Xcel Energy 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

e prime’s results for 2000 were reduced by special charges of 2 cents per share for contractual obligations and other costs associated with

post-merger changes in the strategic operations and related revaluations of e prime’s energy marketing business.

Financing Costs and Preferred Dividends Nonregulated results include interest expense and preferred dividends, which are incurred at

the Xcel Energy and intermediate holding company levels, and are not directly assigned to individual subsidiaries.

In November 2002, the Xcel Energy holding company issued temporary financing, which included detachable options for the purchase

of Xcel Energy notes, which are convertible to Xcel Energy common stock. This temporary financing was replaced with longer-term

holding company financing in late November 2002. Costs incurred to redeem the temporary financing included a redemption premium

of $7.4 million, $5.2 million of debt discount associated with the detachable option and other issuance costs, which increased financing

costs and reduced 2002 earnings by 2 cents per share.

Other Certain costs related to NRG’s restructuring are being incurred at the holding company level. Approximately $5 million of such

costs were incurred in 2002, which reduced earnings by approximately 1 cent per share.

Other nonregulated results for 2000, which include the activity of several nonregulated subsidiaries, were reduced by merger-related

special charges of 2 cents per share. These special charges include $10 million in asset write-downs and losses resulting from various

other nonregulated business ventures that are no longer being pursued after the Xcel Energy merger.

factors affecting results of operations

Xcel Energy’s utility revenues depend on customer usage, which varies with weather conditions, general business conditions and the cost

of energy services. Various regulatory agencies approve the prices for electric and natural gas service within their respective jurisdictions.

In addition, Xcel Energy’s nonregulated businesses have adversely affected Xcel Energy’s earnings in 2002. The historical and future

trends of Xcel Energy’s operating results have been, and are expected to be, affected by the following factors:

Impact of NRG Financial Difficulties NRG is experiencing severe financial difficulties, resulting primarily from declining credit ratings

and lower prices for power. These financial difficulties have caused NRG to miss several scheduled payments of interest and principal

on its bonds and incur approximately $3.1 billion in asset impairment charges. In addition, as a result of being downgraded, NRG was

required to post cash collateral ranging from $1.1 billion to $1.3 billion. NRG has been unable to post this cash collateral and,as a

result, is in default on various obligations. Furthermore, in November 2002, lenders to NRG accelerated approximately $1.1 billion of

NRG’s debt, rendering the debt immediately due and payable. In February 2003, lenders to NRG accelerated an additional $1 billion

of debt. NRG does not contemplate making any principal or interest payments on its corporate-level debt pending the restructuring

of its obligations, and is in default under various debt instruments. As a consequence of the defaults, the lenders are able to seek to

enforce their remedies, if they so choose, and that would likely lead to a bankruptcy filing by NRG. NRG continues to work with its

lenders and bondholders on a comprehensive financial restructuring plan. See further discussion of potential NRG bankruptcy and

financial restructuring under Liquidity and Capital Resources and in Notes 4 and 18 to the Consolidated Financial Statements.

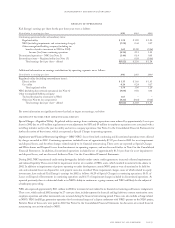

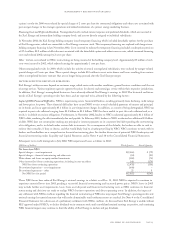

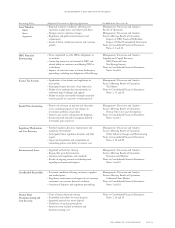

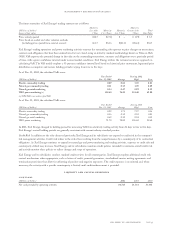

Subsequent to its credit downgrade in July 2002, NRG experienced losses as follows in 2002:

(Millions of dollars) Third Quarter Fourth Quarter

Net losses from NRG:

Special charges – asset impairments $(2,466) $ (79)

Special charges – financial restructuring and other costs (34) (21)

Write-downs and losses on equity method investments (118) (74)

Other income (loss) from continuing operations, including income tax effects 140 (176)

NRG loss from continuing operations (2,478) (350)

Discontinued operations – asset impairments (600) –

Discontinued operations – other 23 9

Net NRG loss for period $(3,055) $(341)

These NRG losses have reduced Xcel Energy’s retained earnings to a deficit as of Dec. 31, 2002. NRG is expected to continue to

experience material losses into 2003, pending a successful financial restructuring and increased power prices. NRG’s losses in 2003

may include further asset impairments, losses from asset disposals and financial restructuring costs as NRG continues its financial

restructuring and decisions are made to realign NRG’s business operations and divest operating assets. In addition, the impact of

any settlement with NRG’s creditors regarding the financial restructuring of NRG also may impact Xcel Energy’s operating results and

retained earnings by material amounts that will not be determinable until settlement terms are reached. See Note 4 to the Consolidated

Financial Statements for a discussion of a preliminary settlement with NRG’s creditors. As discussed later, Xcel Energy is unable,without

SEC approval under PUHCA, to declare dividends on its common stock until consolidated retained earnings are positive, and continuing

NRG financial impacts may continue to limit the ability of Xcel Energy to declare and pay dividends.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 23