Xerox 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(in millions, except per-share data and where otherwise noted)

100

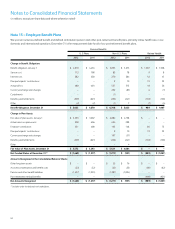

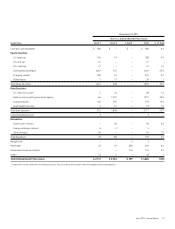

Assumed healthcare cost trend rates were as follows: December 31,

2012 2011

Healthcare cost trend rate assumed for next year 7.5% 8.5%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) 4.9% 4.9%

Year that the rate reaches the ultimate trend rate 2017 2017

Assumed healthcare cost trend rates have a significant effect on the amounts reported for the healthcare plans. A one-percentage-point change in

assumed healthcare cost trend rates would have the following effects:

1% i n c r e a s e 1% d e cr e a s e

Effect on total service and interest cost components $ 3 $ (3)

Effect on post-retirement benefit obligation 62 54

Defined Contribution Plans

We have savings and investment plans in several countries, including the U.S., Finland and Canada. In many instances, employees from those

defined benefit pension plans that have been amended to freeze future service accruals will be transitioned to an enhanced defined contribution

plan. For the U.S. plans, employees may contribute a portion of their salaries and bonuses to the plans, and we match a portion of the employee

contributions. We recorded charges related to our defined contribution plans of $63 in 2012, $66 in 2011 and $51 in 2010.

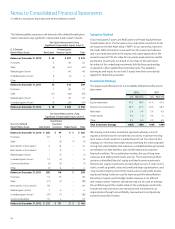

Note 16 – Income and Other Taxes

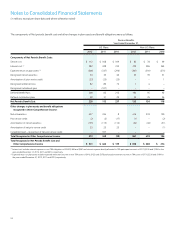

Income before income taxes (“pre-tax income”) was as follows:

Year Ended December 31,

2012 2011 2010

Domestic income $ 878 $ 917 $ 433

Foreign income 470 648 382

Income Before Income Taxes $ 1,348 $ 1,565 $ 815

Provisions (benefits) for income taxes were as follows:

Year Ended December 31,

2012 2011 2010

Federal Income Taxes

Current $ 24 $ 52 $ 153

Deferred 84 134 (17)

Foreign Income Taxes

Current 123 103 59

Deferred – 38 8

State Income Taxes

Current 34 28 46

Deferred 12 31 7

Total Provision (Benefit) $ 277 $ 386 $ 256

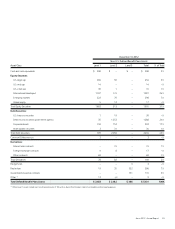

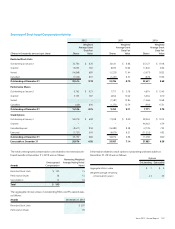

A reconciliation of the U.S. federal statutory income tax rate to the

consolidated effective income tax rate was as follows:

Year Ended December 31,

2012 2011 2010

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

Nondeductible expenses 2.6% 2.0% 6.3%

Effect of tax law changes 0.7% 0.2% (0.2)%

Change in valuation allowance for

deferred tax assets (0.7)% (0.3)% 2.6%

State taxes, net of federal benefit 2.1% 2.4% 2.0%

Audit and other tax return adjustments (4.7)% (1.0)% (3.6)%

Tax-exempt income, credits and incentives (2.6)% (3.1)% (3.9)%

Foreign rate differential adjusted for

U.S. taxation of foreign profits (1) (11.8)% (10.4)% (6.7)%

Other (0.1)% (0.1)% (0.1)%

Effective Income Tax Rate 20.5% 24.7% 31.4%

(1) The “U.S. taxation of foreign profits” represents the U.S. tax, net of foreign tax credits,

associated with actual and deemed repatriations of earnings from our non-U.S.

subsidiaries.

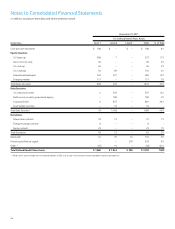

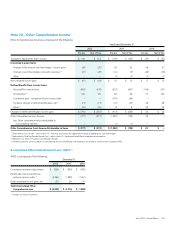

On a consolidated basis, we paid a total of $137, $94 and $49 in

income taxes to federal, foreign and state jurisdictions during the three

years ended December 31, 2012, respectively.