Xerox 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Today’s Xerox

®

2012 Annual Report

Table of contents

-

Page 1

2012 Annual Report Today's Xerox ® -

Page 2

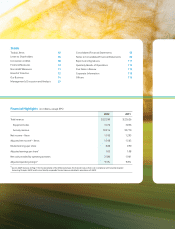

...to Consolidated Financial Statements Reports and Signatures Quarterly Results of Operations Five Years in Review Corporate Information Officers 55 60 111 113 114 115 116 Financial Highlights (in millions, except EPS) 2012 Total revenue Equipment sales Annuity revenue Net income - Xerox Adjusted net... -

Page 3

Today's Xerox is the world's leading enterprise for business process and document management. That means we help take some of the work out of work. Our services, technology and expertise enable workplaces, big and small, to simplify the way work gets done so they can operate more effectively and ... -

Page 4

... the way work gets done in surprising ways. Handling $421 billion in accounts payables annually. We simplify business by managing global finance, accounting and procurement operations for customers across the entire order-to-cash life cycle. All delivered as scalable solutions designed to... -

Page 5

... a day. We simplify business by helping companies manage their customer care operations, help desks and online support. Giving access to timely, scalable and cost-effective call center solutions in any language, anywhere around the world. Collecting 37 billion annual transit fares a year... -

Page 6

.... #1 worldwide revenue market share leadership for our Document Technology. This speaks to the continued power of the Xerox brand in a market that we created and continue to benefit from through healthy margins and established relationships in 160 countries. 1,900. That's the total number of patents... -

Page 7

... from 2011. -Total Services revenue of $11.5 billion, up 6 percent or up 7 percent in constant currency.1 -Total Document Technology revenue of $9.5 billion, down 8 percent or down 6 percent in constant currency.1 • Operating margin of 9.3 percent. 1 First: Managing our Services business for... -

Page 8

... handle $421 billion in accounts payables annually...answer 1.6 million customer interactions daily...manage benefits for more than 11 million employees...process 900 million insurance claims every year...collect 37 billion transit fares annually...reduce document-related costs for enterprises large... -

Page 9

...good time to keep your eye on Xerox. Here's why: • Services-led growth; • profitable leadership from Document Technology; • cash-generating annuity-based business model; • consistent earnings expansion; and • financial strength to invest in building value for Xerox...and building value for... -

Page 10

... Fuji Xerox, invests well over a billion dollars to discover new ways to make our customers more successful. As a global company, we benefit from gathering the unique insights of the most skilled researchers from around the world. Across five research centers in the U.S., Canada, Europe and India... -

Page 11

... better information so they can spend more time on patient care. Xerox Innovation: Creation of a digital dashboard that: • Delivers a real-time view of patient status so they can make better healthcare decisions. • Automatically aggregates data from electronic medical records, medical testing... -

Page 12

...'10 '11 '12 0 '08 '09 '10 '11 '12 * See non-GAAP measures for the reconciliation of the difference between this financial measure that is not in compliance with Generally Accepted Accounting Principles (GAAP) and the most directly comparable financial measure calculated in accordance with GAAP. 10 -

Page 13

... tax benefits Adjusted Weighted average shares for reported EPS Weighted average shares for adjusted EPS Operating Margin (in millions) 2012 Total Revenues Pre-tax Income (loss) Adjustments: Amortization of intangible assets Xerox restructuring charge Curtailment gain ACS acquisition-related costs... -

Page 14

...of the Compensation Committee C: Member of the Corporate Governance Committee D: Member of the Finance Committee Ann N. Reese C, D Executive Director Center for Adoption Policy Rye, NY Mary Agnes Wilderotter D Chairman and Chief Executive Officer Frontier Communications Corporation Stamford, CT 12 -

Page 15

... of a broad range of diverse Services and innovative Document Technologies. Most important, we have talented and empowered people who are committed to growing our business with world-class service and technological advancements that simplify the ways work gets done. Xerox 2012 Annual Report 13 -

Page 16

... $130 billion. This market is comprised of the document systems, software, solutions and services that our customers have relied on for years to help run their businesses and reduce their costs. Xerox led the establishment of the managed print services market and continues to be the industry leader... -

