Xerox 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

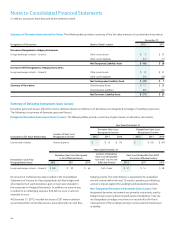

Notes to Consolidated Financial Statements

(in millions, except per-share data and where otherwise noted)

78

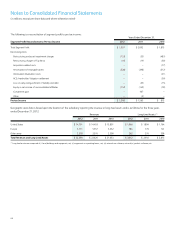

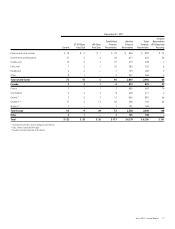

Note 7 – Land, Buildings, Equipment

and Software, Net

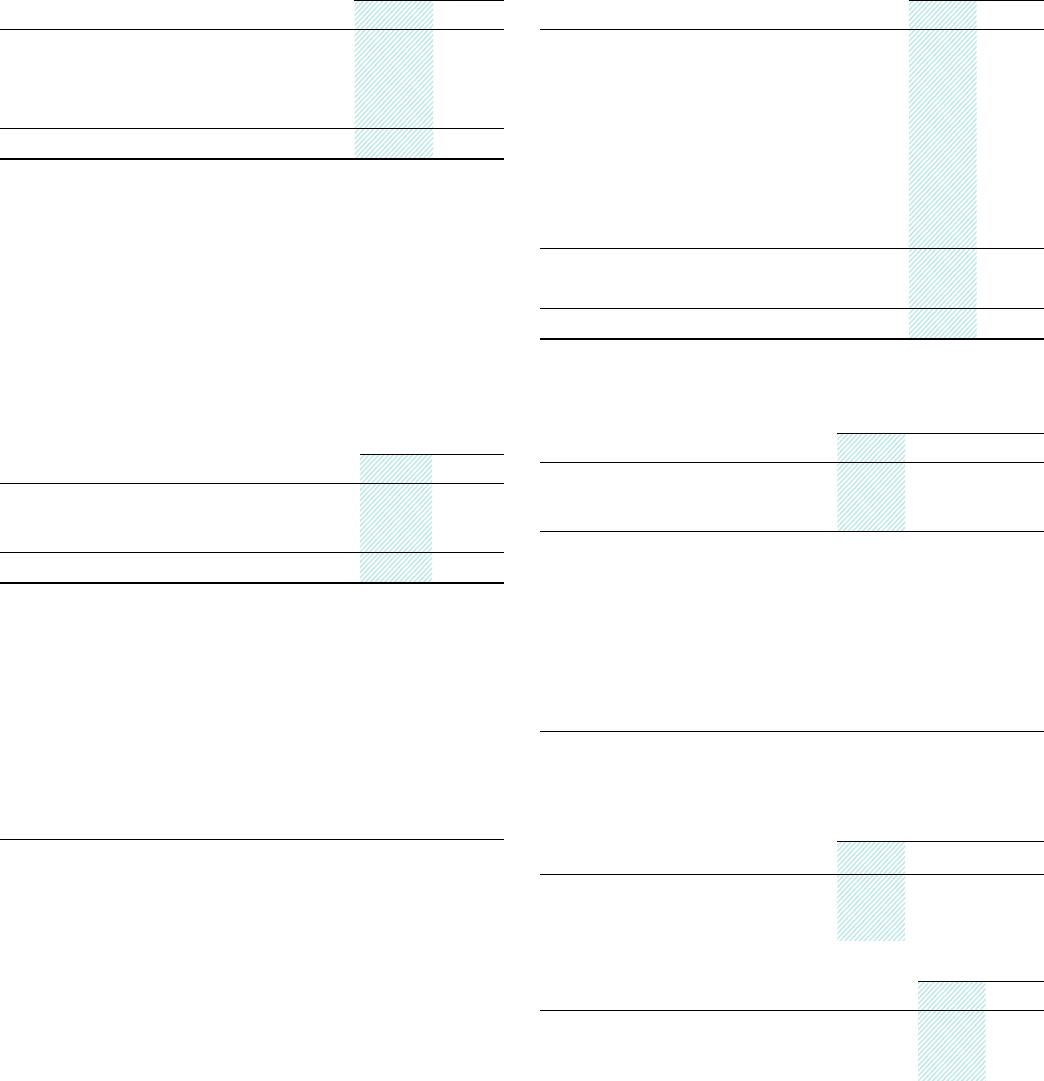

Land, buildings and equipment, net were as follows:

