well as the geographical

mix of profits. In addition, a net tax benefit from adjustments of certain

unrecognized tax positions and deferred tax valuation allowances was

offset by a tax law change.

The 2011 effective tax rate was 24.7% or 27.5% on an adjusted basis.1

The adjusted tax rate for the year was lower than the U.S. statutory

rate primarily due to the geographical mix of profits as well as a higher

foreign tax credit benefit as a result of our decision to repatriate current

year income from certain non-U.S. subsidiaries.

The 2010 effective tax rate was 31.4% or 31.2% on an adjusted basis.1

The adjusted tax rate for the year was lower than the U.S. statutory rate

primarily due to the geographical mix of income before taxes and the

related tax rates in those jurisdictions as well as the U.S. tax impacts on

certain foreign income and tax law changes.

Xerox operations are widely dispersed. The statutory tax rate in most

non-U.S. jurisdictions is lower than the combined U.S. and state tax

rate. The amount of income subject to these lower foreign rates

relative to the amount of U.S. income will impact our effective tax

rate. However, no one country outside of the U.S. is a significant factor

to our overall effective tax rate. Certain foreign income is subject to

U.S. tax net of any available foreign tax credits. Our full year effective

tax rate for 2012 includes a benefit of approximately 12-percentage

points from these non-U.S. operations. Refer to Note 16 – Income and

Other Taxes, in the Consolidated Financial Statements for additional

information regarding the geographic mix of income before taxes and

the related impacts on our effective tax rate.

Our effective tax rate is based on nonrecurring events as well as

recurring factors, including the taxation of foreign income. In

addition, our effective tax rate will change based on discrete or

other nonrecurring events (e.g. audit settlements, tax law changes,

changes in valuation allowances, etc.) that may not be predictable. We

anticipate that our effective tax rate for 2013 will be approximately

28%, which excludes the effects of intangibles amortization and

other discrete events. We also expect to record an estimated discrete

benefit of approximately $19 million in the first quarter 2013 for the

retroactive benefits of the American Taxpayer Relief Act of 2012 which

was signed into law on January 2, 2013.

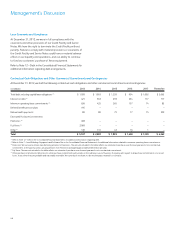

Equity in Net Income of Unconsolidated Affiliates

Year Ended December 31,

(in millions) 2012 2011 2010

Total equity in net income of

unconsolidated affiliates $ 152 $ 149 $ 78

Fuji Xerox after-tax restructuring costs 16 19 38

Equity in net income of unconsolidated affiliates primarily reflects our

25% share of Fuji Xerox.

The 2011 increase of $71 million was primarily due to an increase in

Fuji Xerox’s net income, which was primarily driven by higher revenue

and cost improvements, as well as the strengthening of the Yen and

lower restructuring costs.