Page 17

... of complexity or number of customer locations. • Renowned Innovation - We have a history of innovation and, with more than 11,500 active U.S. patents and five global research centers, we continue to lead the document technology industry and to take our technology into new service areas. See the... -

Page 18

... and returning value to shareholders. Acquisitions Consistent with our strategy to expand our Services offerings through acquisitions, we acquired the following companies in 2012: In July 2012 we acquired: • Wireless Data Services ("WDS"), a telecommunications technical support and consultancy... -

Page 19

... to technologies that improve the efficiency, economics and relevancy of business communications and printing applications. We research methods to create affordable ubiquitous color printing, leveraging our solid ink printing technology. We are also exploring ways to Xerox 2012 Annual Report 17 -

Page 20

... as toner and inks, for our document technology. Xerox Research Center Webster ("XRCW") - Located in Webster, New York, XRCW focuses on system design, imaging, computing and marking science. In addition, XRCW is now focused on innovation to help the healthcare industry. Xerox Research Centre Europe... -

Page 21

...462 Document Technology includes the sale of products and supplies, as well as the associated technical service and financing of those products. Other: $1,400 The Other segment primarily includes revenue from paper sales, wide-format systems, network integration solutions and electronic presentation... -

Page 22

... model and domestic payer service centers. Services include data capture, claims processing, customer care, recovery services and healthcare communications. No competitor has offerings in all of these areas. • Healthcare Provider Solutions: We provide consulting solutions, revenue cycle management... -

Page 23

... employee productivity. In ITO accounts, MPS complements the client IT services that we are currently managing and positions Xerox as a complete IT services provider. Information Technology Outsourcing We specialize in designing, developing and delivering effective IT solutions. Our secure data... -

Page 24

... the associated technical service and financing of those products (that which is not related to document outsourcing contracts). Our Document Technology business is centered around strategic product groups that share common technology, manufacturing and product platforms. Document Technology Revenue... -

Page 25

...and centralized reprographic departments, in addition to education, healthcare and many other industries. With industry leading speeds of up to 125 ppm, this D95/110/125 Copier/Printer helps customers increase productivity and reduce costs. Document Technology segment revenue in 2012. These devices... -

Page 26

... as state sponsors of terrorism by the U.S.: $14,701 Europe: $5,111 Other Areas: $2,578 Revenues by geography are based on the location of the unit reporting the revenue and include export sales. Patents, Trademarks and Licenses Xerox and its subsidiaries were awarded 1,215 U.S. utility patents in... -

Page 27

... with Fuji Xerox under which we purchase and sell products, some of which are the result of mutual research and development agreements. Refer to Note 8 - Investments in Affiliates, at Equity in the Consolidated Financial Statements in our 2012 Annual Report for additional information regarding... -

Page 28

... Document Process Centers. Our global production model is enabled by the use of proprietary technology, which allows us to securely distribute client transactions within data privacy limits across a global workforce. This global production model allows us to leverage lower-cost production locations... -

Page 29

... global enterprises - to focus on their core business and operate more effectively. Headquartered in Norwalk, Connecticut, we offer business process outsourcing, document outsourcing and IT outsourcing services, including data processing, healthcare solutions, HR benefits management, finance support... -

Page 30

... we focused on aligning our costs, investments, diverse portfolio and operations with our services-led strategy that is designed to accelerate growth in Services while maximizing the profitability of our Document Technology business. Total revenue of $22.4 billion in 2012 declined 1% from the prior... -

Page 31

... Accounting Policies in the Consolidated Financial Statements. Sales to Distributors and Resellers - We utilize distributors and resellers to sell many of our Document Technology products to end-user customers. Sales to distributors and resellers are generally recognized as revenue when products... -

Page 32

...future events are used in calculating the expense, liability and asset values related to our defined benefit pension plans. These factors include assumptions we make about the expected return on plan assets, discount rates, the rate of future compensation increases and mortality. Differences between... -

Page 33

... components based on the related underlying employee costs. (in millions) Estimated 2013 2012 Actual 2011 2010 Beneï¬t Plan Funding: Defined benefit pension plans: Cash Stock Total Defined contribution plans Retiree health benefit plans Total Beneï¬t Plan Funding $ 195 - 195 113 80 $ 388... -

