Xerox 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

40

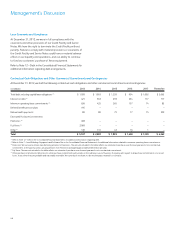

Services segment revenues for the three years ended December 31, 2012 were as follows:

Pro-forma(1)

Revenue Change Change

(in millions) 2012 2011 2010 2012 2011 2011

Business processing outsourcing $ 6,610 $ 6,074 $ 5,145 9% 18% 8%

Document outsourcing 3,659 3,545 3,264 3% 9% 9%

Information technology outsourcing 1,426 1,326 1,249 8% 6% (4)%

Less: Intra-segment elimination (167) (108) (21) * * *

Total Services Revenue $ 11,528 $ 10,837 $ 9,637 6% 12% 6%

* Percent not meaningful.

(1) See the “Non-GAAP Financial Measures” section for an explanation of this non-GAAP financial measure.

Note: In 2011, the Services segment is discussed on a pro-forma1 basis.

ACS was acquired on February 5, 2010, accordingly for comparison

purposes, we adjusted our historical 2010 results to include ACS’s 2010

estimated results for the period from January 1 through February 5,

2010. We believe these pro-forma comparisons provide a perspective

on the impact of the ACS acquisition on our results and trends. Refer to

the “Non-GAAP Financial Measures” section for a further explanation

and discussion of this non-GAAP presentation.

Revenue 2012

Services revenue of $11,528 million increased 6% with a 1-percentage

point negative impact from currency.

• BPO revenue increased 9%, including a 1-percentage point negative

impact from currency, and represented 57% of total Services

revenue. BPO growth was driven by the government healthcare,

healthcare payer, customer care, financial services, retail, travel and

insurance businesses and other state government solutions, as well

as the benefits from recent acquisitions.

• DO revenue increased 3%, including a 2-percentage point negative

impact from currency, and represented 31% of total Services

revenue. The increase in DO revenue was primarily driven by our new

partner print services offerings as well as new signings.

• ITO revenue increased 8% and represented 12% of total Services

revenue. ITO growth was driven by the revenue ramp resulting from

strong growth in recent quarters and also includes 3-percentage

points of growth related to revenue from intercompany services,

which is eliminated in total Services segment revenue.

Segment Margin 2012

Services segment margin of 10.2% decreased 0.9-percentage points

from the prior year primarily due to a decline in gross margin, which

was driven by the ramping of new services contracts, pressure on

government contracts, the impact of lower contract renewals and

lower volumes in some areas of the business. The gross margin decline

was partially offset by the benefits from restructuring and lower SAG,

primarily in DO.

Metrics

Pipeline

Our total services sales pipeline at December 31, 2012, including

synergy opportunities, grew 6% over the prior year. This sales pipeline

includes the Total Contract Value (“TCV”) of new business opportunities

that potentially could be contracted within the next six months and

excludes business opportunities with estimated annual recurring

revenue in excess of $100 million.

Signings

Signings are defined as estimated future revenues from contracts

signed during the period, including renewals of existing contracts.TCV

represents the estimated future contract revenue for pipeline or signed

contracts for signings, as applicable.

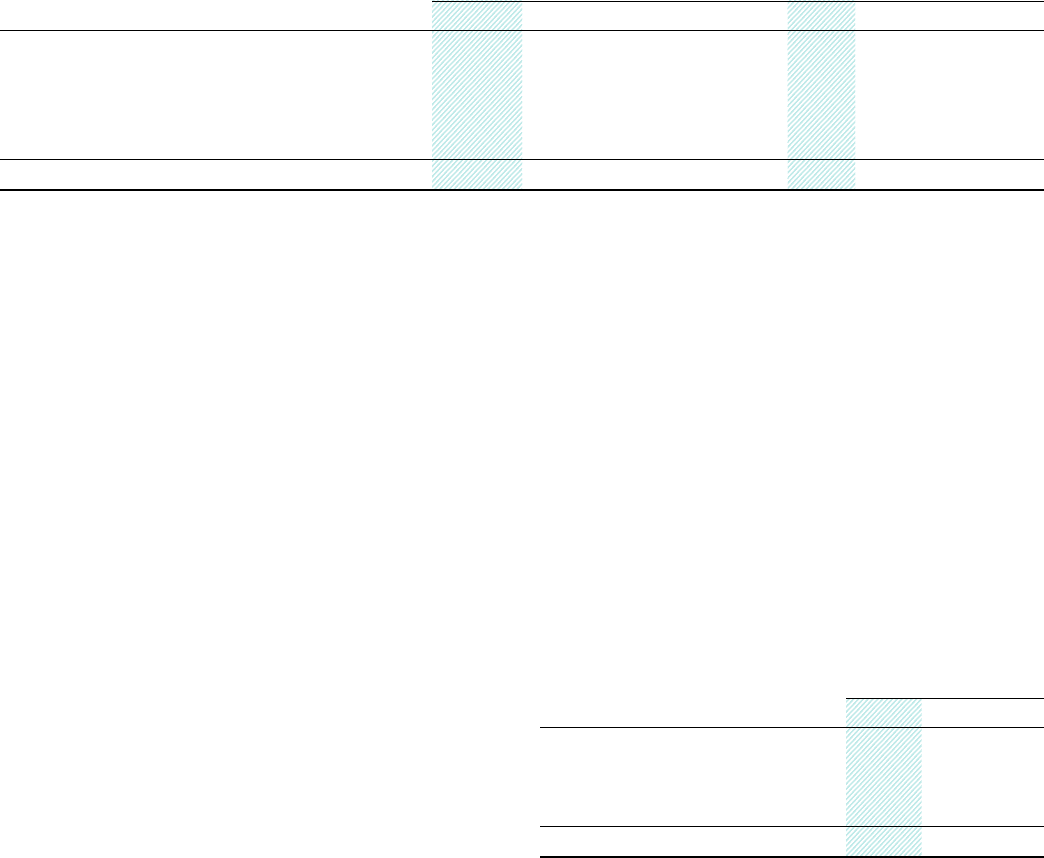

Signings were as follows:

Year Ended December 31,

(in billions) 2012 2011 2010

BPO $ 6.0 $ 6.8 $ 10.0

DO 3.3 4.4 3.3

ITO 1.5 3.4 1.3

Total Signings $ 10.8 $ 14.6 $ 14.6

Services signings were an estimated $10.8 billion in TCV for 2012 and

decreased 25% compared to the prior year. This decline was driven

by a decrease in large deals from the prior year as well as delays

in customer decision making. While the total number of BPO/ITO

contracts signed in 2012 increased from 2011, the decline in large

deals drove a reduction in the average contract length of new business

signings in 2012. The above DO signings amount represents Enterprise

signings only and does not include signings from our partner print

services offerings, which is driving the revenue growth in DO.