Xcel Energy 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

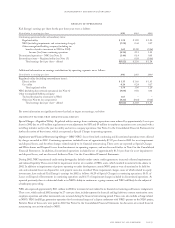

Depreciation and amortization expense increased $131 million, or 14.5 percent, in 2002 and $140 million, or 18.2 percent, in 2001,

primarily due to acquisitions of generating facilities by NRG and additions to utility plant. Higher NRG depreciation expense

accounted for $87 million of the increase in 2002.

Interest income was higher in 2002 and 2001 due to higher cash balances at NRG in both years and to interest on affiliate loans in 2001.

Other income was higher in 2002 and 2001 due mainly to a gain on the sale of nonregulated property and PSCo assets.

Other expense increased in 2002 due largely to variations in currency exchange losses at NRG.

Interest expense increased $152 million, or 20.8 percent, in 2002 and $114 million, or 18.5 percent, in 2001, primarily due to increased

debt of NRG. In addition, long-term debt was refinanced at higher interest rates during 2002. Higher NRG interest expense accounted

for $105 million of the increase in 2002.

Income tax expense decreased by approximately $959 million in 2002, compared with 2001. Nearly all of this decrease relates to NRG’s

2002 losses and the change in tax filing status for NRG effective in the third quarter of 2002, as discussed in Note 11 to the Consolidated

Financial Statements. NRG is now in a tax operating loss carry forward position and is no longer assumed to be part of Xcel Energy’s

consolidated tax group. The effective tax rate for continuing operations, excluding minority interest and before extraordinary items, was

27.3 percent for the year ended Dec. 31, 2002, and 28.8 percent for the same period in 2001. The decrease in the effective rate between

years reflects a nominal tax rate at NRG due to its loss carry forward position. Partially offsetting the NRG tax rate decrease is the impact of

a one-time adjustment to recognize tax benefits from Xcel Energy’s investment in NRG, as discussed in Note 11 to the Consolidated

Financial Statements. The effective tax rate for the regulated utility business and operations other than NRG was significantly lower

in 2002, compared with 2001, due to the benefit recorded on the investment in NRG and the changes in the items listed in the rate

reconciliation in Note 11.

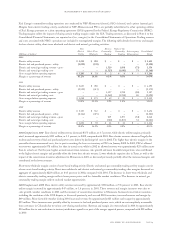

Weather Xcel Energy’s earnings can be significantly affected by weather. Unseasonably hot summers or cold winters increase electric and

natural gas sales, but also can increase expenses, which may not be fully recoverable. Unseasonably mild weather reduces electric and natural

gas sales, but may not reduce expenses, which affects overall results. The following summarizes the estimated impact on the earnings of

the utility subsidiaries of Xcel Energy due to temperature variations from historical averages:

– weather in 2002 increased earnings by an estimated 6 cents per share;

– weather in 2001 had minimal impact on earnings per share; and

– weather in 2000 increased earnings by an estimated 1 cent per share.

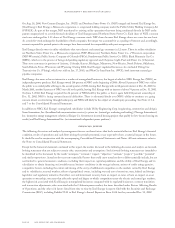

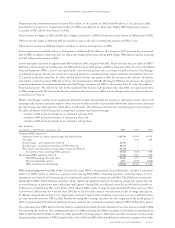

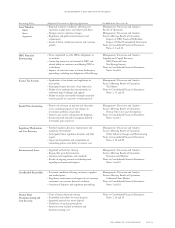

nrg results

Contribution to Xcel Energy’s earnings per share 2002 2001 2000

Continuing NRG operations:

Operations before tax credits, special charges and disposal losses $ (0.54) $ 0.49 $ 0.35

Tax credits –0.14 0.10

Special charges – asset impairments (Note 2) (6.29) ––

Special charges – financial restructuring and NEO (Note 2) (0.27) ––

Write-downs and disposal losses from equity investments (Note 2) (0.51) ––

Income (loss) from continuing NRG operations (7.61) 0.63 0.45

Discontinued NRG operations (Note 3) (1.46) 0.14 0.09

Total NRG earnings (loss) per share (9.07) 0.77 0.54

Minority shareholder interest 0.03 (0.19) (0.08)

NRG contribution to Xcel Energy $ (9.04) $ 0.58 $ 0.46

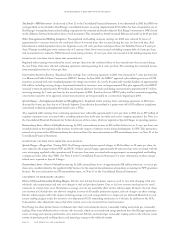

NRG Continuing Operations and Tax Credits As previously stated, NRG is facing extreme financial difficulties, and there is substantial

doubt as to NRG’s ability to continue as a going concern. During 2002, NRG’s continuing operations, excluding impacts of asset

impairments and disposals and restructuring costs, experienced significant losses compared with 2001. The 2002 losses are primarily

attributable to NRG’s North American operations, which experienced significant reductions in domestic energy and capacity sales and

an overall decrease in power pool prices and related spark spreads. During 2002, an additional reserve for uncollectible receivables in

California was established by West Coast Power, which reduced NRG’s equity earnings by approximately $29 million, after tax. West

Coast Power’s 2002 income also was lower than 2001 due to less-favorable contracts and reductions in sales of energy and capacity.

In addition, increased administrative costs, depreciation and interest expense from completed construction costs also contributed to the

less-than-favorable results for NRG in 2002. Partially off-setting these earnings reductions was the recognition, in the fourth quarter of

2002, of approximately $51 million of additional revenues related to the contractual termination related to NRG’s Indian River project.

On a stand-alone basis, NRG does not have the ability to recognize all tax benefits that may ultimately accrue from its losses incurred in 2002,

thus increasing the overall loss from continuing operations. In addition to losing the ability to recognize all tax benefits for operating losses,

NRG in 2002 also lost the ability to utilize tax credits generated by its energy projects. These lower tax credits account for a portion of the

decreased earnings contribution of NRG compared with results in 2001 and 2000, which included income related to recognition of tax credits.

management’s discussion and analysis

xcel energy inc. and subsidiaries page 21