Page 34

... 2012 impairment test, the following were the longterm assumptions for Document Technology and the three reporting units within our Services segment with respect to revenue, operating income and margins, which formed the basis for estimating future cash flows used in the discounted cash flow model... -

Page 35

... by market pricing and lower activity. - Finance income - includes $44 million in gains from the sale of finance receivables from our Document Technology segment (see Note 5 - Finance Receivables, Net in the Consolidated Financial Statements for additional information). Xerox 2012 Annual Report 33 -

Page 36

... 2011 while color device MIF represented 35% of total MIF. An analysis of the change in revenue for each business segment is included in the "Operations Review of Segment Revenue and Profit" section. Costs, Expenses and Other Income Summary of Key Financial Ratios Year Ended December 31, 2012 Total... -

Page 37

... cost and expense management. Note: The acquisition of ACS increased the proportion of our revenue from services, which has a lower gross margin and SAG as a percent of revenue than we historically experienced when Xerox was primarily a technology company. As a result, in 2011 gross margins... -

Page 38

... and services. During 2012 we managed our investments in R&D to align with growth opportunities in areas like business services, color printing and customized communication. Xerox R&D is also strategically coordinated with Fuji Xerox. RD&E as a percent of revenue for the year ended December 31, 2011... -

Page 39

...Gain In December 2011, we amended all of our primary non-union U.S. defined benefit pension plans for salaried employees. Our primary qualified plans had previously been amended to freeze the final average pay formulas within the plans as of December 31, 2012, but the cash balance service credit was... -

Page 40

... tax rate for 2012 includes a benefit of approximately 12-percentage points from these non-U.S. operations. Refer to Note 16 - Income and Other Taxes, in the Consolidated Financial Statements for additional information regarding the geographic mix of income before taxes and the related impacts... -

Page 41

..."), Document Outsourcing ("DO") and Information Technology Outsourcing ("ITO"). The DO business included within the Services segment essentially represents Xerox's pre-ACS acquisition outsourcing business, as ACS's outsourcing business is reported as BPO and ITO revenue. Xerox 2012 Annual Report 39 -

Page 42

...% of total Services revenue. BPO growth was driven by the government healthcare, healthcare payer, customer care, financial services, retail, travel and insurance businesses and other state government solutions, as well as the benefits from recent acquisitions. • DO revenue increased 3%, including... -

Page 43

... renewal rate of 87%. Document Technology Segment Our Document Technology segment includes the sale of products and supplies, as well as the associated technical service and financing of those products. The Document Technology segment represents our pre-ACS acquisition equipment-related business... -

Page 44

... percentages include installations for Document Outsourcing and the Xerox-branded product shipments to GIS. Descriptions of "Entry", "Mid-range" and "High-end" are defined in Note 2 - Segment Reporting, in the Consolidated Financial Statements. Revenue 2011 Document Technology revenue of $10,259... -

Page 45

..., the sale of certain patents and the cross-licensing of certain patents of each party, pursuant to which we received an up-front payment with the remaining amount payable in two equal annual installment payments. Consistent with our accounting policy for these transactions, revenue associated with... -

Page 46

...absence of cash outflows from acquisition-related expenditures. In September 2011, we elected to make a contribution of 16.6 million shares of our common stock, with an aggregate value of approximately $130 million, to our U.S. defined benefit pension plan for salaried employees in order to meet our... -

Page 47

... 31, 2012 and December 31, 2011, respectively, of debt associated with Total finance receivables, net and is the basis for our calculation of "Equipment financing interest" expense. The remainder of the financing debt is associated with Equipment on operating leases. Xerox 2012 Annual Report 45 -

Page 48

... Operating Activities (1) Sales of Accounts Receivable Accounts receivable sales arrangements are utilized in the normal course of business as part of our cash and liquidity management. We have facilities in the U.S., Canada and several countries in Europe that enable us to sell certain accounts... -

Page 49

... in which we operate, (2) the legal requirements of the agreements to which we are a party and (3) the policies and cooperation of the financial institutions we utilize to maintain and provide cash management services. Our principal debt maturities are in line with historical and projected cash... -

