Xerox 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Inside

Today’s Xerox

Letter to Shareholders

Innovation at Work

Financial Measures

Non-GAAP Measures

Board of Directors

Our Business

Management’s Discussion and Analysis

Consolidated Financial Statements

Notes to Consolidated Financial Statements

Reports and Signatures

Quarterly Results of Operations

Five Years in Review

Corporate Information

Officers

02

04

08

10

11

12

14

27

55

60

111

113

114

115

116

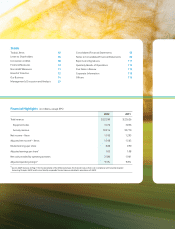

Financial Highlights (in millions, except EPS)

2012 2011

Total revenue $ 22,390 $ 22,626

Equipment sales 3,476 3,856

Annuity revenue 18,914 18,770

Net income – Xerox 1,195 1,295

Adjusted net income* – Xerox 1,398 1,563

Diluted earnings per share 0.88 0.90

Adjusted earnings per share* 1.03 1.08

Net cash provided by operating activities 2,580 1,961

Adjusted operating margin* 9.3% 9.8%

* See non-GAAP measures on Page 11 for the reconciliation of the difference between this financial measure that is not in compliance with Generally Accepted

Accounting Principles (GAAP) and the most directly comparable financial measure calculated in accordance with GAAP.