Xerox 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(in millions, except per-share data and where otherwise noted)

84

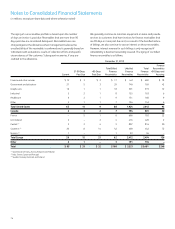

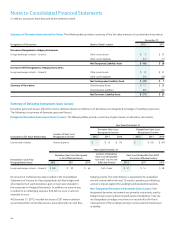

Long-term debt was as follows:

Weighted Average December 31,

Interest Rates at

December 31, 2012 (2) 2012 2011

Xerox Corporation

Senior Notes due 2012 – $ – $ 1,100

Senior Notes due 2013 5.65% 400 400

Floating Rate Notes due 2013 1.71% 600 –

Convertible Notes due 2014 9.00% 19 19

Senior Notes due 2014 8.25% 750 750

Floating Rate Notes due 2014 1.13% 300 300

Senior Notes due 2015 4.29% 1,000 1,000

Notes due 2016 7.20% 250 250

Senior Notes due 2016 6.48% 700 700

Senior Notes due 2017 6.83% 500 500

Senior Notes due 2017 2.98% 500 –

Notes due 2018 0.57% 1 1

Senior Notes due 2018 6.37% 1,000 1,000

Senior Notes due 2019 5.66% 650 650

Senior Notes due 2021 5.39% 1,062 700

Zero Coupon Notes due 2023 – – 301

Senior Notes due 2039 6.78% 350 350

Subtotal – Xerox Corporation $ 8,082 $ 8,021

Subsidiary Companies

Senior Notes due 2015 4.25% 250 250

Borrowings secured by other assets 4.31% 77 76

Other 1.23% 1 3

Subtotal-Subsidiary Companies $ 328 $ 329

Principal Debt Balance 8,410 8,350

Unamortized discount (63) (7)

Fair value adjustments (1) 142 190

Less: current maturities (1,042) (1,445)

Total Long-term Debt $ 7,447 $ 7,088

(1)

Fair value adjustments represent changes in the fair value of hedged debt obligations

attributable to movements in benchmark interest rates. Hedge accounting requires

hedged debt instruments to be reported at an amount equal to the sum of their carrying

value (principal value plus/minus premiums/discounts) and any fair value adjustment.

(2) Represents weighted average effective interest rate which includes the effect of discounts

and premiums on issued debt.

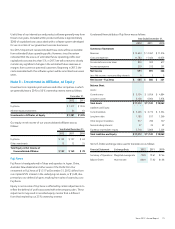

Restricted Cash and Investments

As more fully discussed in Note 17 – Contingencies and Litigation,

various litigation matters in Brazil require us to make cash deposits

to escrow as a condition of continuing the litigation. In addition, as

more fully discussed in Note 4 – Accounts Receivable, Net and Note

5 – Finance Receivables, Net, we continue to service the receivables

sold under most of our receivable sale agreements. As servicer, we may

collect cash related to sold receivables prior to month-end that will be

remitted to the purchaser the following month. Since we are acting on

behalf of the purchaser in our capacity as servicer, such cash collected

is reported as restricted cash. Restricted cash amounts are classified

in our Consolidated Balance Sheets based on when the cash will be

contractually or judicially released.

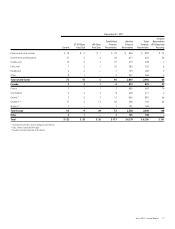

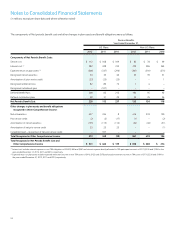

Restricted cash amounts were as follows:

December 31,

2012 2011

Tax and labor litigation deposits in Brazil $ 211 $ 240

Escrow and cash collections related to receivable sales 146 88

Other restricted cash 8 15

Total Restricted Cash and Investments $ 365 $ 343

Net Investment in Discontinued Operations

At December 31, 2012, our net investment in discontinued operations

primarily consisted of a $208 performance-based instrument relating

to the 1997 sale of The Resolution Group (“TRG”) net of remaining

net liabilities associated with our discontinued operations of $18.

The recovery of the performance-based instrument is dependent

on the sufficiency of TRG’s available cash flows, as guaranteed by

TRG’s ultimate parent, which are expected to be recovered in annual

cash distributions through 2017. The performance-based instrument

is pledged as security for our future funding obligations to our U.K.

Pension Plan for salaried employees.

Note 12 – Debt

Short-term borrowings were as follows:

December 31,

2012 2011

Commercial paper $ – $ 100

Current maturities of long-term debt 1,042 1,445

Total Short-term Debt $ 1,042 $ 1,545

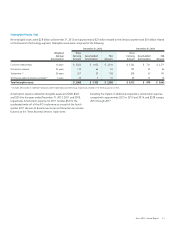

We classify our debt based on the contractual maturity dates of the

underlying debt instruments or as of the earliest put date available to

the debt holders. We defer costs associated with debt issuance over

the applicable term, or to the first put date in the case of convertible

debt or debt with a put feature. These costs are amortized as interest

expense in our Consolidated Statements of Income.