Page 50

... $ 3,063 777 83 - 339 Total debt, including capital lease obligations (1) Interest on debt (1) Minimum operating lease commitments Defined benefit pension plans Retiree health payments Estimated Purchase Commitments: Flextronics (3) Fuji Xerox Other (5) Total (1) (2) 636 195 80 498 2,069... -

Page 51

... medical claims costs incurred during the year. The amounts reported in the above table as retiree health payments represent our estimate of future benefit payments. Fuji Xerox We purchased products, including parts and supplies, from Fuji Xerox totaling $2.1 billion, $2.2 billion and $2.1 billion... -

Page 52

... Limited, Fuji Xerox, Xerox Canada Inc. and Xerox Brasil, and translated into U.S. Dollars using the year-end exchange rates, was approximately $7.1 billion at December 31, 2012. Interest Rate Risk Management The consolidated weighted-average interest rates related to our total debt for 2012, 2011... -

Page 53

... pension plans for salaried employees to fully freeze future benefit and service accruals after December 31, 2012. We exclude these amounts in order to evaluate our current and past operating performance and to better understand the expected future trends in our business. Xerox 2012 Annual Report... -

Page 54

... of liability Xerox and Fuji Xerox restructuring charges ACS acquisition-related costs ACS shareholders' litigation settlement Venezuelan devaluation costs Medicare subsidy tax law change Adjusted Weighted average shares for adjusted EPS (1) Fully diluted shares at December 31, 2012 (2) (1) 203... -

Page 55

... 777 2012 $ 22,390 1,348 2011 $ 22,626 1,565 Total Revenue Pre-tax Income Adjustments: Amortization of intangible assets Xerox restructuring charge Curtailment gain ACS acquisition-related costs Other expenses, net Adjusted Operating Income Pre-tax Income Margin Adjusted Operating Margin (1) 328... -

Page 56

...to identify forward-looking statements. These statements reflect management's current beliefs, assumptions and expectations and are subject to a number of factors that may cause actual results to differ materially. Information concerning these factors is included in our 2012 Annual Report on Form 10... -

Page 57

... income Total Revenues Costs and Expenses Cost of sales Cost of outsourcing, service and rentals Equipment financing interest Research, development and engineering expenses Selling, administrative and general expenses Restructuring and asset impairment charges Acquisition-related costs Amortization... -

Page 58

... $ 1,195 2011 $ 1,328 33 $ 1,295 2010 $ 637 31 $ 606 Net Income Less: Net income attributable to noncontrolling interests Net Income Attributable to Xerox Other Comprehensive Income (Loss), Net: (1) Translation adjustments, net Unrealized (losses) gains, net Changes in defined benefit plans, net... -

Page 59

... debt Accounts payable Accrued compensation and benefits costs Unearned income Other current liabilities Total current liabilities Long-term debt Pension and other benefit liabilities Post-retirement medical benefits Other long-term liabilities Total Liabilities Series A Convertible Preferred Stock... -

Page 60

... affiliates Stock-based compensation Restructuring and asset impairment charges Payments for restructurings Contributions to defined benefit pension plans Increase in accounts receivable and billed portion of finance receivables Collections of deferred proceeds from sales of receivables... -

Page 61

... stock of $12.22 per share in the first quarter of 2010 and $20 per share in each quarter thereafter in 2010, 2011 and 2012. (3) AOCL - Accumulated other comprehensive loss. The accompanying notes are an integral part of these Consolidated Financial Statements. Xerox 2012 Annual Report 59 -

Page 62

... a $22.4 billion global enterprise for business process and document management. We offer business process outsourcing and IT outsourcing services, including data processing, healthcare solutions, human resource benefits management, finance support, transportation solutions and customer relationship... -

Page 63

... by the customer according to the customer's shipping terms. Revenues from equipment under other leases and similar arrangements are accounted for by the operating lease method and are recognized as earned over the lease term, which is generally on a straight-line basis. Xerox 2012 Annual Report 61 -