Estimated December 31,

Useful Lives (Years) 2012 2011

Land $ 61 $ 60

Buildings and building equipment 25 to 50 1,135 1,121

Leasehold improvements Varies 506 461

Plant machinery 5 to 12 1,571 1,557

Office furniture and equipment 3 to 15 1,681 1,470

Other 4 to 20 83 99

Construction in progress 74 93

Subtotal 5,111 4,861

Accumulated depreciation (3,555) (3,249)

Land, Buildings and Equipment, Net $ 1,556 $ 1,612

Depreciation expense and operating lease rent expense were as

follows:

Year Ended December 31,

2012 2011 2010

Depreciation expense $ 452 $ 405 $ 379

Operating lease rent expense (1) 646 681 632

(1) We lease certain land, buildings and equipment, substantially all of which are accounted

for as operating leases. Capital leased assets were less than $80 at December 31, 2012

and 2011, respectively.

Future minimum operating lease commitments that have initial or

remaining non-cancelable lease terms in excess of one year at

December 31, 2012 were as follows:

2013 2014 2015 2016 2017 Thereafter

$636 $425 $265 $157 $74 $83

Internal Use and Product Software

Year Ended December 31,

Additions to: 2012 2011 2010

Internal use software $ 125 $ 163 $ 164

Product software 107 108 70

December 31,

Capitalized costs, net: 2012 2011

Internal use software $ 577 $ 545

Product software 344 256

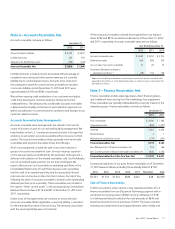

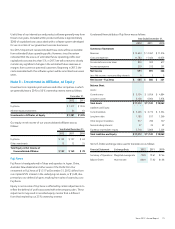

Note 6 – Inventories and Equipment

on Operating Leases, Net

The following is a summary of Inventories by major category:

December 31,

2012 2011

Finished goods $ 844 $ 866

Work-in-process 61 58

Raw materials 106 97

Total Inventories $ 1,011 $ 1,021

The transfer of equipment from our inventories to equipment subject

to an operating lease is presented in our Consolidated Statements of

Cash Flows in the operating activities section. Equipment on operating

leases and similar arrangements consists of our equipment rented to

customers and depreciated to estimated salvage value at the end of

the lease term. We recorded $30, $39 and $31 in inventory write-down

charges for the years ended December 31, 2012, 2011 and 2010,

respectively.

Equipment on operating leases and the related accumulated

depreciation were as follows:

December 31,

2012 2011

Equipment on operating leases $ 1,533 $ 1,556

Accumulated depreciation (998) (1,023)

Equipment on Operating Leases, Net $ 535 $ 533

Depreciable lives generally vary from three to four years consistent

with our planned and historical usage of the equipment subject

to operating leases. Depreciation and obsolescence expense for

equipment on operating leases was $279, $294 and $313 for the

years ended December 31, 2012, 2011 and 2010, respectively. Our

equipment operating lease terms vary, generally from one to three

years. Scheduled minimum future rental revenues on operating leases

with original terms of one year or longer are:

2013 2014 2015 2016 2017 Thereafter

$397 $285 $177 $103 $46 $15

Total contingent rentals on operating leases, consisting principally of

usage charges in excess of minimum contracted amounts, for the years

ended December 31, 2012, 2011 and 2010 amounted to $158, $154

and $133, respectively.