Xerox 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

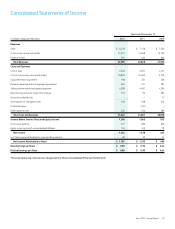

45Xerox 2012 Annual Report

• $351 million increase from higher share repurchases in 2012.

• $157 million increase from net debt activity. 2012 reflects net

proceeds of $1.1 billion from Senior Notes issued in March offset by

net payments on 2012 Senior Notes of $1.1 billion that matured

in May and a decrease of $100 million in Commercial Paper. 2011

includes proceeds of $1.0 billion from the issuance of Senior Notes

offset by the repayment of $750 million for Senior Notes due in

2011 and a decrease of $200 million in Commercial Paper.

• $47 million increase due to higher distributions to noncontrolling

interests.

Net cash used in financing activities was $1,586 million for the year

ended December 31, 2011. The $1,530 million decrease in the use of

cash from 2010 was primarily due to the following:

• $3,105 million decrease from net debt activity. 2011 includes

proceeds of $1.0 billion from the issuance of Senior Notes offset by

the repayment of $750 million for Senior Notes due in 2011 and a

decrease of $200 million in Commercial Paper. 2010 includes the

repayments of $1,733 million of ACS’s debt on the acquisition date,

$950 million of Senior Notes, $550 million early redemption of the

2013 Senior Notes, net payments of $109 million for other debt

and $14 million of debt issuance costs for the bridge loan facility

commitment, which was terminated in 2009. These payments were

offset by an increase of $300 million in Commercial Paper.

• $701 million increase resulting from the resumption of our share

repurchase program.

• $670 million increase reflecting the payment of our liability to Xerox

Capital Trust I in connection with their redemption of preferred

securities.

• $139 million increase due to lower proceeds from the issuances of

common stock under our stock option plans.

• $26 million increase reflecting a full year of dividend payments on

shares issued in connection with the acquisition of ACS in 2010.

• $12 million increase due to higher share repurchases related to

employee withholding taxes on stock-based compensation vesting.

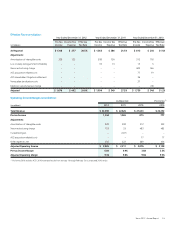

Customer Financing Activities

We provide lease equipment financing to our customers, primarily

in our Document Technology segment. Our lease contracts permit

customers to pay for equipment over time rather than at the date

of installation. Our investment in these contracts is reflected in Total

finance assets, net. We primarily fund our customer financing activity

through cash generated from operations, cash on hand, commercial

paper borrowings, sales and securitizations of finance receivables and

proceeds from capital markets offerings.

We have arrangements in certain international countries and

domestically with our small and mid-sized customers, where third-

party financial institutions independently provide lease financing,

on a non-recourse basis to Xerox, directly to our customers. In these

arrangements, we sell and transfer title of the equipment to these

financial institutions. Generally, we have no continuing ownership

rights in the equipment subsequent to its sale; therefore, the

unrelated third-party finance receivable and debt are not included in

our Consolidated Financial Statements.

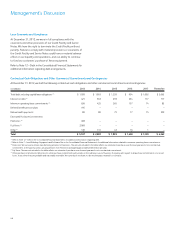

The following represents our Total finance assets, net associated with

our lease and finance operations: December 31,

(in millions) 2012 2011

Total Finance receivables, net (1) $ 5,313 $ 6,362

Equipment on operating leases, net 535 533

Total Finance Assets, Net $ 5,848 $ 6,895

(1) Includes (i) billed portion of finance receivables, net, (ii) finance receivables, net and

(iii) finance receivables due after one year, net as included in our Consolidated Balance

Sheets.

The decrease of $1,047 million in Total finance assets, net reflects

the sale of finance receivables (discussed further below) and the

decrease in equipment sales over the past several years, as well as

equipment sales growth in regions or operations where we don’t

offer direct leasing. These impacts were partially offset by an

increase of $83 million due to currency.

We maintain a certain level of debt, referred to as financing debt,

to support our investment in these lease contracts or Total finance

assets, net. We maintain this financing debt at an assumed 7:1

leverage ratio of debt to equity as compared to our Total finance

assets, net for this financing aspect of our business. Based on this

leverage, the following represents the breakdown of our total debt

at December 31, 2012 and 2011 between financing debt and core

debt: December 31,

(in millions) 2012 2011

Financing debt (1) $ 5,117 $ 6,033

Core debt 3,372 2,600

Total Debt $ 8,489 $ 8,633

(1) Financing debt includes $4,649 million and $5,567 million as of December 31, 2012

and December 31, 2011, respectively, of debt associated with Total finance receivables,

net and is the basis for our calculation of “Equipment financing interest” expense. The

remainder of the financing debt is associated with Equipment on operating leases.