Page 64

... effect. The pricing interest rates generally equal the implicit rates within the leases, as corroborated by our comparisons of cash to lease selling prices. Sales to distributors and resellers: We utilize distributors and resellers to sell many of our technology products to end-user customers. We... -

Page 65

...outsourcing services are generally recognized as services are rendered, which is generally on the basis of the number of accounts or transactions processed. Information technology processing revenues are recognized as services are provided to the customer, generally at the contractual selling prices... -

Page 66

... product launch. Sustaining engineering costs were $110, $108 and $128 in 2012, 2011 and 2010, respectively. Refer to Management's Discussion and Analysis, RD&E section for additional information regarding RD&E expense. Land, Buildings and Equipment and Equipment on Operating Leases Land, buildings... -

Page 67

... used in calculating the expense, liability and asset values related to our pension and retiree health benefit plans. These factors include assumptions we make about the discount rate, expected return on plan assets, rate of increase in healthcare costs, the rate of future compensation increases and... -

Page 68

... revenues from our partner print services offerings. Information technology outsourcing services include service arrangements where we manage a customer's IT-related activities, such as application management and application development, data center operations or testing and quality assurance... -

Page 69

Our Document Technology segment is centered on strategic product groups, which share common technology, manufacturing and product platforms. This segment includes the sale of document systems and supplies, technical services and product financing. Our products range from: • Entry, which includes ... -

Page 70

...78) - - 815 2012 $ 1,997 2011 $ 2,092 2010 $ 1,875 Geographic area data is based upon the location of the subsidiary reporting the revenue or long-lived assets and is as follows for the three years ended December 31, 2012: Revenues 2012 United States Europe Other areas Total Revenues and Long-Lived... -

Page 71

... acquired four additional businesses in 2012 for a total of $61 in cash, primarily related to customer care and software to support our BPO service offerings. The following table summarizes the purchase price allocations for our 2012 acquisitions as of the acquisition dates: Weighted-Average Life... -

Page 72

... range from cash management services to statement and check processing. In July 2011, we acquired Education Sales and Marketing, LLC ("ESM"), a leading provider of outsourced enrollment management and student loan default solutions, for approximately $43 net of cash acquired. The acquisition of ESM... -

Page 73

... net carrying value of $682 (net of an allowance of $18) to a third-party financial institution for cash proceeds of $630 and beneficial interests from the purchaser of $101. The lease contracts, including associated service and supply elements, were initially sold Xerox 2012 Annual Report 71 -

Page 74

... quality indicators and the financial health of specific customer classes or groups. The allowance for doubtful finance receivables is inherently more difficult to estimate than the allowance for trade accounts receivable because the underlying lease portfolio has an average maturity, at any time... -

Page 75

... and smaller units. In the U.S. and Canada, customers are further evaluated or segregated by class based on industry sector. The primary customer classes are Finance & Other Services; Government & Education; Graphic Arts; Industrial; Healthcare and Other. In Europe, customers are further grouped by... -

Page 76

... quality indicators are as follows: December 31, 2012 Investment Grade Finance and other services Government and education Graphic arts Industrial Healthcare Other Total United States Finance and other services Government and education Graphic arts Industrial Other Total Canada France U.K./Ireland... -

Page 77

December 31, 2011 Investment Grade Finance and other services Government and education Graphic arts Industrial Healthcare Other Total United States Finance and other services Government and education Graphic arts Industrial Other Total Canada France U.K./Ireland Central (1) Southern (2) Nordics (3)... -

Page 78

...and Accruing $ 18 42 12 6 9 6 93 30 22 2 30 72 - 126 - $ 249 Current Finance and other services Government and education Graphic arts Industrial Healthcare Other Total United States Canada France U.K./Ireland Central (1) 31-90 Days Past Due $ 3 5 1 2 2 1 14 3 5 - 2 8 - 15 1 $ 33 >90 Days Past Due... -

Page 79

... Accruing $ 15 29 7 6 5 4 66 27 16 4 46 82 - 148 - $ 241 Current Finance and other services Government and education Graphic arts Industrial Healthcare Other Total United States Canada France U.K./Ireland Central (1) (2) 31-90 Days Past Due $ 4 5 2 2 2 1 16 2 1 2 2 4 - 9 1 $ 28 >90 Days Past Due... -

