Xerox 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5Xerox 2012 Annual Report

the economic uncertainty across most regions, we put our focus on

reducing the cost base while expanding distribution through indirect

channels. This year, we’re ramping up marketing investments and

introducing new offerings while broadening our channel partnerships –

positioning us better to pursue profitable opportunities.

So, although 2012 presented our business with some obstacles, we

moved forward in refining our business model, improving operational

efficiency and growing our Services business – all while delivering value

to you. Here’s a summary of how we performed:

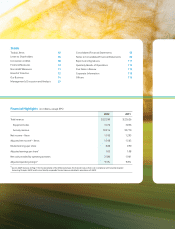

• Net income of $1.2 billion; adjusted net income of $1.4 billion.1

• GAAP earnings per share of 88 cents; adjusted earnings per share

of $1.03.1

• Total revenue of $22.4 billion, down 1 percent or flat in constant

currency1 from 2011.

-Total Services revenue of $11.5 billion, up 6 percent or up

7 percent in constant currency.1

-Total Document Technology revenue of $9.5 billion, down

8 percent or down 6 percent in constant currency.1

• Operating margin of 9.3 percent.1

• Operating cash flow of $2.6 billion.

• Share repurchase of $1.05 billion and $255 million in dividends.

Priorities Drive Performance

We participate in a $600 billion market. And we continue to tackle

it aggressively on four fronts.

First: Managing our Services business for growth. I mentioned

earlier that revenue from our Services business is now more than half

of our total revenue and is growing at a steady pace. We expect it will

grow to two-thirds of our revenue by 2017. My confidence in the long-

term success of our Services business stems from the diversity of our

offerings and the deep expertise we’ve established to work closely with

clients on their important business processes:

• When a major automobile company selected Xerox to handle their

employee benefits program, we were able to build, manage and

support their open enrollment process in a matter of months.

• Just as a telecommunications company decided to start selling their

new product in Brazil, they tapped us to open, staff and lead their

in-country customer care service.

• As soon as the Affordable Care Act in the United States became

more of a certainty for state governments, several of our government

clients looked to us for help establishing Health Insurance Exchanges

and strengthening the administrative backbone of their Medicaid

and other health and welfare programs.

I could go on but the bottom line is that our Services business will

continue to grow because of the breadth and depth of our offerings

and, more important, because of our respected experience, innovation

and expertise that wins us trust from our clients. That trust helped us

sign new contracts during 2012 worth more than $2 billion in annual

revenue and to win 85 percent of the contracts that were up for

renewal during the year. It’s trust we never take for granted.

Michelin wanted to outsource F&A, so they made tracks

to our door.

Our Challenge: Bring efficiency and cost savings to global

Finance and Accounting operations.

Bottom-line Results: Michelin was initiating a major

transformation program for its Finance function. To improve

performance, reduce costs and enhance overall quality, the

company chose us to provide global outsourced Finance and

Accounting services. We built an F&A solution that today meets

company requirements and service level expectations.