Xerox 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(in millions, except per-share data and where otherwise noted)

102

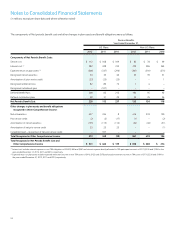

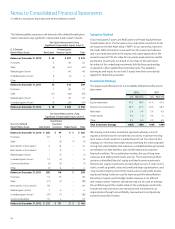

The tax effects of temporary differences that give rise to significant

portions of the deferred taxes were as follows:

December 31,

2012 2011

Deferred Tax Assets

Research and development $ 793 $ 876

Post-retirement medical benefits 359 368

Anticipated foreign repatriations 264 41

Depreciation and amortization 52 71

Net operating losses 630 637

Other operating reserves 300 285

Tax credit carryforwards 177 379

Deferred compensation 312 306

Allowance for doubtful accounts 73 93

Restructuring reserves 30 29

Pension 696 547

Other 143 132

Subtotal 3,829 3,764

Valuation allowance (654) (677)

Total $ 3,175 $ 3,087

Deferred Tax Liabilities

Unearned income and installment sales $ 947 $ 996

Intangibles and goodwill 1,252 1,261

Other 48 41

Total $ 2,247 $ 2,298

Total Deferred Taxes, Net $ 928 $ 789

The above amounts are classified as current or long-term in the

Consolidated Balance Sheets in accordance with the asset or liability

to which they relate or, when applicable, based on the expected timing

of the reversal. Current deferred tax assets at December 31, 2012 and

2011 amounted to $273 and $229, respectively.

The deferred tax assets for the respective periods were assessed

for recoverability and, where applicable, a valuation allowance was

recorded to reduce the total deferred tax asset to an amount that

will more-likely-than-not be realized in the future. The net change in

the total valuation allowance for the years ended December 31, 2012

and 2011 was a decrease of $23 and $58, respectively. The valuation

allowance relates primarily to certain net operating loss carryforwards,

tax credit carryforwards and deductible temporary differences for

which we have concluded it is more-likely-than-not that these items will

not be realized in the ordinary course of operations.

Although realization is not assured, we have concluded that it is

more-likely-than-not that the deferred tax assets, for which a valuation

allowance was determined to be unnecessary, will be realized in the

ordinary course of operations based on the available positive and

negative evidence, including scheduling of deferred tax liabilities and

projected income from operating activities. The amount of the net

deferred tax assets considered realizable, however, could be reduced

in the near term if actual future income or income tax rates are lower

than estimated, or if there are differences in the timing or amount of

future reversals of existing taxable or deductible temporary differences.

At December 31, 2012, we had tax credit carryforwards of $177

available to offset future income taxes, of which $79 are available

to carryforward indefinitely while the remaining $98 will expire

2013 through 2032 if not utilized. We also had net operating loss

carryforwards for income tax purposes of $1.3 billion that will expire

2013 through 2032, if not utilized, and $2.4 billion available to offset

future taxable income indefinitely.

Note 17 – Contingencies and Litigation

As more fully discussed below, we are involved in a variety of claims,

lawsuits, investigations and proceedings concerning securities law,

intellectual property law, environmental law, employment law and the

Employee Retirement Income Security Act (“ERISA”). We determine

whether an estimated loss from a contingency should be accrued by

assessing whether a loss is deemed probable and can be reasonably

estimated. We assess our potential liability by analyzing our litigation

and regulatory matters using available information. We develop our

views on estimated losses in consultation with outside counsel handling

our defense in these matters, which involves an analysis of potential

results, assuming a combination of litigation and settlement strategies.

Should developments in any of these matters cause a change in our

determination as to an unfavorable outcome and result in the need to

recognize a material accrual, or should any of these matters result in a

final adverse judgment or be settled for significant amounts, they could

have a material adverse effect on our results of operations, cash flows

and financial position in the period or periods in which such change in

determination, judgment or settlement occurs.

Additionally, guarantees, indemnifications and claims arise during

the ordinary course of business from relationships with suppliers,

customers and nonconsolidated affiliates when the Company

undertakes an obligation to guarantee the performance of others if

specified triggering events occur. Nonperformance under a contract

could trigger an obligation of the Company. These potential claims

include actions based upon alleged exposures to products, real estate,

intellectual property such as patents, environmental matters and other

indemnifications. The ultimate effect on future financial results is not

subject to reasonable estimation because considerable uncertainty

exists as to the final outcome of these claims. However, while the

ultimate liabilities resulting from such claims may be significant to

results of operations in the period recognized, management does not

anticipate they will have a material adverse effect on the Company’s

consolidated financial position or liquidity. As of December 31,