Page 80

... Consolidated Financial Statements (in millions, except per-share data and where otherwise noted) Note 6 - Inventories and Equipment on Operating Leases, Net The following is a summary of Inventories by major category: December 31, 2012 Finished goods Work-in-process Raw materials Total Inventories... -

Page 81

... future revenues or margins from current or potential customers. Beginning in 2013, the costs associated with this software system will be amortized over seven years. Condensed financial data of Fuji Xerox was as follows: Year Ended December 31, 2012 Summary of Operations Revenues Costs and... -

Page 82

...research and development costs. Transactions with Fuji Xerox were as follows: Year Ended December 31, 2012 Dividends received from Fuji Xerox Royalty revenue earned Inventory purchases from Fuji Xerox Inventory sales to Fuji Xerox R&D payments received from Fuji Xerox R&D payments paid to Fuji Xerox... -

Page 83

...approximately $2.4 billion related to the Services segment and $0.4 billion related to the Document Technology segment. Intangible assets were comprised of the following: December 31, 2012 Weighted Average Amortization Customer relationships Distribution network Trademarks (1) December 31, 2011 Net... -

Page 84

..., 2012 is as follows: Lease Cancellation and Other Costs $ 20 28 (9) 19 (14) 25 1 (6) (5) (13) 7 5 - 5 (5) $ 7 $ Asset Impairments (1) $ - 26 - 26 (26) - 5 - 5 (5) - 2 (1) 1 (1) - $ Total 74 524 (41) 483 (234) 323 104 (71) 33 (233) 123 167 (14) 153 (146) $ 130 Severance and Related Costs Balance at... -

Page 85

... summarizes the total amount of costs incurred in connection with these restructuring programs by segment: Year Ended December 31, 2012 Services Document Technology Other Total Net Restructuring Charges $ 71 82 - $ 153 $ $ 2011 12 23 (2) 33 $ 2010 104 325 54 $ 483 Dividends payable Distributor and... -

Page 86

... Escrow and cash collections related to receivable sales Other restricted cash Total Restricted Cash and Investments $ 211 146 8 $ 365 2011 $ 240 88 15 $ 343 Long-term debt was as follows: Weighted Average Interest Rates at December 31, 2012 (2) Xerox Corporation Senior Notes due 2012 Senior Notes... -

Page 87

... from the date of issue. The CP Notes are sold at a discount from par or, alternatively, sold at par and bear interest at market rates. At December 31, 2012, we did not have any CP Notes outstanding. Credit Facility We have a $2.0 billion unsecured revolving Credit Facility with a group of lenders... -

Page 88

... average finance receivable balance during the applicable period. Interest Rate Risk Management We may use interest rate swap agreements to manage our interest rate exposure and to achieve a desired proportion of variable and fixed rate debt. These derivatives may be designated as fair value hedges... -

Page 89

... designated cash flow hedges and all components of each derivative's gain or loss was included in the assessment of hedge effectiveness. The net (liability) asset fair value of these contracts was $(48) and $26 as of December 31, 2012 and December 31, 2011, respectively. Xerox 2012 Annual Report... -

Page 90

...rate contracts Location of Gain (Loss) Recognized in Income Interest expense Year Ended December 31, Derivative Gain (Loss) Recognized in OCI (Effective Portion) 2012 $ (50) $ 2011 30 2010 $ 46 Location of Derivative Gain (Loss) Reclassiï¬ed from AOCI into Income (Effective Portion) Cost of sales... -

Page 91

... life insurance Deferred compensation investments in mutual funds Total Liabilities: Foreign exchange contracts - forwards Deferred compensation plan liabilities Total $ 82 110 $ 192 $ 31 97 $ 128 $ 11 77 23 $ 111 $ 58 69 23 $ 150 2011 Summary of Other Financial Assets and Liabilities Fair Value... -

Page 92

... Funded Status at December 31 (1) Amounts Recognized in the Consolidated Balance Sheets: Other long-term assets Accrued compensation and benefit costs Pension and other benefit liabilities Post-retirement medical benefits Net Amounts Recognized (1) Non-U.S. Plans 2011 2012 2011 Retiree Health 2012... -

