Xerox 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83Xerox 2012 Annual Report

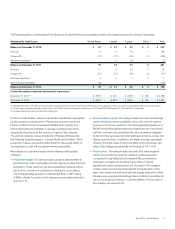

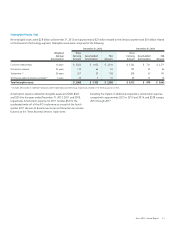

The following table summarizes the reconciliation to the Consolidated

Statements of Cash Flows:

Year Ended December 31,

2012 2011 2010

Charges against reserve $ (146) $ (233) $ (234)

Asset impairment 1 5 26

Effects of foreign currency and

other non-cash items 1 10 (5)

Restructuring Cash Payments $ (144) $ (218) $ (213)

The following table summarizes the total amount of costs incurred in

connection with these restructuring programs by segment:

Year Ended December 31,

2012 2011 2010

Services $ 71 $ 12 $ 104

Document Technology 82 23 325

Other – (2) 54

Total Net Restructuring Charges $ 153 $ 33 $ 483

Refer to the “Restructuring and Asset Impairment Charges” section of

our MD&A for additional discussion of net restructuring charges for the

three years ended December 31, 2012.

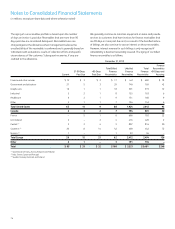

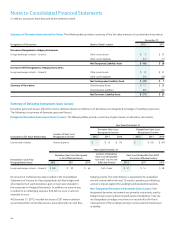

Note 11 – Supplementary Financial Information

The components of other current and long-term assets and liabilities

were as follows:

December 31,

2012 2011

Other Current Assets

Deferred taxes and income taxes receivable $ 296 $ 261

Royalties, license fees and software maintenance 165 143

Restricted cash 151 97

Prepaid expenses 143 147

Derivative instruments 11 58

Deferred purchase price from sales of accounts receivables 116 97

Beneficial interests – sales of finance receivables 35 –

Advances and deposits 29 28

Other 216 227

Total Other Current Assets $ 1,162 $ 1,058

December 31,

(continued) 2012 2011

Other Current Liabilities

Deferred taxes and income taxes payable $ 105 $ 83

Other taxes payable 170 150

Interest payable 83 84

Restructuring reserves 122 116

Derivative instruments 82 31

Product warranties 13 15

Dividends payable 69 74

Distributor and reseller rebates/commissions 117 112

Servicer liabilities 146 88

Other 869 878

Total Other Current Liabilities $ 1,776 $ 1,631

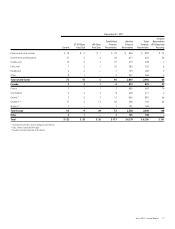

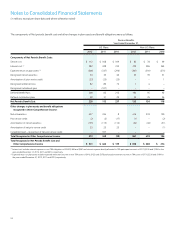

Other Long-term Assets

Prepaid pension costs $ 35 $ 76

Net investment in discontinued operations 190 204

Internal use software, net 577 545

Product software, net 344 256

Restricted cash 214 246

Debt issuance costs, net 37 38

Customer contract costs, net 356 294

Beneficial interests – sales of finance receivables 68 –

Deferred compensation plan investments 100 92

Other 416 365

Total Other Long-term Assets $ 2,337 $ 2,116

Other Long-term Liabilities

Deferred and other tax liabilities $ 262 $ 290

Environmental reserves 14 16

Unearned income 134 82

Restructuring reserves 8 7

Other 360 466

Total Other Long-term Liabilities $ 778 $ 861