Xerox 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87Xerox 2012 Annual Report

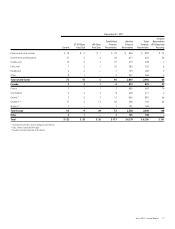

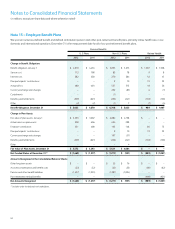

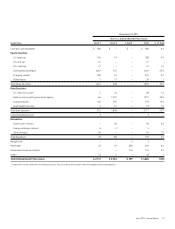

The following is a summary of the primary hedging positions and

corresponding fair values as of December 31, 2012:

Gross Fair Value

Currencies Hedged (Buy/Sell) Notional Value Asset (Liability)(1)

Japanese Yen/U.S. Dollar $ 640 $ (37)

U.S. Dollar/Euro 559 (6)

U.K. Pound Sterling/Euro 516 (4)

Euro/U.K. Pound Sterling 502 5

Japanese Yen/Euro 463 (33)

Euro/U.S. Dollar 188 1

U.S. Dollar/Japanese Yen 87 –

Indian Rupee/U.S. Dollar 65 1

Mexican Peso/U.S. Dollar 65 1

Euro/Japanese Yen 61 –

Philippine Peso/U.S. Dollar 52 1

Euro/Swiss Franc 37 –

Swiss Franc/Euro 29 –

U.S. Dollar/Canadian Dollar 25 –

All Other 216 –

Total Foreign Exchange Hedging $ 3,505 $ (71)

(1) Represents the net receivable (payable) amount included in the Consolidated Balance

Sheet at December 31, 2012.

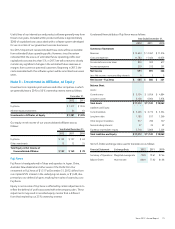

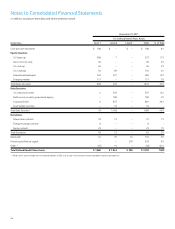

Foreign Currency Cash Flow Hedges: We designate a portion of our

foreign currency derivative contracts as cash flow hedges of our foreign

currency-denominated inventory purchases, sales and expenses.

No amount of ineffectiveness was recorded in the Consolidated

Statements of Income for these designated cash flow hedges and

all components of each derivative’s gain or loss was included in the

assessment of hedge effectiveness. The net (liability) asset fair value

of these contracts was $(48) and $26 as of December 31, 2012 and

December 31, 2011, respectively.