Page 93

...) the benefit calculated under a formula that provides for the accumulation of salary and interest credits during an employee's work life or (iii) the individual account balance from the Company's prior defined contribution plan (Transitional Retirement Account or TRA). Xerox 2012 Annual Report 91 -

Page 94

Notes to Consolidated Financial Statements (in millions, except per-share data and where otherwise noted) The components of Net periodic benefit cost and other changes in plan assets and benefit obligations were as follows: Pension Beneï¬ts Year Ended December 31, U.S. Plans 2012 Components of Net... -

Page 95

... its retiree healthcare costs. The amendment resulted in a net decrease of $55 to the retiree medical benefit obligation and a corresponding $34 after tax increase to equity. This amendment reduced both the 2012 and 2011 retiree-health expenses by approximately $13. Xerox 2012 Annual Report 93 -

Page 96

... dates, the global pension plan assets were $9.0 billion and $8.3 billion, respectively. These assets were invested among several asset classes. Our common stock represents approximately $99 or 1.0% of total plan assets at December 31, 2012. The following tables presents the defined benefit plans... -

Page 97

...security issued by government agency Corporate bonds Asset backed securities Total Debt Securities Common/Collective trust Derivatives: Interest rate contracts Foreign exchange contracts Other contracts Total Derivatives Hedge funds Real estate Guaranteed insurance contracts Other (1) Level 1 $ 500... -

Page 98

... cap Xerox common stock U.S. mid cap U.S. small cap International developed Emerging markets Total Equity Securities Debt Securities: U.S. treasury securities Debt security issued by government agency Corporate bonds Asset backed securities Total Debt Securities Derivatives: Interest rate contracts... -

Page 99

... by government agency Corporate bonds Asset backed securities Total Debt Securities Common/Collective trust Derivatives: Interest rate contracts Foreign exchange contracts Other contracts Total Derivatives Hedge funds Real estate Guaranteed insurance contracts Other (1) Total Deï¬ned Beneï¬t Plans... -

Page 100

... gains (losses) Currency translation Other Balance at December 31, 2011 Purchases Sales Net transfers in from Level 2 Realized gains (losses) Unrealized gains (losses) Currency translation 67 - 2 - - 12 (4) (3) 280 13 (21) 69 1 (25) 15 We employ a total return investment approach whereby a mix of... -

Page 101

... 5.1% 3.5% Retiree Health 2012 Discount rate 3.6% 2011 4.5% 2010 4.9% 2010 Non-U.S. 5.3% 2.7% Weighted-average assumptions used to determine net periodic benefit cost for years ended December 31: Pension Beneï¬ts 2013 U.S. Discount rate Expected return on plan assets Rate of compensation increase... -

Page 102

... cost trend rates have a significant effect on the amounts reported for the healthcare plans. A one-percentage-point change in assumed healthcare cost trend rates would have the following effects: 1% increase Effect on total service and interest cost components Effect on post-retirement benefit... -

Page 103

... Changes in defined benefit plans Stock option and incentive plans, net Cash flow hedges Translation adjustments Total Income Tax Expense (Beneï¬t) $ (233) (5) (24) (9) 6 (277) 1 3 2 $ 115 12 (6) 5 6 $ 273 $ 277 2011 $ 386 2010 $ 256 Included in the balances at December 31, 2012, 2011 and 2010 are... -

Page 104

... Post-retirement medical benefits Anticipated foreign repatriations Depreciation and amortization Net operating losses Other operating reserves Tax credit carryforwards Deferred compensation Allowance for doubtful accounts Restructuring reserves Pension Other Subtotal Valuation allowance Total... -

Page 105

...labor matters principally relate to claims made by former employees and contract labor for the equivalent payment of all social security and other related labor benefits, as well as consequential tax claims, as if they were regular employees. As of December 31, 2012, the total amounts related to the... -

Page 106

... generally extend over a period equivalent to the lease term or the expected useful life of the equipment under a cash sale. The service agreements involve the payment of fees in return for our performance of repairs and maintenance. As a consequence, we do not have any significant product warranty... -

