Xerox 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99Xerox 2012 Annual Report

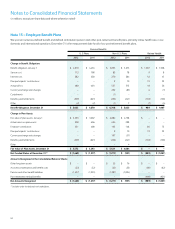

Expected Long-term Rate of Return

We employ a “building block” approach in determining the long-term

rate of return for plan assets. Historical markets are studied and long-

term relationships between equities and fixed income are assessed.

Current market factors such as inflation and interest rates are evaluated

before long-term capital market assumptions are determined. The long-

term portfolio return is established giving consideration to investment

diversification and rebalancing. Peer data and historical returns are

reviewed periodically to assess reasonableness and appropriateness.

Contributions

In 2012, we made cash contributions of $364 ($201 U.S. and

$163 Non-U.S.) and $84 to our defined benefit pension plans and

retiree health benefit plans, respectively. We also elected to make

a contribution of 15.4 million shares of our common stock, with an

aggregate value of approximately $130, to our U.S. defined benefit

pension plan for salaried employees in order to meet our planned

level of funding for 2012. Accordingly, total contributions to our

defined benefit pension plans were $494 ($331 U.S. and $163

Non-U.S.) in 2012.

In 2013 we expect, based on current actuarial calculations, to make

contributions of approximately $195 ($26 U.S. and $169 non-U.S.) to

our defined benefit pension plans and $80 to our retiree health benefit

plans. The decrease in required contributions to our U.S. defined benefit

pension plans reflect the expected benefits from the pension funding

legislation enacted in the U.S. during 2012.

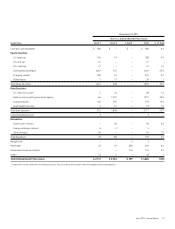

Estimated Future Benefit Payments

The following benefit payments, which reflect expected future service,

as appropriate, are expected to be paid during the following years:

Pension Benefits

U.S. Non-U.S. Total Retiree Health

2013 $ 483 $ 248 $ 731 $ 80

2014 445 251 696 80

2015 402 261 663 79

2016 370 274 644 77

2017 348 280 628 75

Years 2018-2022 1,425 1,550 2,975 339

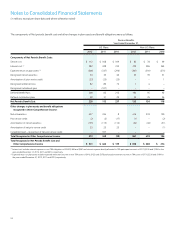

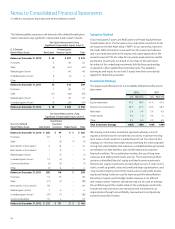

Assumptions

Weighted-average assumptions used to determine benefit obligations at the plan measurement dates:

Pension Benefits

2012 2011 2010

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Discount rate 3.7% 4.0% 4.8% 4 . 6% 5 .1% 5. 3%

Rate of compensation increase 0.2% 2 .6% 3.5% 2.7% 3.5% 2.7%

Retiree Health

2012 2011 2010

Discount rate 3.6% 4.5% 4.9%

Weighted-average assumptions used to determine net periodic benefit cost for years ended December 31:

Pension Benefits

2013 2012 2011 2010

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Discount rate 3.7% 4.0% 4.8% 4.6% 5.1% 5.3% 5.7% 5.7%

Expected return on plan assets 7.8% 6.1% 7.8% 6.2% 8.3% 6.6% 8.3% 6.6%

Rate of compensation increase 0.2% 2.6% 3.5% 2.7% 3.5% 2.7% 3.5% 3.6%

Retiree Health

2013 2012 2011 2010

Discount rate 3.6% 4.5% 4.9% 5.4%

Note: Expected return on plan assets is not applicable to retiree health benefits as these plans are not funded. Rate of compensation increase is not applicable to retiree health benefits as

compensation levels do not impact earned benefits.