Xerox 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

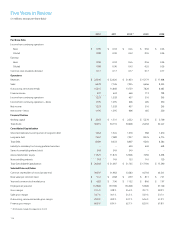

Notes to Consolidated Financial Statements

(in millions, except per-share data and where otherwise noted)

108

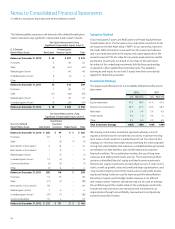

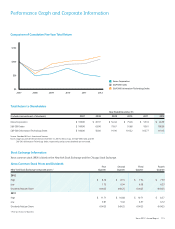

Assumptions Pre-August 2009 Options August 2009 Options

Strike price $ 6.89 $ 6.33

Expected volatility 37.90% 38.05%

Risk-free interest rate 0.23% 1.96%

Dividend yield 1.97% 1.97%

Expected term 0.75 years 4.2 years

The total intrinsic value and actual tax benefit realized for vested and exercised stock-based awards was as follows:

December 31, 2012 December 31, 2011 December 31, 2010

Total Total Total

Intrinsic Cash Tax Intrinsic Cash Tax Intrinsic Cash Tax

Awards Value Received Benefit Value Received Benefit Value Received Benefit

Restricted Stock Units $ 117 $ – $ 33 $ 56 $ – $ 22 $ 31 $ – $ 10

Performance Shares – – – 17 – 6 12 – 5

Stock Options 12 44 4 18 44 7 155 183 56

No Performance Shares vested in 2012 since the 2009 primary award grant that normally would have vested in 2012 was replaced with a grant of

Restricted Stock Units with a market based condition and therefore were accounted and reported for as part of Restricted Stock Units.

ACS Acquisition

In connection with the acquisition of ACS (see Note 3 – Acquisitions for

additional information), outstanding ACS options were converted into

96,662 thousand Xerox options. The Xerox options have a weighted

average exercise price of $6.79 per option. The estimated fair value

associated with the options issued was approximately $222 based on a

Black-Scholes valuation model utilizing the assumptions stated below.

Approximately $168 of the estimated fair value is associated with ACS

options issued prior to August 2009, which became fully vested and

exercisable upon the acquisition in accordance with preexisting change-

in-control provisions, and was recorded as part of the acquisition fair

value. The remaining $54 is associated with ACS options issued in

August 2009 which did not fully vest and become exercisable upon

the acquisition, but continue to vest according to specified vesting

schedules and, therefore, is being expensed as compensation cost over

the remaining vesting period. The options generally expire 10 years

from date of grant. 33,693 thousand Xerox options issued upon this

conversion remain outstanding at December 31, 2012.