Xerox 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

48

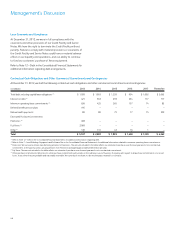

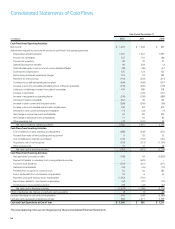

Contractual Cash Obligations and Other Commercial Commitments and Contingencies

At December 31, 2012, we had the following contractual cash obligations and other commercial commitments and contingencies:

(in millions) 2013 2014 2015 2016 2017 Thereafter

Total debt, including capital lease obligations (1) $ 1,039 $ 1,093 $ 1,259 $ 954 $ 1,002 $ 3,063

Interest on debt (1) 421 363 293 234 177 777

Minimum operating lease commitments (2) 636 425 265 157 74 83

Defined benefit pension plans 195 – – – – –

Retiree health payments 80 80 79 77 75 339

Estimated Purchase Commitments:

Flextronics (3) 498 – – – – –

Fuji Xerox (4) 2,069 – – – – –

Other (5) 169 131 43 16 1 –

Total $ 5,107 $ 2,092 $ 1,939 $ 1,438 $ 1,329 $ 4,262

(1) Refer to Note 12 – Debt in the Consolidated Financial Statements for additional information regarding debt.

(2) Refer to Note 7 – Land, Buildings, Equipment and Software, Net in the Consolidated Financial Statements for additional information related to minimum operating lease commitments.

(3) Flextronics: We outsource certain manufacturing activities to Flextronics. The amount included in the table reflects our estimate of purchases over the next year and is not a contractual

commitment. In the past two years, actual purchases from Flextronics averaged approximately $600 million per year.

(4) Fuji Xerox: The amount included in the table reflects our estimate of purchases over the next year and is not a contractual commitment.

(5) Other purchase commitments: We enter into other purchase commitments with vendors in the ordinary course of business. Our policy with respect to all purchase commitments is to record

losses, if any, when they are probable and reasonably estimable. We currently do not have, nor do we anticipate, material loss contracts.

Loan Covenants and Compliance

At December 31, 2012, we were in full compliance with the

covenants and other provisions of our Credit Facility and Senior

Notes. We have the right to terminate the Credit Facility without

penalty. Failure to comply with material provisions or covenants of

the Credit Facility and Senior Notes could have a material adverse

effect on our liquidity and operations, and our ability to continue

to fund our customers’ purchase of Xerox equipment.

Refer to Note 12 – Debt in the Consolidated Financial Statements for

additional information regarding debt arrangements.