Page 107

... such credit support. We have service arrangements where we service third-party student loans in the Federal Family Education Loan program ("FFEL") on behalf of various financial institutions. We service these loans for investors under outsourcing arrangements and do not acquire any servicing rights... -

Page 108

... to U.S. pension plan Acquisition of Treasury stock Cancellation of Treasury stock Other Balance at December 31, 2012 (1) (2) Treasury Stock Shares 87,943 (72,435) - 15,508 - - 146,278 (146,862) - 14,924 Restricted Stock Units: Compensation expense is based upon the grant date market price for... -

Page 109

Summary of Stock-based Compensation Activity 2012 Weighted Average Grant Date Fair Shares Value 2011 Weighted Average Grant Date Fair Shares Value 2010 Weighted Average Grant Date Fair Shares Value (Shares in thousands; amounts per share) Restricted Stock Units Outstanding at January 1 Granted ... -

Page 110

... No Performance Shares vested in 2012 since the 2009 primary award grant that normally would have vested in 2012 was replaced with a grant of Restricted Stock Units with a market based condition and therefore were accounted and reported for as part of Restricted Stock Units. ACS Acquisition In... -

Page 111

...to Cost of sales - refer to Note 13 - Financial Instruments for additional information regarding our cash flow hedges. Reclassified to Total Net Periodic Benefit Cost - refer to Note 15 - Employee Benefit Plans for additional information. (3) Represents our share of Fuji Xerox's benefit plan changes... -

Page 112

... to Consolidated Financial Statements (in millions, except per-share data and where otherwise noted) Note 21 - Earnings per Share The following table sets forth the computation of basic and diluted earnings per share of common stock (shares in thousands): Year Ended December 31, 2012 Basic Earnings... -

Page 113

.... Based on the above evaluation, management has concluded that our internal control over financial reporting was effective as of December 31, 2012. Ursula M. Burns Chief Executive Officer Luca Maestri Chief Financial Officer Gary R. Kabureck Chief Accounting Officer Xerox 2012 Annual Report 111 -

Page 114

... balance sheets and the related consolidated statements of income, comprehensive income, cash flows and shareholders' equity present fairly, in all material respects, the financial position of Xerox Corporation and its subsidiaries at December 31, 2012 and 2011, and the results of their operations... -

Page 115

Quarterly Results of Operations (Unaudited) (in millions, except per-share data) First Quarter 2012 Revenues Costs and Expenses Income Before Income Taxes and Equity Income Income tax expenses Equity in net income of unconsolidated affiliates Net Income Less: Net income - noncontrolling ... -

Page 116

... Total Consolidated Capitalization Selected Data and Ratios Common shareholders of record at year-end Book value per common share Year-end common stock market price Employees at year-end Gross margin Sales gross margin Outsourcing, service and rentals gross margin Finance gross margin (1) 2011... -

Page 117

...on the New York Stock Exchange and the Chicago Stock Exchange. Xerox Common Stock Prices and Dividends New York Stock Exchange composite prices * 2012 High Low Dividends Paid per Share 2011 High Low Dividends Paid per Share * Price as of close of business Xerox 2012 Annual Report 115 First Quarter... -

Page 118

..., Global Graphic Communications Operations Xerox Technology Kevin Kyser Vice President Chief Operating Officer, Information Technology Outsourcing Xerox Services James H. Lesko Vice President Vice President, Investor Relations Joseph H. Mancini Jr. Vice President Chief Accounting Officer Ivy... -

Page 119

... Xerox Corporate Headquarters 45 Glover Avenue Norwalk, CT 06856 Proxy material mailed on April 8, 2013 to shareholders of record as of March 25, 2013. Investor Contacts Jennifer Horsley [email protected] Joseph Ketchum [email protected] This annual report is also available online... -

Page 120

..., CT 06856-4505 United States 203.968.3000 www.xerox.com ® ©2013 Xerox Corporation. All rights reserved. Xerox®, Xerox and Design®, ColorQube®, DocuColor®, FreeFlow®, iGen®, iGen4®, Phaser®, WorkCentre® and Xerox Nuvera® are trademarks of, or licensed to Xerox Corporation in the United...